Equatorial Guinea liquid-cooled energy storage battery

What are the battery energy storage projects in Equatorial Guinea Over a gigawatt of bids from battery storage project developers have been successful in the first-ever competitive auctions

Get a quote

Equatorial Guinea outdoor energy storage power disassembly

Taleveras to construct Africa''''s largest oil storage Why assessing key suppliers is backbone of nuclear power; Considered to be the Africa''''s largest oil storage terminal, the Bioko Oil

Get a quote

Doing Business with Equatorial Guinea

Ensure compliance with your country''s export regulations and Equatorial Guinea''s import requirements. Check for any specific product certifications or standards needed. Establish

Get a quote

Equatorial Guinea: Energy Country Profile

Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on decarbonizing our energy mix. This page provides the data for

Get a quote

ENERGY PROFILE Equatorial Guinea

only apply to developing areas. Energy self-sufficiency has been defined as total primary energy production divide by total primary energy supply. Energy trade includes all commodities in

Get a quote

Equatorial Guinea Energy Storage Market (2024-2030)

Equatorial Guinea Energy Storage Industry Life Cycle Historical Data and Forecast of Equatorial Guinea Energy Storage Market Revenues & Volume By Type for the Period 2020- 2030

Get a quote

Energy Storage Batteries in Equatorial Guinea: Powering the Future

While batteries dominate current talks, green hydrogen storage is creeping into conversations. Energy Undersecretary Juan Pablo recently hinted at pilot projects combining solar, batteries,

Get a quote

Equatorial Guinea

Equatorial Guinea imports most of its consumer products, and consequently was hit by the Russian war of aggression in Ukraine, which caused food shortages that worsened already

Get a quote

Battery Equipment Supplied In Equatorial Guinea

The GS200 Energy Storage System is self-contained, modular storage system delivering the most cost-effective and safest energy storage on the market. The zinc/iron flow battery incorporates

Get a quote

Equatorial Guinea Energy Storage Power Station Project

August 23, 2019: Equatorial Guinea is set to construct the first liquefied natural gas (LNG) storage and regasification plant in West Africa, advancing efforts to monetise gas resources through

Get a quote

Equatorial Guinea Major Exports – Countryaah

Equatorial Guinea''s oil is primarily used for energy generation and refined petroleum production globally. Exports of liquefied natural gas (LNG) were valued at approximately $2

Get a quote

Equatorial Guinea Energy Storage Cabinet Manufacturing Company

Which is the best energy storage cabinet on the grid side in Equatorial Guinea Our range of products is designed to meet the diverse needs of base station energy storage.

Get a quote

Equatorial Guinea electricity storage solutions

Energy Storage Systems & Solutions | Enel X Improving your facility''''s flexibility with energy storage helps to keep energy costs in control in your community and make the electric grid

Get a quote

Equatorial Guinea | Africa Energy Portal

The country economy traditionally depended on three commodities; oil and petroleum which contributes 78% to the GDP and cocoa, coffee, and timber and considered as the third-largest

Get a quote

Equatorial Guinea energy storage asia 2024

Equatorial Guinea is Open for Business, Open to Investors, Says Equatorial Guinea and Nigeria signed a regional gas supply deal in August 2024 to process Nigerian gas at Equatorial

Get a quote

Equatorial Guinea electricity storage solutions

This infographic summarizes results from simulations that demonstrate the ability of Equatorial Guinea to match all-purpose energy demand with wind-water-solar (WWS) electricity and heat

Get a quote

5 FAQs about [Equatorial Guinea exports energy storage products]

What are the main exports of Equatorial Guinea?

The top products exported by Equatorial Guinea are Crude Oil and Petroleum Gases. Crude Oil contributes to 30.82% of total trade value, equal to US$6,829,091 thousand, while Petroleum Gases account for 1.26%.

What is the electricity rate in Equatorial Guinea?

Electrification rates are relatively high in Equatorial Guinea at 66%. The country began oil production in the late 1990s and began LNG exports in 2007.

What are the different types of energy transformation in Equatorial Guinea?

