Top 7 Solar Energy Projects in the Asia-Pacific Region

Boasting some of the largest and most innovative solar energy projects in the world, this region is setting benchmarks for sustainable energy development. Here, we

Get a quote

ASEAN''s growing potential in the global solar race

In 2022, at the 7th ASEAN Energy Outlook meeting, it was forecasted that energy needs by 2050 would be tripled compared with 2020 levels, and this will prompt a shift from

Get a quote

The Top 5 Largest Solar Projects In South East Asia

Currently, ASEAN''s renewable energy capacity stands at 32 percent, comprising hydropower, geothermal, bioenergy, solar, and wind. To meet this goal, countries of South

Get a quote

Gas investments in South-east Asia undermine green

SINGAPORE – South-east Asia faces a major energy conundrum – ramp up the switch to natural gas from polluting coal to meet growing energy

Get a quote

Beyond tripling: Keeping ASEAN''s solar & wind momentum

About This report tracks solar and wind generation in ASEAN between 2015 and 2022, and analyses the additional capacity needed by 2030 to align with the International

Get a quote

Southeast Asia''s role in tripling global renewables

[31] There has been minimal investment in renewable energy in Singapore in recent decades. As of 2020, solar energy only accounted for

Get a quote

What are the solar energy resources in East Asia? | NenPower

The region''s diverse climatic conditions enhance solar energy generation capabilities, with countries such as China and Japan leading the charge through substantial

Get a quote

ASEAN, East Asia Must Increase Annual Solar

Jakarta, 27 February 2023: To meet their climate goals, the ASEAN region and East Asia must increase by 25% their annual solar capacity by 2030, and that

Get a quote

Philippines emerges as South-east Asia''s renewable

MANILA – The Philippines has leapfrogged its South-east Asian neighbours to become a regional leader in planned clean-power projects as

Get a quote

Southeast Asia''s green transition at a tipping point

The global energy landscape is experiencing a seismic shift. Since 2021, electricity generation from coal and gas has remained stagnant, while solar power generation has grown

Get a quote

A Race to the Top: Southeast Asia 2024

ASEAN member states have set a collective renewable energy capacity target of 35% by 2025. Including all types of renewable power, the region is already close to meeting its goal by

Get a quote

The Top 5 Largest Solar Projects In South East Asia

Currently, ASEAN''s renewable energy capacity stands at 32 percent, comprising hydropower, geothermal, bioenergy, solar, and wind. To

Get a quote

Key findings – Southeast Asia Energy Outlook 2022 – Analysis

Between 2016 and 2020, annual average energy investment in Southeast Asia was around USD 70 billion, of which around 40% went to clean energy technologies – mostly solar PV, wind and

Get a quote

Renewable Energy in Southeast Asia

This essay explores the current status and future role of renewable energy in Southeast Asia''s power-generation system, reviews obstacles to energy diversification, and

Get a quote

Report_ASEAN_24

ASEAN''s clean power pathways: 2024 insights Growing electricity demand and reliance on fossil fuels in ASEAN continue to hinder climate goals and economic opportunities. Solar, wind and

Get a quote

Annex: Regional Factsheets (Global Renewables Outlook)

The wind and solar PV capacities in the Transforming Energy Scenario in 2030 in this report are slightly higher than the estimates presented in IRENA''s reports (IRENA, 2019b; 2019c) which

Get a quote

Top 7 Solar Energy Projects in the Asia-Pacific Region

Boasting some of the largest and most innovative solar energy projects in the world, this region is setting benchmarks for sustainable energy

Get a quote

Asean Power Grid: Can South-east Asia finally plug into a shared

Asean Power Grid: Can South-east Asia finally plug into a shared power future? Cross-border clean energy projects are gaining momentum, with 2025 shaping up as a

Get a quote

Mapping the future of solar capacity in Southeast Asia

Sunny Southeast Asia has made significant strides in solar energy, with solar farm capacity exceeding 20GW across ASEAN countries. Despite

Get a quote

Mapping the future of solar capacity in Southeast Asia

Sunny Southeast Asia has made significant strides in solar energy, with solar farm capacity exceeding 20 GW across ASEAN countries. Despite this rapid growth and ambitious

Get a quote

How Pakistan pulled off one of the fastest solar revolutions in the

Pakistan has become one of the biggest new solar markets. It''s bringing cheap, clean power but analysts warn of potential trouble ahead.

Get a quote

The sunny side of Asia

This study explores the growth of solar power in seven key Asian countries, the potential for future growth and the avoided fossil fuel costs due to solar electricity generation

Get a quote

Beyond tripling: Keeping ASEAN''s solar & wind

About This report tracks solar and wind generation in ASEAN between 2015 and 2022, and analyses the additional capacity needed by

Get a quote

ASEAN, East Asia Must Increase Annual Solar Capacity by 25

Jakarta, 27 February 2023: To meet their climate goals, the ASEAN region and East Asia must increase by 25% their annual solar capacity by 2030, and that opportunities and challenges in

Get a quote

Where is solar energy distributed in East Asia? | NenPower

The phenomenon of solar energy has gained substantial momentum in recent years, particularly in East Asia, where nations are recognizing its potential to address energy

Get a quote

6 FAQs about [East Asia s all-around solar energy]

How much solar power does Southeast Asia have?

