Report | Global 4G and 5G Base Station Market 2023 by Manufacturers

Chapter 3, the 4G & 5G Base Station competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast. Chapter

Get a quote

Market Share of Top Three Suppliers of Base Stations Projected

Chinese and European suppliers of base station equipment are expected to once again account for a global market share of more than 70% in 2021, and the top three suppliers

Get a quote

Market share of top 3 suppliers of base stations to undergo slight

Not only is Samsung supplying base station components to the three largest mobile network operators in Korea, but it is also collaborating with operators in the US (including

Get a quote

Market Share of Top Three Suppliers of Base Stations

Huawei and ZTE have subsequently become unable to acquire key RF front-end components from US suppliers, thereby prompting Huawei to

Get a quote

Huawei Launches GreenSite and PowerStar2.0 for Green 5G

At the 2021 Global Mobile Broadband Forum (MBBF), Aaron Jiang, President of Huawei''s SRAN Product Line, launched the GreenSite and PowerStar2.0 solutions to help

Get a quote

Green Development 2030 Report

Key green technologies should be considered to cover every link of the energy transmission chain, including auxiliary equipment that supplies energy, the main base station equipment

Get a quote

Vodafone and Huawei co-develop compact green base station

The 2G base station has been tested initially by Vodafone-controlled Vodacom in South Africa and the parent firm is now reviewing its options for commercial launch in various

Get a quote

Huawei is the top mobile base station equipment

The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23%

Get a quote

Huawei Green Antenna Series Wins GSMA GLOMO Award

Huawei green antennas have currently been deployed in more than 75 countries, recognized as a top choice for green and efficient network construction among global operators.

Get a quote

Hot Sale HUAWEI UBBPg1a 03050BYF for Huawei

The Huawei UBBPg1a 03050BYF is a component used in the Huawei BBU 3900 Baseband unit. It is an interface board that provides connectivity and

Get a quote

Huawei Green Antennas Deployed in Ene...

PRESS RELEASE: In recent days, Northwestern China has seen the first deployment of Huawei''s green antennas. By improving base station energy efficiency, the

Get a quote

Huawei is the top mobile base station equipment supplier in global

The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is

Get a quote

Site Power Facility

Huawei Site Power Facility offers energy-efficient, low-carbon power supply solutions, enabling carriers to build environmentally sustainable, resilient networks for modern

Get a quote

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Get a quote

Market Share of Top Three Suppliers of Base Stations Projected

Huawei and ZTE have subsequently become unable to acquire key RF front-end components from US suppliers, thereby prompting Huawei to shift its base station

Get a quote

Market share of top 3 suppliers of base stations to

Not only is Samsung supplying base station components to the three largest mobile network operators in Korea, but it is also collaborating

Get a quote

On-site energy reductions: Methods & concerns

Huawei''s green GSM base station uses multi-density carrier and RF broadband technology, with each module supporting four to six carrier waves. Its

Get a quote

Huawei Green Network Power Series Help Carriers Reduce

Peng Jianhua, President of the Site Power Facility Domain of Huawei Digital Power Technologies Co., Ltd., unveiled a series of new products for green sites and green equipment rooms, aimed

Get a quote

Huawei Launches Intelligent SitePower Solution for

During the 9th Global ICT Energy Efficiency Summit in Dubai, Huawei showcased its next-generation digital and intelligent site power facility

Get a quote

Green Sky White Paper

The green-oriented innovations of wireless networks require end-to-end collaboration of network devices. As an essential component that transmits and receives signals on wireless networks,

Get a quote

Telenor''s Green Connection

So far, we have installed more than 3,000 solar-powered base stations across our operations, and we are working to deploy more solar and wind solutions coupled with power purchase

Get a quote

6 FAQs about [Who are the suppliers of Huawei s green base stations ]

What are the top 3 base station equipment providers in the world?

The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares. The noticeable point is amid US sanctions, Huawei still leads the global market share and continues its leadership.

Who owns the base station equipment market?

The report discloses that more than 70% of the market is covered by Chinese and European suppliers. The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares.

Does Samsung supply base station components?

Not only is Samsung supplying base station components to the three largest mobile network operators in Korea, but it is also collaborating with operators in the US (including AT&T, Sprint, and Verizon) while having established supply agreements with NTT DoCoMo in Japan.

What is the market share of base station equipment suppliers?

A world-leading market intelligence provider – TrendForce released the global market share analysis report of suppliers of base station equipment. The report discloses that more than 70% of the market is covered by Chinese and European suppliers.

Which 5G base station supplier has received the first overseas orders?

On the other hand, Japanese supplier NEC has received its first ever overseas orders this year, from British mobile network Vodafone. Japan-based Fujitsu, likewise, has also been chosen by the British government as an alternative supplier of 5G base station equipment in place of Huawei.

Why is Huawei still leading the global market?

The noticeable point is amid US sanctions, Huawei still leads the global market share and continues its leadership. In reasons behind these growing shares are the product cost and high demand from the Chinese market.

