Renewable Energy Manufacturing in Türkiye Explained

With strategic manufacturing capabilities, competitive pricing, and a logistics network bridging Asia and Europe, Türkiye now plays a pivotal role in the export of solar

Get a quote

Turkey''s solar ambitions range beyond its borders –

For equipment suppliers, Türkiye offers a potential lifeline in a challenging global market. Demand has dwindled due to the ongoing module

Get a quote

India Shines Brighter: Rising Solar Exports Amid Global Trade

India has become an increasingly influential player in the global solar photovoltaic market, leveraging its abundant sunlight and a growing focus on renewable energy. The

Get a quote

Türkiye Solar Photovoltaic (PV) Power Market Outlook 2024÷2033

PRODUCT INFO This market report offers an incisive and reliable long-term overview of the photovoltaic sector of the country for the next long-term period, 2024 ÷ 2033. Türkiye has the

Get a quote

Solar and wind power transition in Türkiye: An input-output

Export data for solar PV panels and cells is only available from 2022 in Turkstat. With photovoltaic cells, panels, and panel parts, exports rose to 460 million USD and imports to 1.5 billion USD

Get a quote

Expanding Horizons: Turkey''s Solar Ambitions Reach Beyond

Module manufacturing in Turkey predominantly revolves around module assembly, characterized by a handful of established players and a multitude of newcomers. According to

Get a quote

17. Türkiye

With solar PV installations exceeding 9 GW in less than 10 years, the PV panel production market has also expanded. There are more than 30 solar module manufacturers in Türkiye which

Get a quote

Turkey sets minimum price for solar cell imports – pv magazine

The Turkish government has set a minimum import price of $60/kg, so solar cell imports exceeding this threshold will be subject to import duties. The measure is designed to

Get a quote

Turkey''s installed solar capacity reaches 12.2GW

Turkey''s installed solar capacity has surpassed wind thanks to the addition of hybrid projects, adding 510MW of capacity to the solar sector.

Get a quote

Türkiye doubles import price reference for solar parts to boost

T he Turkish Trade Ministry introduced a surveillance measure that sets the reference import price at $170 per kilogram for certain photovoltaic cells and circuit boards,

Get a quote

Turkey''s solar ambitions extend beyond its frontiers

It''s a pivotal time for solar in Türkiye. In the first two months of 2024, the country added 1.1 GW of new generation capacity, equivalent to around half of its PV installation total

Get a quote

Analysis of countries exporting Chinese photovoltaic energy

It can be observed from the chart that China''s exports of photovoltaic modules to the world in 2024 will almost certainly show growth compared to last year. Apart from the

Get a quote

Türkiye doubles import price reference for solar parts

T he Turkish Trade Ministry introduced a surveillance measure that sets the reference import price at $170 per kilogram for certain photovoltaic

Get a quote

Turkish solar panel manufacturers expanding their capacity

Together with a range of other technologies, China rules the world''s solar power market from equipment manufacturing to planning and building photovoltaic facilities. But

Get a quote

Ankara Solar

Ankara Solar, Turkey''s solar panel manufacturer, is a leading global provider of comprehensive photovoltaic (PV) solar energy solutions that are truly Taking Energy Forward. By integrating

Get a quote

Türkiye doubles import price reference for solar parts to boost

Minimum customs value introduced for solar components The scope of the updated import policy includes photovoltaic cells that are not assembled into modules or panels, as well

Get a quote

Turkey Solar Energy Market Size, Share Analysis & Industry

The Turkey Solar Energy Market is expected to reach 23.5 gigawatt in 2025 and grow at a CAGR of 20.62% to reach 60 gigawatt by 2030. Kalyon PV, Smart Solar, HT Solar

Get a quote

Turkish solar panel manufacturers expanding their

Together with a range of other technologies, China rules the world''s solar power market from equipment manufacturing to planning and building

Get a quote

Türkiye''s largest PV module manufacturing plant commissioned

Currently only solar modules are being produced at the factory with cell production scheduled to start in the coming months. The plant will have a production capacity of 300 MW,

Get a quote

Top 5 Turkish Solar Panel Manufacturers 2025

Thanks to its favorable climate and growing infrastructure, Turkey is home to several cutting-edge solar panel manufacturers. In this article, we showcase the top 5 Turkish solar

Get a quote

Astronergy Announces TOPCon Solar Cell Factory In Turkey

Chinese solar cell and module producer Astronergy plans to build a TOPCon solar cell manufacturing facility in Turkey, along with an R&D center. It will be

Get a quote

Turkey''s solar ambitions range beyond its borders – pv magazine

For equipment suppliers, Türkiye offers a potential lifeline in a challenging global market. Demand has dwindled due to the ongoing module oversupply situation in Europe.

Get a quote

Top 5 Turkish Solar Panel Manufacturers 2025

Thanks to its favorable climate and growing infrastructure, Turkey is home to several cutting-edge solar panel manufacturers. In this article, we

Get a quote

Dominant PV Trade Flows In Europe 2022

The past reports6 traces the development over time, while this report focuses on the trade flows of 2022, distinguishing between PV cells and modules. Both of these two extra-European import

Get a quote

6 FAQs about [Türkiye exports photovoltaic modules]

Is Turkey the first European country to produce solar panels?

Minister of Industry and Technology Mehmet Fatih Kacır said earlier this year that Turkey is the first in Europe in solar panel production. Kalyon Energy or Enerji completed its Konya Karapınar solar power plant last year. It has 1.35 GW in peak capacity, more than any facility of the kind in geographic Europe.

How much does a PV system cost in Türkiye?