One of the most important types of transformation for the energy system is the refining of crude oil into oil products, such as the fuels that power automobiles, ships and planes. No data for Equatorial Guinea for 2022. Another important form of transformation is the generation of electricity.

Is biomass a source of electricity in Equatorial Guinea?

Traditional biomass – the burning of charcoal, crop waste, and other organic matter – is not included. This can be an important source in lower-income settings. Equatorial Guinea: How much of the country’s electricity comes from nuclear power? Nuclear power – alongside renewables – is a low-carbon source of electricity.

What transformations are taking place in Equatorial Guinea in 2022?

No data for Equatorial Guinea for 2022. Another important form of transformation is the generation of electricity. Thermal power plants generate electricity by harnessing the heat of burning fuels or nuclear reactions – during which up to half of their energy content is lost.

Guess what you want to know

-

Equatorial Guinea portable energy storage box manufacturer

Equatorial Guinea portable energy storage box manufacturer

-

The largest energy storage power station in Equatorial Guinea

The largest energy storage power station in Equatorial Guinea

-

Equatorial Guinea Second Power Plant Energy Storage Project

Equatorial Guinea Second Power Plant Energy Storage Project

-

Namibia exports energy storage products

Namibia exports energy storage products

-

Equatorial Guinea grid-side energy storage cabinet manufacturer

Equatorial Guinea grid-side energy storage cabinet manufacturer

-

Lithium battery energy storage cabinet price in Equatorial Guinea

Lithium battery energy storage cabinet price in Equatorial Guinea

-

How much does energy storage equipment cost in Equatorial Guinea

How much does energy storage equipment cost in Equatorial Guinea

-

Equatorial Guinea Industrial Energy Storage Cabinet Model Query

Equatorial Guinea Industrial Energy Storage Cabinet Model Query

-

Equatorial Guinea Industrial Energy Storage Cabinet Supplier

Equatorial Guinea Industrial Energy Storage Cabinet Supplier

-

Guinea Industrial Energy Storage Products

Guinea Industrial Energy Storage Products

Industrial & Commercial Energy Storage Market Growth

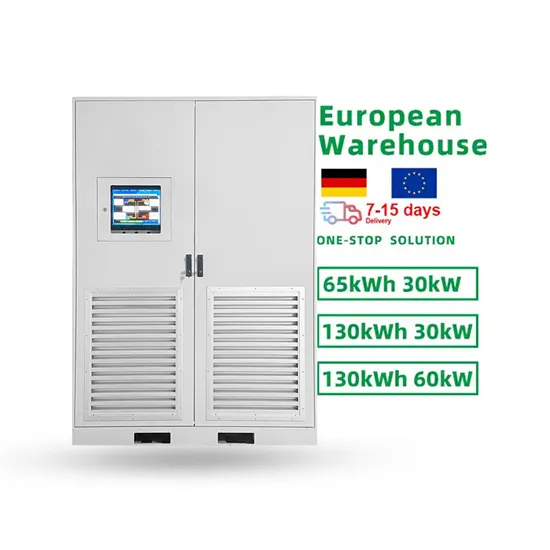

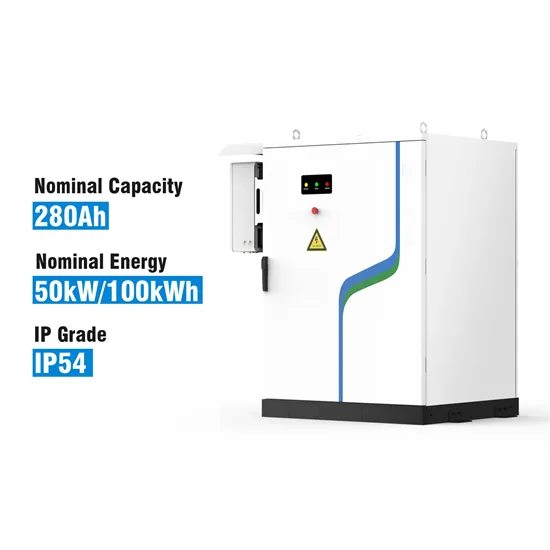

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.