China to construct over 4.5 million 5G base stations in

China plans to construct over 4.5 million 5G base stations in 2025 while introducing additional policy and financial incentives to support

Get a quote

5g Base Station Market Size & Share Analysis

Ultra-Reliable Low Latency Communications (URLLC), a subdivision of 5G network architecture, is enabling efficient scheduling of data transfers for advanced services across

Get a quote

How China is revolutionising warfare with world''s first

The mobile 5G base station, developed jointly by China Mobile Communications Group and the People''s Liberation Army (PLA), can offer

Get a quote

Shared Network Smart Co-Governance White Paper

With this White Paper, global partners in the communications industry are provided with insights to better understand meaningful subjects such as the concerted operation, optimization,

Get a quote

China telcos have 1 million-plus 5G base stations, but are they

Ruiwen Ke, Chairman and CEO of China Telecom, said yesterday, "We have built the largest 5G SA RAN sharing network, the largest NB-IoT network and the largest gigabit

Get a quote

China Telecom, China Unicom successfully roll out

To carry out the new development concept of "innovation, coordination, green, openness, and sharing", and accelerate the construction

Get a quote

The Mobile Economy China 2024

China Telecom''s co-construction and sharing of 5G base stations reduces carbon emissions by more than 10 million tonnes each year, while its AI energy-saving platform reduces energy

Get a quote

China Telecom and China Unicom have opened more than 27,000 shared 5G

On September 9 this year, China Unicom and China Telecom jointly announced that they would cooperate on 5G network co-construction and sharing. According to the cooperation

Get a quote

Shared Network Smart Co-Governance White Paper

G have posed tremendous pressure on operators. In order to accelerate the large-scale deployment of 5G networks, China Telecom and China Unicom, in 2019, embarked on an

Get a quote

China Telecom and China Unicom jointly build and share 5G RAN

China Telecom and China Unicom, two of China''s three leading telecom operators, and two of its four 5G licensees, will jointly cover parts of the country with one shared 5G radio

Get a quote

China to construct over 4.5 million 5G base stations in 2025

China plans to construct over 4.5 million 5G base stations in 2025 while introducing additional policy and financial incentives to support industries expected to shape the next

Get a quote

China Telecom and China Unicom Jointly Rolles Out 990,000 Shared 5G

In September 2019, China Telecom and China Unicom comprehensively launched 5G network co-construction and sharing. They have since then built the first co-construction

Get a quote

China Telecom, China Unicom successfully roll out world''s largest 5G

According to the " Framework Agreement on Co-building and Co-sharing 5G Networks " reached by China Telecom and China Unicom, the two parties will jointly construct

Get a quote

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can

Get a quote

A multi-level perspective on 5G transition: The China case

The case selection is based on the criteria of influential cases (Seawright and Gerring, 2008) since China as an aggressive promoter of 5G has a disproportionate amount of

Get a quote

5G regulation and law in China | CMS Expert Guides

Are you looking for information on 5G regulation and law in China? This CMS Expert Guide provides you with everything you need to know.

Get a quote

China Telecom, China Unicom successfully roll out

According to the " Framework Agreement on Co-building and Co-sharing 5G Networks " reached by China Telecom and China Unicom, the two

Get a quote

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Get a quote

China Telecom and China Unicom Jointly Rolles Out 990,000

In September 2019, China Telecom and China Unicom comprehensively launched 5G network co-construction and sharing. They have since then built the first co-construction

Get a quote

China''s carriers to build a shared 5G network

China Telecom and China Unicom have reached a tentative agreement to jointly build a 5G network and share network infrastructure. And it''s possible that China Mobile may

Get a quote

Artificial intelligence for reducing the carbon emissions of 5G

China has emerged as a global leader in 5G networks, with more than 2.1 million 5G base stations having been deployed since 2021, accounting for over 60% of all such

Get a quote

China has more than 3.8 million 5G base stations

There were more than 3.8 million 5G base stations in China by the end of May 2024, the latest data from the Ministry of Industry and Information Technology (MIIT) has shown.

Get a quote

Machine Learning and Analytical Power Consumption

Abstract—The energy consumption of the fifth generation (5G) of mobile networks is one of the major concerns of the telecom industry. However, there is not currently an accurate and

Get a quote

27th February 2023 2

Since 2019, China Telecom and China Unicom have been working on 5G network co-construction and sharing, with major breakthroughs made in technology development,

Get a quote

China Telecom and China Unicom have opened more than

On September 9 this year, China Unicom and China Telecom jointly announced that they would cooperate on 5G network co-construction and sharing. According to the cooperation

Get a quote

World first as PLA mobile 5G base station revealed

The military 5G also makes use of China''s latest civilian technologies. As of November, China had built nearly 4.2 million civilian 5G base stations, far exceeding any other

Get a quote

6 FAQs about [Can China Communications 5G base stations be shared ]

How many 5G base stations are there in China?