Presently, ASEAN boasts 28 GW of large utility-scale solar and wind power, contributing 9 percent to the region’s total electricity capacity. Solar photovoltaics (PV) play a pivotal role renewable energy revolution of Southeast Asia. Abundant sunlight, economic growth, and the rising demand for clean energy drive this shift.

Does Asia need solar power?

Asia’s growing energy demand has often been framed through the lens of its coal, gas or nuclear dependence, but solar power is growing rapidly across the region. Over the last decade China, India, South Korea, Viet Nam and Japan have significantly increased the share of solar power in their respective energy mixes.

How much solar capacity do ASEAN and East Asia need?

ASEAN, East Asia Must Increase Annual Solar Capacity by 25% to Re... Jakarta, 27 February 2023: To meet their climate goals, the ASEAN region and East Asia must increase by 25% their annual solar capacity by 2030, and that opportunities and challenges in the solar value chain must be identified.

Why is solar power important in Asia-Pacific?

The Asia-Pacific region is at the forefront of the global renewable energy revolution, with solar power leading the way. The top solar energy projects in this region not only demonstrate the immense potential of solar power but also highlight the commitment of various countries to sustainable energy solutions.

Is Southeast Asia ready for solar energy?

Positioned near the equator, Southeast Asia’s solar irradiance levels was up 10 per cent in 2023, highlighting the region’s potential for solar energy advancement. Southeast Asia’s total solar and wind energy generation have surged from 4.2 terawatt-hours (TWh) in 2015 to over 50 TWh in 2022.

How much solar power will Southeast Asia produce in 2022?

Southeast Asia’s total solar and wind energy generation have surged from 4.2 terawatt-hours (TWh) in 2015 to over 50 TWh in 2022. To put this into perspective, just 1 TWh could power about 10 billion 100-watt lightbulbs simultaneously. Looking ahead, ASEAN leaders have set ambitious goals for the region’s energy future.

Guess what you want to know

-

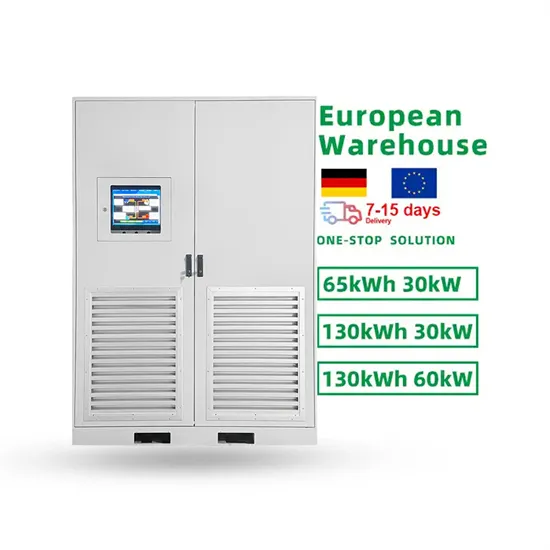

East Asia Coal-to-Electricity Energy Storage Equipment Manufacturer

East Asia Coal-to-Electricity Energy Storage Equipment Manufacturer

-

East Asia Energy Storage System Integration

East Asia Energy Storage System Integration

-

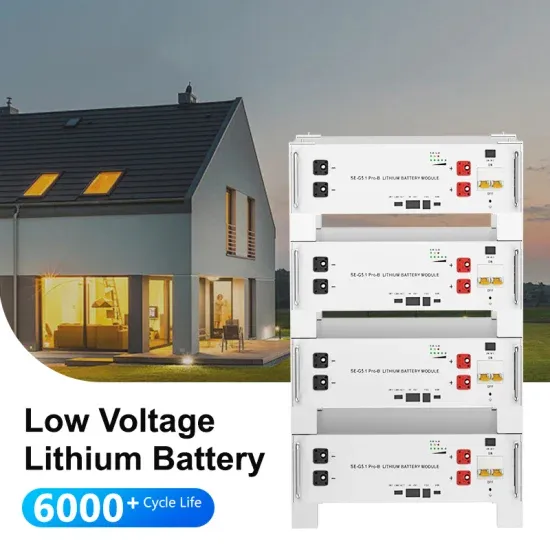

East Asia Home Photovoltaic Energy Storage Project

East Asia Home Photovoltaic Energy Storage Project

-

East Asia Park Container Energy Storage

East Asia Park Container Energy Storage

-

East Asia Energy Storage Battery Quote

East Asia Energy Storage Battery Quote

-

East Asia Energy Bureau Energy Storage Project

East Asia Energy Bureau Energy Storage Project

-

East Asia factory photovoltaic solar panels

East Asia factory photovoltaic solar panels

-

East Asia s wind solar and storage multi-energy complementarity

East Asia s wind solar and storage multi-energy complementarity

-

East Asia Energy Storage Power Supply Customization

East Asia Energy Storage Power Supply Customization

-

East Asia s new energy storage industry

East Asia s new energy storage industry

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.