NRG, Calpine selected as finalists for Texas Energy

The Public Utility Commission of Texas chose 17 companies to move forward with the application process for low-interest loans from a

Get a quote

Energy Storage Power Station Equity: The $33 Billion

Energy storage power station equity, the unsung hero enabling our transition to renewable energy. With the global energy storage market hitting $33 billion annually [1], investors are

Get a quote

Project Financing and Energy Storage: Risks and Revenue

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and

Get a quote

How can individuals carry out energy storage power station projects

The undertaking of energy storage power station projects entails a multifaceted approach grounded in meticulous planning and informed decision-making. Individuals aspiring

Get a quote

Energy storage project in local oil field expected to retain federal

2 days ago· A hybrid energy storage project in western Kern that was approved for federal financial support under the Biden administration has managed to survive under the Trump

Get a quote

Energy storage

The construction of the large-scale Battery Energy Storage System (BESS) next to the Pumped Storage Power Plant (ESP) Żarnowiec with a power rating of no less than 200 MW and

Get a quote

Energy Storage Proposals Face Pushback from Some Communities

In July 2024, Hochul announced that New York State will receive U.S. Department of Energy funding for a long-duration energy storage demonstration project that will use fire

Get a quote

Local opposition, not the new administration, is holding back US energy

In the last year alone, several important BESS projects in New York, Maryland and other states have been cancelled or delayed due to a rise in community opposition.

Get a quote

Energy storage overcapacity can cause power system instability

The expansion is driven mainly by local governments and lacks coordination with new energy stations and the power grid.

Get a quote

We Have An Energy Storage Problem

The Inflation Reduction Act extends a tax credits to energy storage projects. That''s a good thing, because this country and the world has a big energy storage problem.

Get a quote

Energy Storage Industry In The Next Decade: Technological

In 2023, multiple overseas energy storage power station fire accidents caused the industry to pay high attention to safety, but the global unified energy storage safety standards,

Get a quote

Honduras Energy Storage Power Station Project: Powering a

That''s the vision behind the Honduras energy storage power station project. But why should you care? Whether you''re an investor eyeing Central America''s energy sector or a

Get a quote

Microsoft Word

The uses for this work include: Inform DOE-FE of range of technologies and potential R&D. Perform initial steps for scoping the work required to analyze and model the benefits that could

Get a quote

Trump Is Freezing Money for Clean Energy

About 80 percent of manufacturing investments spurred by a Biden-era climate law have flowed to Republican districts. Efforts to stop federal payments are already causing pain.

Get a quote

Local opposition, not the new administration, is holding back US

In the last year alone, several important BESS projects in New York, Maryland and other states have been cancelled or delayed due to a rise in community opposition.

Get a quote

Energy Storage Power Station Project Loans: Your Gateway to

Let''s cut to the chase: the global energy storage market is booming like a Tesla battery on Red Bull. With a staggering $33 billion industry generating nearly 100 gigawatt-hours annually [1],

Get a quote

World''s largest flywheel energy storage connects to

The project was developed and financed by Shenzen Energy Group. Image: Shenzen Energy Group. A project in China, claimed as the

Get a quote

Project Financing and Energy Storage: Risks and

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to

Get a quote

Technology Strategy Assessment

In 2019, this capacity represented approximately 93% of U.S. utility-scale energy storage power capacity and approximately 99% of U.S. energy storage capability [2]. PSH functions as an

Get a quote

How do grants and funds contribute to the financial viability of

Grants and funds play a crucial role in enhancing the financial viability of Long-Duration Energy Storage (LDES) projects by addressing several challenges inherent in these

Get a quote

How much does it cost to invest in a 100M energy

The financial commitments related to investing in a 100 million energy storage power station are substantial and multifaceted. The initial

Get a quote

Why Energy Storage Power Station Projects Are Being

As project developers scramble to adapt, one thing''s clear: the era of "build first, ask questions later" in energy storage is officially over. The projects that survive this shakeout

Get a quote

What is energy storage power station project?

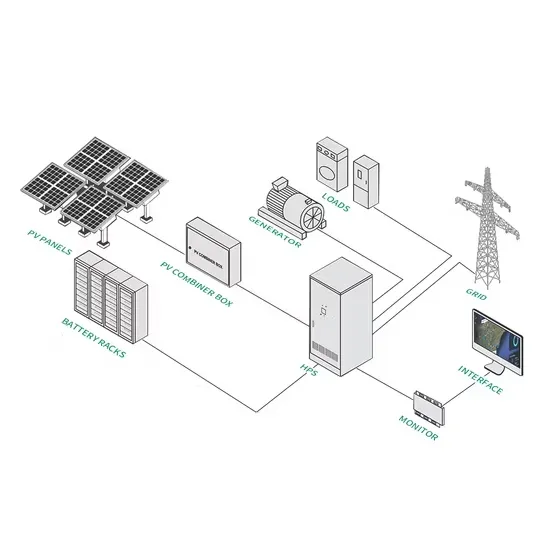

1. Energy storage power station projects represent foundational advancements in contemporary energy management, serving several critical

Get a quote

Romania: Funds for battery storage projects, major

In its first, the Romanian government has allocated EU funds for two major battery energy storage projects via the National Recovery and

Get a quote

Energy storage power station project lacks funds

US solar PV and energy storage project developer Intersect Power has closed two financing deals worth US$837 million for three battery energy storage system (BESS) projects in Texas.

