Battery energy storage systems in Brazil: current regulatory and

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Get a quote

Reliable Power: Energy storage solutions for telecom

As telecom operators in India expand their network coverage, they are faced with the inadequacies of power grids and the risks of unexpected

Get a quote

Brazil is making outdoor power supply BESS

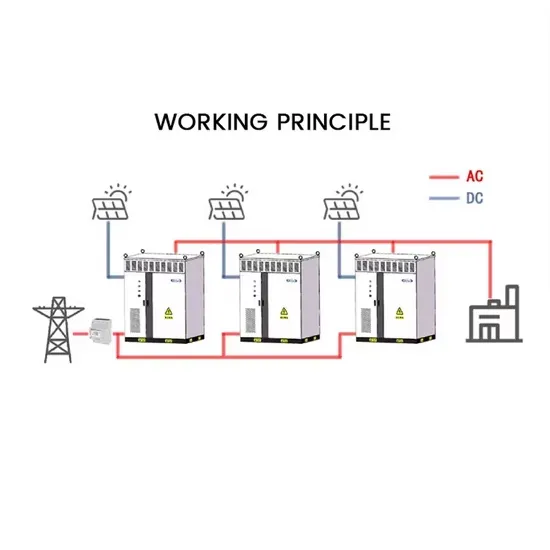

The grid-forming PCS allows the BESS to operate independently of the main grid, providing a reliable power supply without interruption. Beyond this, on the grid side, BESS can further

Get a quote

Sustainable Power Supply Solutions for Off-Grid Base Stations

The telecommunication sector plays a significant role in shaping the global economy and the way people share information and knowledge. At present, the

Get a quote

Characterization of the Operation of a BESS with a

Without an external power supply, BESS commands the action of islanded operation, maintaining both voltage and frequency requirements of

Get a quote

''Brazil could have $3.8bn battery energy storage

Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are

Get a quote

Load Profile of Telecom Towers and Potential Renewable Energy Power

Moreover, information related to growth of the telecom industry, telecom tower configurations and power supply needs, conventional power supply options, and hybrid system

Get a quote

Telecom battery energy storage refers to the use of

Telecom battery energy storage refers to the use of batteries to store energy in the context of telecommunications infrastructure. In the

Get a quote

What are the Essential Site Requirements for Battery Energy

In recent years, Battery Energy Storage Systems (BESS) have become an essential part of the energy landscape. With a growing emphasis on renewable energy

Get a quote

Leveraging Battery Energy Storage for Enhanced Eficiency in

BESS can act as a reliable backup power source during grid outages. The stored energy in the batteries is readily available to power critical telecom equipment, ensuring uninterrupted

Get a quote

Brazil Battery Energy Storage System Market (2025-2031)

The Battery Energy Storage System (BESS) market in Brazil is witnessing growth as utilities, renewable energy developers, and commercial customers deploy energy storage solutions to

Get a quote

The state of battery storage (BESS) in Latin America:

Key details for those who want to understand and succeed in the BESS market in Latin America. Country by country analysis. Brazil, Colombia,

Get a quote

Brazil announces first battery storage auction

October 18, 2024: Brazilian minister of energy and mining, Alexandre Silveira de Oliveira, has announced the country''s first large-scale battery storage auction to be held in 2025. A public

Get a quote

Brazil Battery Energy Storage Systems Market Report

The Brazil Battery Energy Storage Systems (BESS) market in the first quarter of 2025 is characterized by robust growth driven by the country''s expanding renewable energy sector.

Get a quote

Battery Energy Storage: The Backbone of Modern Telecom

Telecom infrastructure relies heavily on a consistent power supply to ensure the uninterrupted operation of networks and services. From cell towers to data centers, the

Get a quote

Battery Energy Storage System (BESS)

BESS is a battery energy storage system with inverters, battery, cooling, output transformer, safety features and controls. Helping to minimize energy costs, it delivers standard conformity,

Get a quote

Brazil''s power grid: Insights for strategic action

We recommend active participation in shaping BESS regulations, contributing to public consultations, applying international experience, and identifying supply chain bottlenecks to

Get a quote

GESP: Battery Energy Storage Systems (BESS) to

The Program will play a cornerstone role in the future towards a more diversified and resilient power grid, as well as for more reliable and lower cost energy

Get a quote

Brazil power storage sector seeks support | Latest Market News

Lower battery prices and increases to intermittent power generation could boost battery energy storage systems (BESS) in Brazil, reaching roughly 7.2GW of installed capacity by 2040 or

Get a quote

What to Know About Telecom Power Supply Features

Understand the key features of telecom power supplies, including voltage stability, energy efficiency, scalability, and environmental durability for

Get a quote

Outdoor Telecom Power Supply

The outdoor telecom power Supply system integrated with the high efficiency rectifier, intelligence controller and advanced thermal cooling system. Besides,

Get a quote

GESP: Battery Energy Storage Systems (BESS) to Increase the

The Program will play a cornerstone role in the future towards a more diversified and resilient power grid, as well as for more reliable and lower cost energy supply for MSMEs.

Get a quote

Brazil Outdoor BESS Solutions Key Applications and Market Trends

Discover how Brazil''s outdoor Battery Energy Storage Systems (BESS) are transforming energy management across industries. Learn about market opportunities, technical advantages, and

Get a quote

''Brazil could have $3.8bn battery energy storage market by 2030''

Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

Get a quote

Guess what you want to know

-

Kazakhstan outdoor communication power supply BESS latest information

Kazakhstan outdoor communication power supply BESS latest information

-

Brazil BESS outdoor base station power supply company

Brazil BESS outdoor base station power supply company

-

Outdoor Telecommunication Power Supply BESS Specifications

Outdoor Telecommunication Power Supply BESS Specifications

-

Slovenia Outdoor Telecommunication Power Supply BESS

Slovenia Outdoor Telecommunication Power Supply BESS

-

Latest information on island outdoor communication power supply BESS

Latest information on island outdoor communication power supply BESS

-

BESS outdoor communication power supply electricity fee

BESS outdoor communication power supply electricity fee

-

How is the outdoor communication power supply BESS business

How is the outdoor communication power supply BESS business

-

Vietnam BESS outdoor base station power supply

Vietnam BESS outdoor base station power supply

-

Huijue outdoor communication power supply BESS price

Huijue outdoor communication power supply BESS price

-

How about the cooperative outdoor communication power supply BESS

How about the cooperative outdoor communication power supply BESS

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.