Germany to spend extra €900 million on charging

German transport minister Volker Wissing has announced new state support programmes to speed up the lagging development of sufficient charging infrastructure for

Get a quote

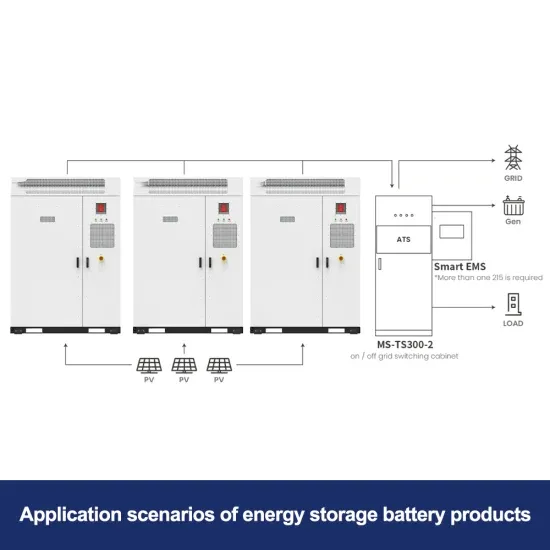

Energy Storage Technology Development Under the

The charging pile energy storage system can be divided into four parts: the distribution network device, the charging system, the battery

Get a quote

Electric vehicle charging infrastructure in Germany

While most EV owners could install or already had access to private charging facilities, the German public charging network also needs to

Get a quote

Germany''s public EV charging points: Analysing the 2023

For this purpose, after a short summary on what is known so far about the German CI and e- mobility usage, the overall distribution of public charging stations (CS), based on an empirical

Get a quote

Germany Electric Vehicles and Charging Infrastructure

According to the German Association of the Automotive Industry (VDA), the distribution of charging points in Germany is also not equitable as 48% of the country''s

Get a quote

Allocation method of coupled PV‐energy storage‐charging station

The hybrid AC/DC distribution network has become a research hotspot because of the wide access to multiple sources and loads. Meanwhile, extreme disasters in the planning

Get a quote

Electric vehicle charging infrastructure in Germany

While most EV owners could install or already had access to private charging facilities, the German public charging network also needs to match the growing electric vehicle

Get a quote

Key success factors unlocking the hidden potential in Germany''s

While Germany has made commendable progress, charging point distribution remains unbalanced. Germany''s map reveals disparities between eastern and western regions

Get a quote

Efficient allocation of capacitors and vehicle-to-grid integration

The economic and environmental aspects of integrating photovoltaic (PV) systems with energy storage and charging stations are considered, particularly considering the effects

Get a quote

Germany battery storage grid-connection requests exceed 500 GW

Germany''s grid connection requests for battery storage exceed 500 GW, a figure driven by a "first come, first served" approval system rather than viable projects, according to

Get a quote

Optimal power dispatching for a grid-connected electric vehicle

The paper proposes an optimization approach and a modeling framework for a PV-Grid-integrated electric vehicle charging station (EVCS) with battery storage and peer-to

Get a quote

Public Charging Infrastructure in Germany

This paper gives an overview of the differences in the utilization across the public charging infrastructure in Germany. To this end, a dataset on the utilization of 21164 public

Get a quote

Top 12 EV Recharge Providers in Germany | September 2024

Germany''s electric car recharge station providers offer diverse solutions, from fast-charging technology to energy storage integration, ensuring that electric vehicle owners have

Get a quote

Charging infrastructure in Germany: Notable progress,

Although the gap between the supply and demand for charging points in Germany is narrowing, significant disparities remain. Emden leads

Get a quote

Enhancing Behind-the-Meter Visibility of grid edge PV Systems

The growing adoption of solar panels, battery storage, and Electric Vehicle (EV) chargers is driving a profound transformation in the distribution grid system. However, limited

Get a quote

Charging infrastructure in Germany: Notable progress, but

Although the gap between the supply and demand for charging points in Germany is narrowing, significant disparities remain. Emden leads the deployment, but three-quarters of

Get a quote

Electricity Storage Strategy

Electricity storage has an important role to play in this, both for energy storage as such and also for the stabilisation of the electricity system and the grids. Currently, a strong and market