In summer 2023, a new 10-year feed-in tariff (FIT) of TRY 1.06 ($0.03)/kWh was introduced for PV systems installed between July 1, 2021, and Dec. 31, 2030. Projects that use PV modules made in Türkiye get even more support, benefiting from a further five-year FIT of TRY 0.288/kWh.

Will a vat tariff affect foreign solar panels?

A tariff of $25/m 2 is now in place for solar modules imported from Vietnam, Malaysia, Thailand, Croatia, and Jordan. If that wasn’t enough to discourage module imports, changes to VAT rules, in November 2023, have had a significant impact on the cost-per-Watt of foreign photovoltaics.

How much power does Türkiye have in 2022?

Türkiye At the end of December 2022, total installed power capacity in Türkiye reached 103,809 MW, out of which PV plants accounted for 9,425 MW. The amount of solar PV projects under completion are estimated to be 1-1.5 GW. This capacity can be considered in addition to the installed capacity in 2022.

How many Turkish module assemblers are there?

And as pv magazine discovered at SolarEX 2024, a three-day trade fair in Istanbul in April 2024, the number of domestic module assembly businesses has ballooned. Different numbers were discussed on the exhibition floor but the general consensus was that there are at least 80, and likely more than 90, Turkish module assemblers.

Will China impose antidumping fees on imported PV modules?

In 2017, the government unveiled a list of 16 China-based PV manufacturers whose imported modules would be subjected to $20/m 2 antidumping fees. Those were the lucky ones, as other Chinese businesses were hit with a $25 fee from the same measure.

Guess what you want to know

-

Nigeria exports photovoltaic modules

Nigeria exports photovoltaic modules

-

What are the requirements for exporting photovoltaic modules

What are the requirements for exporting photovoltaic modules

-

Uzbekistan double-glass photovoltaic modules

Uzbekistan double-glass photovoltaic modules

-

How much are the prices of photovoltaic modules in Asia

How much are the prices of photovoltaic modules in Asia

-

India flexible solar photovoltaic modules

India flexible solar photovoltaic modules

-

Syria double-glass photovoltaic modules

Syria double-glass photovoltaic modules

-

Chad double-glass photovoltaic modules

Chad double-glass photovoltaic modules

-

Is the battery temperature of photovoltaic modules high

Is the battery temperature of photovoltaic modules high

-

Prices of photovoltaic modules from major manufacturers

Prices of photovoltaic modules from major manufacturers

-

Huawei solar panels photovoltaic modules

Huawei solar panels photovoltaic modules

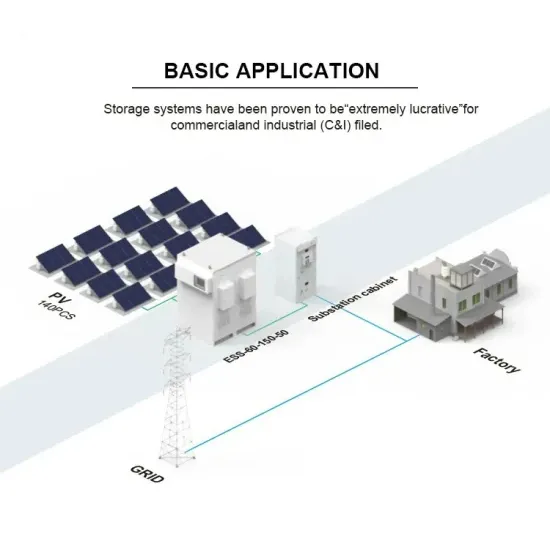

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

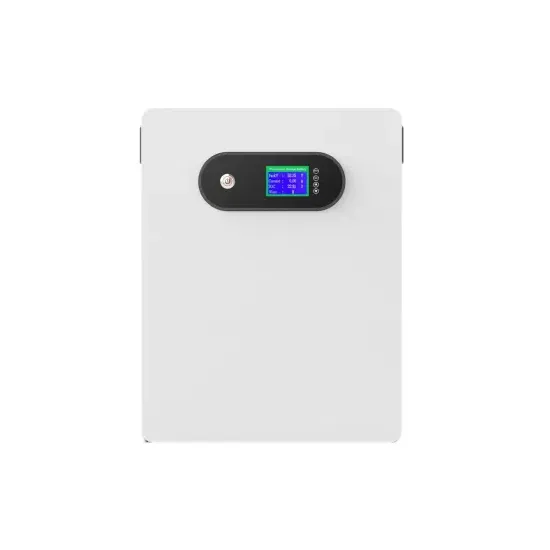

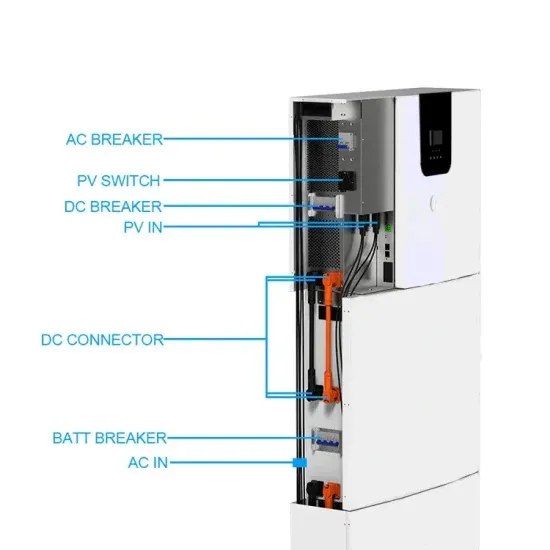

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.