Energy storage a key goal for Oman: H.E. Al Aufi

H.E. Eng. Salim bin Nasser al Aufi, Minister of Energy and Minerals, affirmed Oman''s commitment to developing storage capacity to address imbalances in supply from

Get a quote

Muscat energy storage container production plant

r the needs of mobile energy storage market. Located 300 kilometers west of Muscat, Oman''''s capital, the Ibri Solar Photovoltaic (PV) Independent Power Plant is a pioneering renewable

Get a quote

Port of Sohar Liquids Storage Terminal, Oman

Oiltanking Odfjell Terminals operates the Port of Sohar liquids storage terminal, which is located in Al Batinah North Governorate in Oman.

Get a quote

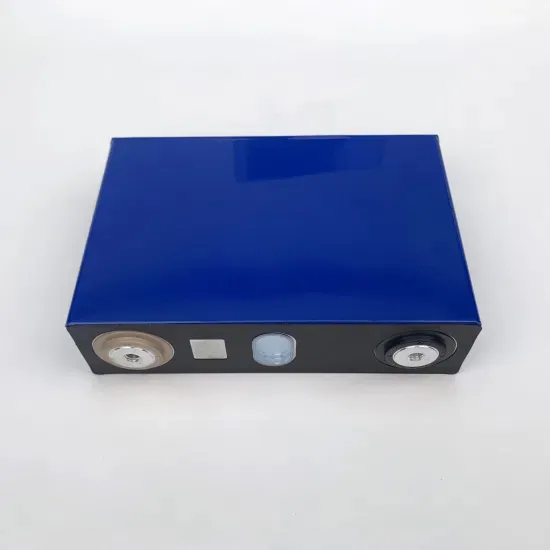

Oman energy storage battery container technology

The superior battery cell technology powering this energy storage solution answers some of the most pressing challenges in the sustainable energy industry today.

Get a quote

Energy Storage New Materials in Muscat: The Desert''s Hidden

A recent PwC report notes: "Oman''s storage material sector could attract $2 billion in FDI by 2027 – and that''s before considering the 35% annual growth in regional renewable

Get a quote

OQ investments boost Oman''s fuel storage capacity

Major investments by OQ – the integrated energy group of Oman – in the country''s fuel storage infrastructure are poised to strengthen its pivotal role in strategic fuel logistics,

Get a quote

Enhancing electricity supply mix in Oman with energy storage systems

This paper aims to review energy storage options for the Main Interconnected System (MIS) in Oman. In addition, it presents a techno-economic case study on utilising

Get a quote

Oman Green Hydrogen Strategy

Oman political stability index 0.51 (2021) on a scale of -2.5 to 2.5. Political stability index includes corruption perceptions, political rights, civil liberties,

Get a quote

Muscat Energy Storage Announcement: Powering Oman''s

Why the Muscat Energy Storage Announcement Matters (and Why You Should Care) a sun-baked nation where ancient frankincense trade routes now hum with lithium-ion

Get a quote

First-ever battery storage option for Oman''s Ibri III solar project

According to a senior official of Nama Power and Water Procurement Company (PWP), the single procurer of power and water capacity in the Sultanate of Oman, the

Get a quote

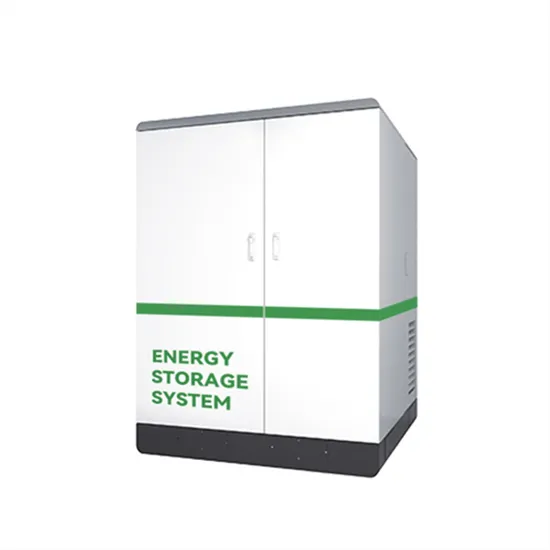

Muscat Large Energy Storage Cabinet Cost: What Businesses

Whether you''re ready to dive in or just testing the waters, understanding Muscat large energy storage cabinet costs could be your ticket to energy independence.