Get a quote

AI-based optimal allocation of BESS, EV charging station and DG

Battery energy storage system (BESS) is a promising technology capable of enhancing system reliability and can be used to facilitate the integration of high penetration

Get a quote

Batteries and EV Charging Stations in Germany (237 found)

Find detailed information about batteries and ev charging stations companies Germany for your Electrical and surveillance needs from our Electrical directory. Make sales enquiries or order

Get a quote

The Energy Storage Market in Germany

ISSUE 2019 Energy storage systems are an integral part of Germany''s Energiewende ("Energy Transition") project. While the demand for energy storage is growing across Europe, Germany

Get a quote

Comprehensive benefits analysis of electric vehicle charging station

The paper analyzes the benefits of charging station integrated photovoltaic and energy storage, power grid and society.

Get a quote

Analysis of electric vehicle charging station usage and profitability

This paper provides empirical data and a profitability estimation of public charging infrastructure usage in Germany. Given that, in Germany, there are now 2.5 times as many

Get a quote

The state of public EV charging infrastructure in Germany

This article provides a comprehensive overview of the current state of EV charging infrastructure in Germany, highlighting key data, market trends, and innovative solutions.

Get a quote

Key success factors unlocking the hidden potential in

While Germany has made commendable progress, charging point distribution remains unbalanced. Germany''s map reveals disparities between

Get a quote

Germany''s EV charging market overview

There are 8 brands that dominate the EV charging station market. Currently 5.7GW of available capacity is distributed over the different competitors in the German market.

Get a quote

Solving steps of PV‐ES‐CS configuration model in

Download scientific diagram | Solving steps of PV‐ES‐CS configuration model in AC/DC hybrid distribution network. from publication: Allocation method of

Get a quote

6 FAQs about [Germany s energy storage charging station distribution]

Do EV owners need public charging facilities in Germany?

While most EV owners could install or already had access to private charging facilities, the German public charging network also needs to match the growing electric vehicle fleet. Discover all statistics and data on Electric vehicle charging infrastructure in Germany now on statista.com!

How EV charging infrastructure is growing in Germany?

The growth of electric vehicle (EV) charging infrastructure in Germany has made significant progress over the past year. According to the 2024 Electric Charging Network Ranking, published by the German Association of the Automotive Industry (VDA), by 1st July 2024, there were 142,793 public chargers registered, of which 30,048 are fast.

Are public charging stations used in Germany?

This paper gives an overview of the differences in the utilization across the public charging infrastructure in Germany. To this end, a dataset on the utilization of 21164 public and semi-public charging stations in Germany is evaluated.

Does Germany have a good charging point distribution?

While Germany has made commendable progress, charging point distribution remains unbalanced. Germany’s map reveals disparities between eastern and western regions and variations based on population density and other demographic factors. Western and highly populated areas dominate charging points, aligning with EV sales distribution.

Do electric vehicles need a charging infrastructure in Germany?

Abstract: The current increase in the number of electric vehicles in Germany requires an adequately developed charging infrastructure. Large numbers of public and semi-public charging stations are necessary to ensure sufficient coverage of charging options.

How many subsidized charging points are there in Germany?

As a result of this large financing effort, nearly 893,100 subsidized charging points were in operation in mid-2024. While most EV owners could install or already had access to private charging facilities, the German public charging network also needs to match the growing electric vehicle fleet.

Guess what you want to know

-

Can energy storage be connected to a charging station

Can energy storage be connected to a charging station

-

Energy storage power station charging equipment

Energy storage power station charging equipment

-

Huawei charging station energy storage mode

Huawei charging station energy storage mode

-

North Africa Electric Charging Station Energy Storage Station

North Africa Electric Charging Station Energy Storage Station

-

Distribution of Energy Storage Charging Pile in Saint Lucia

Distribution of Energy Storage Charging Pile in Saint Lucia

-

Cameroon Energy Storage Charging Station

Cameroon Energy Storage Charging Station

-

Desert Energy Storage Charging Station

Desert Energy Storage Charging Station

-

BESS Mobile Energy Storage Charging Station in Croatia

BESS Mobile Energy Storage Charging Station in Croatia

-

Laos energy storage cabinet station charging pile cabinet manufacturer

Laos energy storage cabinet station charging pile cabinet manufacturer

-

Nordic Energy Storage Charging Station Quote

Nordic Energy Storage Charging Station Quote

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.