The rebound effect of solar panel adoption: Evidence from Dutch

Households adopt solar panels for different reasons, but usually with a reduced electricity bill in mind. However, the access to solar power at near zero marginal costs may

Get a quote

Quantifying the rebound effects of residential solar panel adoption

Customers who adopt solar panels can reduce their energy bills and lower the effective average electricity prices they pay. When the price falls, a solar consumer might

Get a quote

Solar rebound: The unintended consequences of subsidies

Additionally, we collect the size and date of installation of the PV system which allows us to estimate average consumption before and after the PV installation. We document

Get a quote

Microeconomics of the solar rebound effect – Energy Policy and

The "solar rebound effect" is a phenomenon where households with residential solar photovoltaic (PV) systems end up consuming more electricity in response to greater solar

Get a quote

The rebound effect of solar panel adoption: Evidence from Du

Downloadable (with restrictions)! Households adopt solar panels for different reasons, but usually with a reduced electricity bill in mind. However, the access to solar power at near zero

Get a quote

Solar PV Rebound Effect on Regional Demand

Download Citation | On Dec 4, 2022, Nariman Mahdavi published Solar PV Rebound Effect on Regional Demand | Find, read and cite all the research you need on ResearchGate

Get a quote

The solar rebound effect in residential PV

The panel dataset contains detailed monthly information on electricity demand and bills, solar system capacity, production, and installation

Get a quote

Electricity consumption changes following solar adoption: Testing

We explore several potential drivers of an increase in electricity consumption. These results have important implications for electricity planning and policy, suggesting that rooftop

Get a quote

Solar Market Insight Report Q3 2025

4 days ago· Every segment saw declining volumes except for commercial solar, where a strong pipeline of projects under California''s former net metering regime continues to come online.

Get a quote

What Are Transparent Solar Panels? Explore Types, Uses, Cost,

Transparent solar panels are the latest technology PV modules that generate electricity by absorbing UV and infrared light, while letting visible light pass through. Explore

Get a quote

Q3 2024 Solar Industry Review: Declining Prices Across

Profitability and Future Outlook: Polysilicon prices remained largely stable in the third quarter, with occasional signs of minor weekly rebounds, indicating limited downside.

Get a quote

US solar manufacturers lag skyrocketing market demand

Right now, U.S. manufacturers do not produce enough solar panels to meet the nation''s demand, but industry investments and federal tax

Get a quote

Spring 2024 Solar Industry Update

Spring 2024 Solar Industry Update David Feldman Jarett Zuboy Krysta Dummit, Solar Energy Technologies Office Dana Stright Matthew Heine Shayna Grossman, ORISEa Fellow Robert

Get a quote

Rooftop solar expected to rebound in 2025

The growth in rooftop solar is expected to recover in 2025 – fuelled by rising electricity tariffs, ongoing energy insecurity and an oversupply of

Get a quote

China''s solar industry rebounds, but will boom-bust cycle repeat?

China''s solar panel industry is showing signs of booming again after a prolonged downturn - raising fears of another bust when the splurge of public money that is driving a

Get a quote

THE REBOUND EFFECT OF SOLAR PANEL ADOPTION:

Households adopt solar panels for different reasons, but always with a reduced elec-tricity bill in mind. However, the access to solar power at near zero marginal costs may well induce

Get a quote

The residential solar market: Down, not out | McKinsey

Residential solar might be down today, but its long-term prospects remain solid. We see that residential solar is poised for steady growth, especially for companies that take the

Get a quote

The solar rebound effect in residential PV

Researchers from Australia and Vietnam have analyzed the short and long-term dynamics of the so-called solar energy rebound effect. The rebound effect consists of a

Get a quote

solar revolution is shaking up the global energy game

3 days ago· China''s $625 billion clean energy boom pushes wind and solar past fossil fuels, reshaping global markets and fossil fuel demand outlook.

Get a quote

The Rooftop Solar Industry Is Struggling, but It Isn''t

Experts say the dip in residential solar installations is only temporary. Here''s where the industry stands and where it''s going. The solar industry is

Get a quote

The Solar Rebound Effect Explained

There''s a phenomenon in the residential solar industry that causes headaches for solar homeowners and solar installers alike. Thanks to new research, we can finally put a

Get a quote

The Rooftop Solar Industry Is Struggling, but It Isn''t Collapsing

Experts say the dip in residential solar installations is only temporary. Here''s where the industry stands and where it''s going. The solar industry is contracting in 2024. The solar industry...

Get a quote

Slight rebound in PV module prices, demand outlook remains

Demand for solar panels remains stable despite price declines. The European PV market showed resilience in August, with the PV Purchasing Managers'' Index (PMI) holding steady at 68.