Get a quote

Muscat Energy Storage Container Solutions: Powering Oman''s

Every 100 MWh of deployed container storage creates 83 local jobs in Oman. But the bigger story is energy independence—remote villages using solar+storage combinations are reporting 90%

Get a quote

Muscat Energy Storage Prices 2025: Trends, Analysis & What

Why Muscat''s Battery Market Feels Like a Spice Souk Bargain Hunt Ever tried haggling in Muscat''s Muttrah Souq? The current energy storage market here has similar energy - minus

Get a quote

Energy storage a key goal for Oman: H.E. Al Aufi

H.E. Eng. Salim bin Nasser al Aufi, Minister of Energy and Minerals, affirmed Oman''s commitment to developing storage capacity to address

Get a quote

Oman storage containers tenders

Get access to latest Oman storage containers tenders and government contracts. Find business opportunities for Oman storage container tenders, Oman Bulk storage container tenders,

Get a quote

Oman cimc energy storage group factory operation

It is a subsidiary of China International Marine Containers (Group) Co., Ltd (000039.SZ). CIMC ENRIC is principally engaged in design, development, manufacturing, engineering, sales and

Get a quote

OQ Investments Enhance Oman''s Fuel Storage Capacity: Key

OQ, Oman''s integrated energy group, is investing $328 million in fuel storage hubs to enhance strategic logistics. The Musandam hub, costing $204 million, aims to ensure fuel

Get a quote

Oman smart energy storage cabinet market

MUSCAT: The Oman Power and Water Procurement Company (OPWP), the single buyer of electricity and water output in the Sultanate of Oman, says it plans to study options for energy

Get a quote

Powering Oman''s Future: How Energy Storage Manufacturers

Why Your Business Needs an Oman Energy Storage Manufacturer Phone Number Let''s face it – when your solar farm suddenly needs backup batteries during a sandstorm, you

Get a quote

Enhancing electricity supply mix in Oman with energy storage

This paper aims to review energy storage options for the Main Interconnected System (MIS) in Oman. In addition, it presents a techno-economic case study on utilising

Get a quote

Storage Bins – AL AQDEEN TRADING – Industrial

Supply & Installation of industrial warehouse racking and shelving systems in Sultanate of Oman, providing an array of storage systems and solutions for

Get a quote

Container Storage – Container Master – Official website

Container Depot is the new concept in Oman and particularly in Sohar in order to store, repair and maintain empty Shipping Containers at multi stack storage yard.