Guess what you want to know

-

Distribution of 5G green base stations in the Vatican

Distribution of 5G green base stations in the Vatican

-

Huawei s share of wind power in China s communication base stations

Huawei s share of wind power in China s communication base stations

-

Is China Communications 5G base stations using Huawei

Is China Communications 5G base stations using Huawei

-

What are the green PV communication base stations in Syria

What are the green PV communication base stations in Syria

-

Reasons for the increase in green base stations for 5G communication

Reasons for the increase in green base stations for 5G communication

-

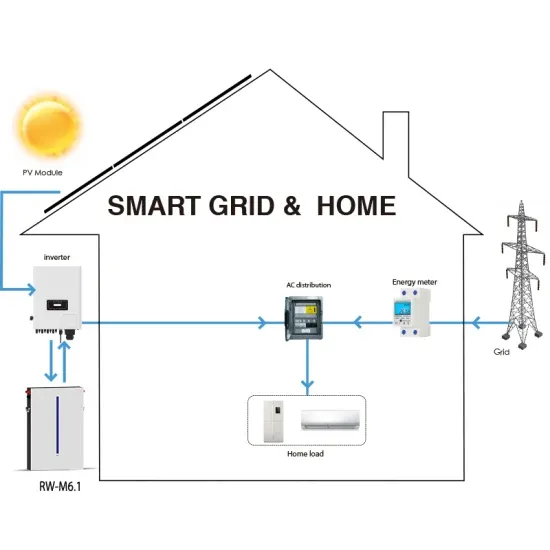

How to use energy storage containers for green communication base stations

How to use energy storage containers for green communication base stations

-

How much does it cost to upgrade Huawei s communication equipment base stations

How much does it cost to upgrade Huawei s communication equipment base stations

-

Angola supports green communication base stations

Angola supports green communication base stations

-

Where are the green base stations in Mali

Where are the green base stations in Mali

-

Measures to protect green communication base stations

Measures to protect green communication base stations

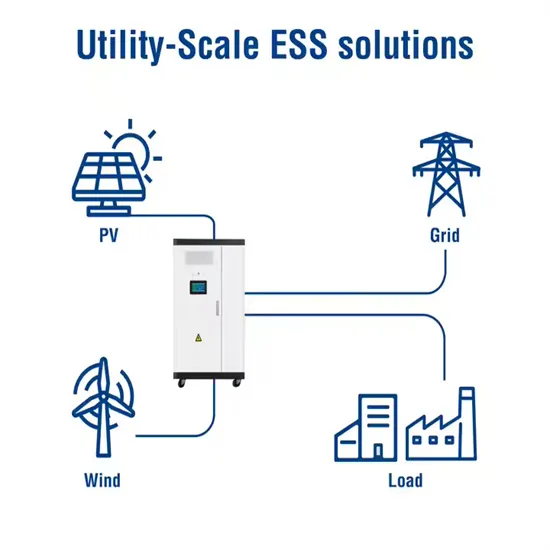

Industrial & Commercial Energy Storage Market Growth

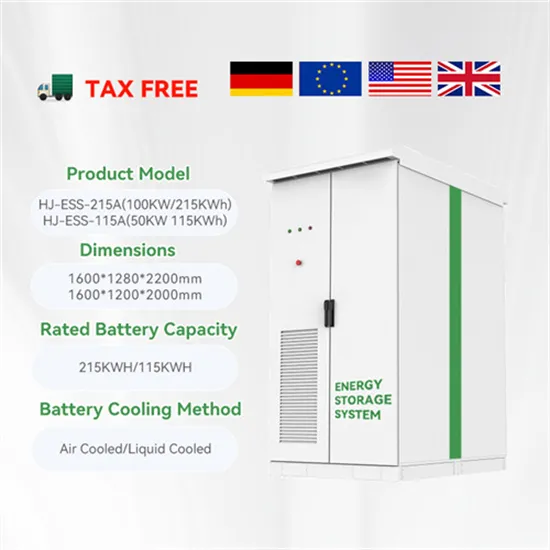

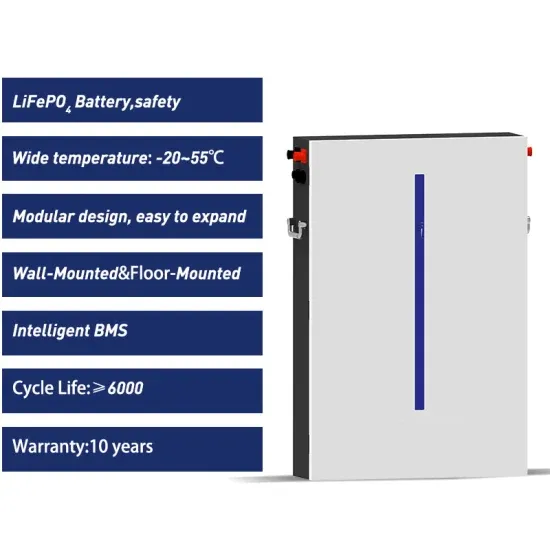

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.