With 4.19 million 5G base stations already operational across China, the MIIT emphasized that “promoting 5G revolution and 6G innovation will be one of the priorities” for 2025, according to a report by Chinese newspaper China Daily. Chinese main operators are China Mobile, China Telecom and China Unicom.

Does China have a 5G network?

Wen Ku, director-general of the China Communications Standards Association, highlighted the nation’s progress in telecommunications, stating, “China has made remarkable strides in 5G infrastructure, which gives it an unparalleled edge in exploring 6G technologies.”

Who are China's 5G operators?

Chinese main operators are China Mobile, China Telecom and China Unicom. In addition to its expected expansion in the 5G field, China noted that it is also set to begin trials for 10-gigabit optical networks and enhance computing power infrastructure, reflecting the growing demand for artificial intelligence (AI) technologies.

What will China do with the 5G push?

Alongside the 5G push, China will also start trials for 10-gigabit optical networks and optimize computing power centers amid an artificial intelligence (AI) boom brought on by ChatGPT.

Can the US match China in 5G?

The United States should take the same tack if it wants to match China in 5G. Ever-stronger patent rights encourage counterproductive disputes that are a drag on industry, a drag on research and development, and ultimately a drag on domestic competitiveness on the global stage.

Does China want a nationalized 5G infrastructure?

Huawei’s investment in 5G technologies is backed by the Chinese government and construction is well underway throughout the country. Concerns in Washington, D.C. have prompted conversations calling for a nationalized 5G infrastructure as Huawei leaps to the forefront of 5G development.

Guess what you want to know

-

Is China Communications 5G base stations using Huawei

Is China Communications 5G base stations using Huawei

-

China Communications Corporation to build 5G base stations

China Communications Corporation to build 5G base stations

-

Distribution of 5G base stations in China Industrial Park Communications

Distribution of 5G base stations in China Industrial Park Communications

-

China Southern Power Grid builds 5G base stations

China Southern Power Grid builds 5G base stations

-

Austria Communications builds 5G base stations

Austria Communications builds 5G base stations

-

Kiribati Communications 30 000 5G base stations

Kiribati Communications 30 000 5G base stations

-

Sophia Communications and 5G base stations

Sophia Communications and 5G base stations

-

Belarus 5G base station China Communications

Belarus 5G base station China Communications

-

Are Belgian Communications base stations used for 5G base stations

Are Belgian Communications base stations used for 5G base stations

-

What are the 5G base stations in the communications industry

What are the 5G base stations in the communications industry

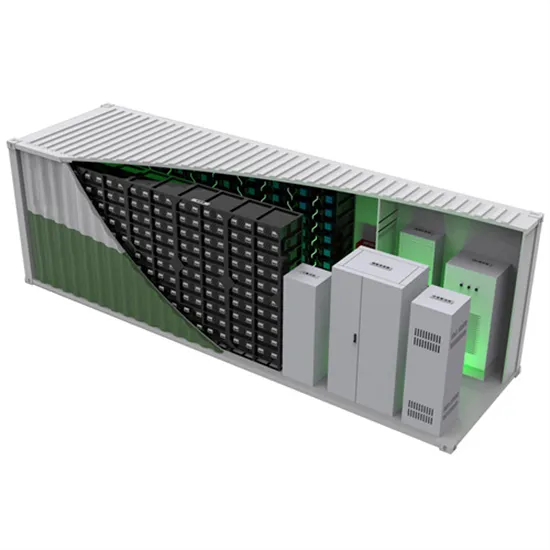

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

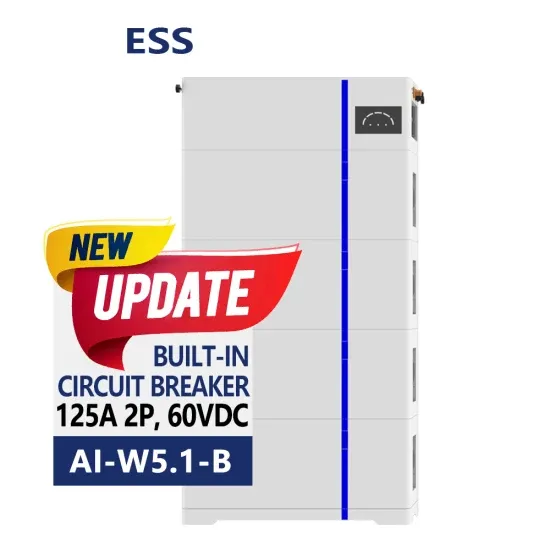

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.