Get a quote

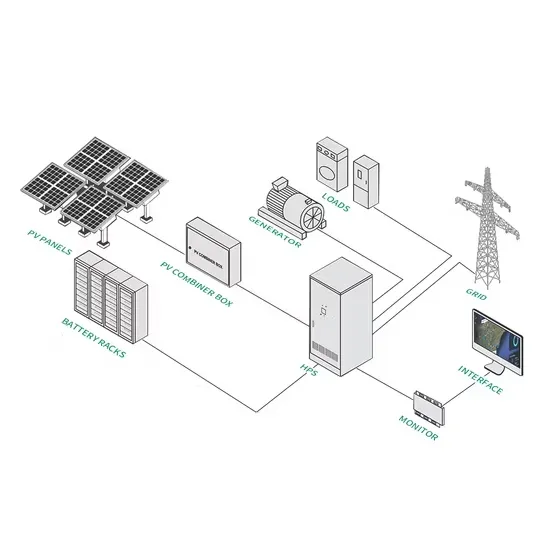

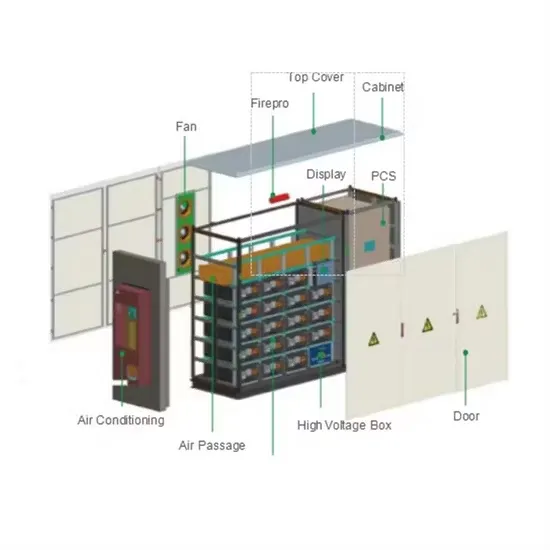

Containerized Energy Storage System: How it Works

A Containerized Energy-Storage System, or CESS, is an innovative energy storage solution packaged within a modular, transportable container. It

Get a quote

Oman

Oman''s energy supply is entirely generated by nationally-produced natural gas and oil products and the country is a large exporter of oil and gas. The government has recently launched the

Get a quote

First large-scale energy storage project advances

Energy Dome, as the supplier of the technology, will deliver the entire battery storage plant for the Oman project. Takhzeen, for its part, will install the plant, while owning

Get a quote

6 FAQs about [Oman Energy Storage Container Budget]

Which utility-scale energy storage options are available in Oman?

Reviewing the status of three utility-scale energy storage options: pumped hydroelectric energy storage (PHES), compressed air energy storage, and hydrogen storage. Conducting a techno-economic case study on utilising PHES facilities to supply peak demand in Oman.

What is the electricity market structure in Oman?

Electricity market structure in Oman Unlike the electrical energy sources used in traditional power plants, renewable energy sources are not dispatchable and will vary over time; as a result, the energy feed in the network will be intermittent.

How much will Oman's power sector invest in the next six years?

Taken together with parallel plans for the implementation of a raft of Wind IPPs and combined cycle gas turbine (CCGT) power projects, total investment in Oman’s power sector is set to balloon to well over $5 billion over the next six years through to 2030.

Can PHES facilities supply peak demand in Oman?

Conducting a techno-economic case study on utilising PHES facilities to supply peak demand in Oman. This manuscript proceeds by reviewing the status of utility-scale energy storage options in Section 2. Section 3 presents the status and main challenges of Oman’s MIS.

What is Oman's new PV policy?

Recently, the government in Oman introduced new policy that encourages the residential sector to instal photovoltaic (PV) cells on their rooftops. This is expected to have more energy produced from PV in the future, which will be fed back to the grid.

What are the challenges of the power sector in Oman?

The second challenge of the power sector in Oman is subsidies, which include subsidies to electricity customers and fuel subsidies to generating facilities. In 2016, financial subsidies reached OMR 389.9 million (AER 2019 ). As a percentage of the economic cost of electricity, subsidies vary between 48% in MIS and 85% in RAEC (Albadi 2017 ).

Guess what you want to know

-

Uruguay Energy Storage Container Budget

Uruguay Energy Storage Container Budget

-

Mali Energy Storage Container Power Station Budget

Mali Energy Storage Container Power Station Budget

-

Outdoor solar energy storage container has long-lasting power

Outdoor solar energy storage container has long-lasting power

-

Saint Kitts and Nevis energy storage container manufacturer

Saint Kitts and Nevis energy storage container manufacturer

-

Vietnam Energy Storage Cabinet Container

Vietnam Energy Storage Cabinet Container

-

Estonian container energy storage system supplier

Estonian container energy storage system supplier

-

Peru reliable energy storage container for sale

Peru reliable energy storage container for sale

-

German Energy Storage Container Procurement

German Energy Storage Container Procurement

-

Senegal container energy storage cabinet solution

Senegal container energy storage cabinet solution

-

New Energy Container Energy Storage Base Station

New Energy Container Energy Storage Base Station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.