Get a quote

US solar manufacturers lag skyrocketing market demand

Right now, U.S. manufacturers do not produce enough solar panels to meet the nation''s demand, but industry investments and federal tax incentives have been making

Get a quote

The Rebound Effect of Solar Panel Adoption: Evidence from

summary statistics for solar and non-solar houses separately (see Table 1). The statistics suggest that, on average, the households with solar panels consume around 7.5 kWh more

Get a quote

Smarter Forecasts, Brighter Future: How Machine Learning is

1 day ago· However, technologies like bifacial solar panels, anti-corrosion coatings, and hybrid energy systems (combining solar with hydropower or wind) could help these regions maximize

Get a quote

6 FAQs about [Solar panel demand rebounds]

Do solar households have a rebound effect?

More precisely, solar households in the first quartile of the electricity production distribution show a rebound effect around 11%, whereas the households in the last quartile of the distribution exhibit a rebound effect around 36%. Rebound effect by seasons. The dependent variable is daily electricity consumption.

What is solar PV rebound effect?

The solar PV rebound effect shows heterogeneity across time and production level, with higher rebound effects during seasons characterized by higher solar irradiance. The threat of global warming and climate change urges countries and communities to take action.

Do solar panels increase electricity consumption?

Our point estimate translates to a rebound effect of 28.5%, suggesting that nearly a third of the electricity produced by a customer's solar panels is used for increased energy services, rather than reduced grid electricity consumption. We explore several potential drivers of an increase in electricity consumption.

Are solar panels a good investment?

Households adopt solar panels for different reasons, but usually with a reduced electricity bill in mind. However, the access to solar power at near zero marginal costs may well induce rebound effects which shift households’ demand curve and distort the net effects of solar PV investments.

Is residential solar down today?

Residential solar might be down today, but its long-term prospects remain solid. We see that residential solar is poised for steady growth, especially for companies that take the right steps now in preparation to enter the next phase.

Does solar irradiation cause a rebound effect?

This variation across seasons might also indicate that the rebound effect is mainly arising due to short-run responses to electricity production level, instead of a change in households’ appliance stock, as we observe no difference in electricity consumption levels of solar and non-solar homes during seasons with lower solar irradiation.

Guess what you want to know

-

Solar panel price supply and demand trends

Solar panel price supply and demand trends

-

Total solar panel demand

Total solar panel demand

-

Double-layer solar panel photovoltaic panels

Double-layer solar panel photovoltaic panels

-

Tunisian solar panel company

Tunisian solar panel company

-

18v 10 watt solar panel

18v 10 watt solar panel

-

Photovoltaic panels to solar panel equipment

Photovoltaic panels to solar panel equipment

-

Thickness of single glass solar panel

Thickness of single glass solar panel

-

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

-

UK New Energy Building Solar Panel Components Wholesale

UK New Energy Building Solar Panel Components Wholesale

-

Iranian Photovoltaic Solar Panel Company

Iranian Photovoltaic Solar Panel Company

Industrial & Commercial Energy Storage Market Growth

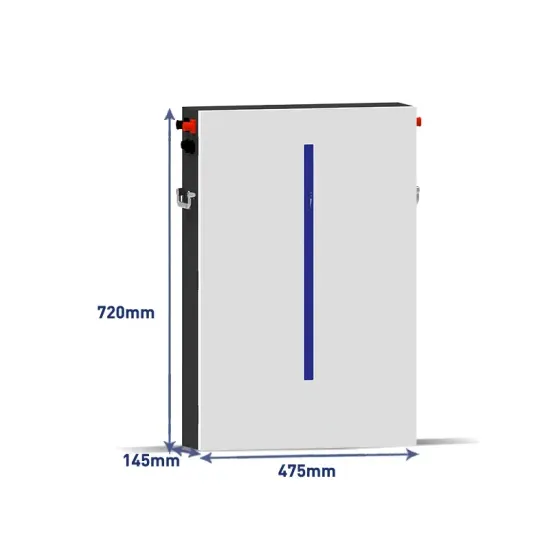

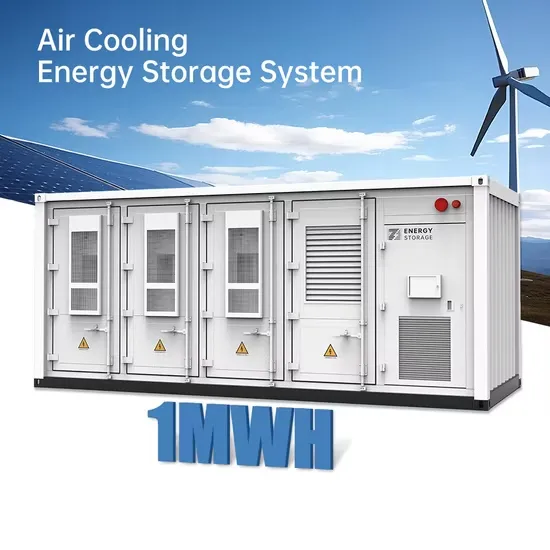

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.