Get a quote

6 FAQs about [Energy storage power station project lacks funds]

Does project finance apply to energy storage projects?

The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects. Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and cashflows of an energy storage project.

Do we have post-generation energy storage issues?

We have post-generation storage issues as well. Usually, when people think about post-generation energy storage, they think of electrochemical batteries. However, batteries represent a small minority of electrical storage capacity at present. About 90% of current grid storage is in the form of pumped hydro facilities.

Why is energy storage oversupply a problem?

The expansion is driven mainly by local governments and lacks coordination with new energy stations and the power grid. In some regions, a considerable storage oversupply could lead to conflicts in power-dispatch strategies across timescales and jurisdictions, increasing the risk of system instability and large-scale blackouts.

What technology risks are associated with energy storage systems?

Technology Risks Lithium-ion batteries remain the most widespread technology used in energy storage systems, but energy storage systems also use hydrogen, compressed air, and other battery technologies. Project finance lenders view all of these newer technologies as having increased risk due to a lack of historical data.

Is excessive energy storage a threat to China's power system?

But the risks for power-system security of the converse problem — excessive energy storage — have been mostly overlooked. China plans to install up to 180 million kilowatts of pumped-storage hydropower capacity by 2030. This is around 3.5 times the current capacity, and equivalent to 8 power plants the size of China’s Three Gorges Dam.

Why do energy storage stations have different voltage levels?

The situation is further complicated by electrochemical-energy storage stations that operate at different voltage levels, hindering the suppression of fluctuations caused by inherently variable energy sources, such as wind and sunlight. Expansion of the capacity to generate energy must align with the capacity to store it.

Guess what you want to know

-

Saint Lucia Energy Storage Power Station Project Construction

Saint Lucia Energy Storage Power Station Project Construction

-

Cambodia Siem Reap Energy Storage Power Station Construction Project

Cambodia Siem Reap Energy Storage Power Station Construction Project

-

Large Energy Storage Power Station Project in Zhongcheng City

Large Energy Storage Power Station Project in Zhongcheng City

-

Armenia Energy Storage Power Station Project

Armenia Energy Storage Power Station Project

-

Tajikistan Mobile Energy Storage Power Station Project

Tajikistan Mobile Energy Storage Power Station Project

-

Albania Wind Solar Energy Storage Power Station Project

Albania Wind Solar Energy Storage Power Station Project

-

Commercial Energy Storage Power Station Project

Commercial Energy Storage Power Station Project

-

Canada Mobile Energy Storage Power Station Project

Canada Mobile Energy Storage Power Station Project

-

Canada Photovoltaic Power Station Energy Storage Project

Canada Photovoltaic Power Station Energy Storage Project

-

German energy storage power station and power grid project

German energy storage power station and power grid project

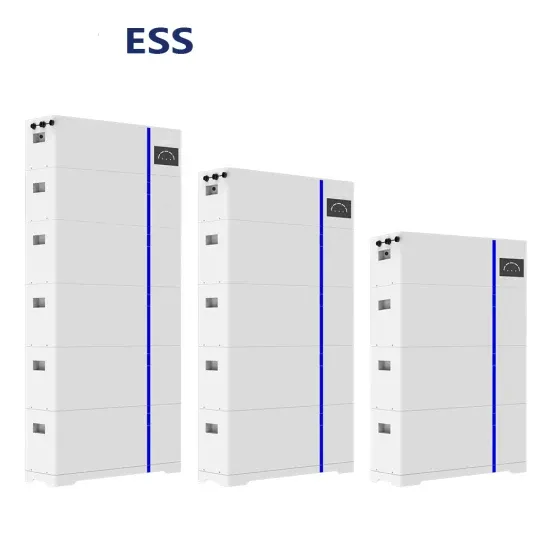

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

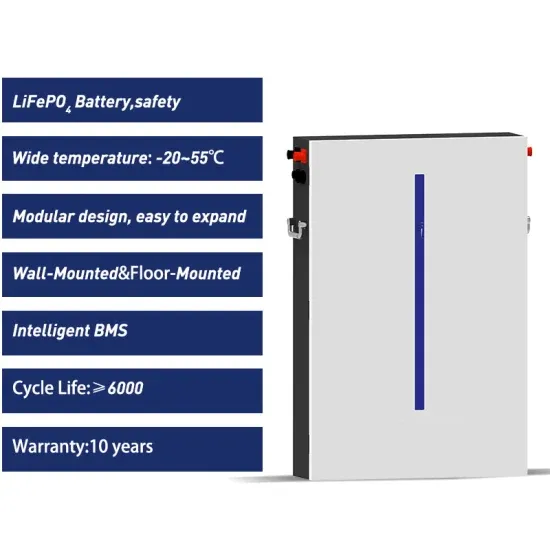

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.