Silicon Carbide in 5G Wireless Communications: Faster,

5G networks require power electronics that can handle high voltages and frequencies, making SiC an ideal candidate. SiC-based power devices, such as MOSFETs and IGBTs, are being

Get a quote

Silicon Carbide (SiC) Substrates for Base Station Future-Proofing

The global market for Silicon Carbide (SiC) Substrates for Base Station is anticipated to exhibit substantial growth over the forecast period, driven by the increasing

Get a quote

Device Technologies and Circuits for 5G and 6G | SpringerLink

Gallium nitride (GaN) and silicon carbide (SiC) are the best devices for power switching [40]. SiC substrates are also capable of operating in extremely high temperatures.

Get a quote

SiC Wafer Market Growth in 5G Base Station and New Energy

Under the conditions of the same power level, the use of devices on single crystal SiC substrate can reduce the volume of electric drives and electronic controls to meet the

Get a quote

Breaking new ground with silicon carbide

As 5G networks expand worldwide, the demand for high-performance, energy-efficient power electronics in radio receiver base stations is growing. SiC technology is becoming a preferred

Get a quote

From New Energy Vehicles to 5G Base Stations: How Silicon

1 day ago· 5G base stations have stringent requirements for power devices in high-frequency and high-temperature environments, making silicon carbide-based gallium nitride (GaN-on-SiC)

Get a quote

MaxLinear Linearization and Cree GaN on SiC Power

The use of GaN on SiC with effective linearization accelerates the rollout of 5G by enabling significant power, thermal, and cost savings through

Get a quote

Silicon Carbide in 5G Wireless Communications

Silicon Carbide is a widely recognized semiconductor material with unique properties that have made it a popular choice for various applications. This remarkable material has caught the

Get a quote

Power Amp Wars Begin For 5G

Demand is increasing for power amplifier chips and other RF devices for 5G base stations, setting the stage for a showdown among different companies and technologies.

Get a quote

Silicon Carbide (SiC) Substrates for Base Station Market

Silicon Carbide (SiC) Substrates for Base Station Market size was valued at USD 1.2 Billion in 2024 and is forecasted to grow at a CAGR of 12.

Get a quote

SiC 5g, Silicon Carbide In Electronics | Junko Energy

SiC-based gallium nitride devices, due to their small size and high power, are gradually being used in base station power amplifiers. The high thermal conductivity and low RF loss of SiC

Get a quote

5G Base Station Chips Market Report | Global Forecast From

The global 5G base station chips market size was valued at approximately USD 1.5 billion in 2023 and is projected to reach around USD 8.2 billion by 2032, growing at a compound annual

Get a quote

Silicon Carbide Substrates Transforming Base Station

As the number of 5G-enabled devices and services skyrockets, the pressure on base stations to deliver uninterrupted, high-speed connectivity continues to mount. SiC

Get a quote

MaxLinear Linearization and Cree GaN on SiC Power Amplifiers

The use of GaN on SiC with effective linearization accelerates the rollout of 5G by enabling significant power, thermal, and cost savings through more efficient wireless

Get a quote

Silicon Carbide in 5G Wireless Communications: Faster,

Silicon Carbide is a game-changer in the world of 5G wireless communications, offering faster, stronger, and more reliable performance. Its unique material properties make it an ideal choice

Get a quote

Semiconductor Silicon Carbide (SiC) Power Devices Market

Market expansion is driven by a 32% rise in EV adoption, a 21% increase in smart grid infrastructure, and a 17% uptick in 5G base station installations. US Semiconductor

Get a quote

From New Energy Vehicles to 5G Base Stations: How Silicon Carbide

1 day ago· 5G base stations have stringent requirements for power devices in high-frequency and high-temperature environments, making silicon carbide-based gallium nitride (GaN-on-SiC)

Get a quote

GaN-on-SiC application to 5G base stations ramping up in US,

Vendors in the US and Europe are ramping up application of third-generation semiconductor materials including SiC (silicon carbide) and GaN to 5G base stations and EVs,

Get a quote

GaN HEMT Integration In 5G Base Stations

Technical Solution: Wolfspeed has pioneered GaN HEMT technology for 5G base stations with their advanced GaN-on-SiC (Silicon Carbide) solutions. Their technology delivers

Get a quote

Silicon Carbide in 5G Infrastructure and Telecommunications

Silicon Carbide (SiC) is emerging as a game-changer in 5G infrastructure and telecommunications. With its superior properties compared to traditional silicon, SiC is driving

Get a quote

GaN HEMTs for Wireless Communication

Gallium nitride (GaN) high electron mobility transistors (HEMTs) have been widely used for high-power and high-frequency applications, such as cellular base stations, owing to their superior

Get a quote

The secret sauce of silicon carbide wafer success

Another example are 5G base stations: they process an increasing amount of data resulting in a rise of power requirements. SiC semiconductors are used for MHz switching and

Get a quote

Silicon Carbide in 5G Wireless Communications

Silicon Carbide is a widely recognized semiconductor material with unique properties that have made it a popular choice for various applications. This

Get a quote

Silicon carbide (SiC) and gallium nitride (GaN), who is

Because 5G base stations will employ multi-transmit and multi-receive antenna array solutions, GaN radiofrequency devices have

Get a quote

Could GaN Gain Ground in India''s Semiconductor Story?

As India races to expand its semiconductor industry, another material that has risen to prominence is gallium nitride (GaN). Popularized once blue LEDs became a reality,

Get a quote

SiC 5g, Silicon Carbide In Electronics | Junko Energy

SiC-based gallium nitride devices, due to their small size and high power, are gradually being used in base station power amplifiers. The high thermal

Get a quote

Silicon Carbide (SiC) Substrates for Base Station

The global market for Silicon Carbide (SiC) Substrates for Base Station is anticipated to exhibit substantial growth over the forecast period,

Get a quote

6 FAQs about [5G base station power silicon carbide]

How can Gan be used in 5G?

The use of GaN on SiC with effective linearization accelerates the rollout of 5G by enabling significant power, thermal, and cost savings through more efficient wireless transmission.

How much power does a 5G base station use?

Each nation has a different 5G strategy. For 5G, China uses 3.5GHz as the frequency. Then, a 5G base station resembles a 4G system, but it’s on a much larger scale. For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts.

What is a 5G power amplifier?

The power amplifier device is a key component that boosts the RF power signals in base stations. It’s based on two competitive technologies, silicon-based LDMOS or RF gallium nitride (GaN). GaN, a III-V technology, outperforms LDMOS, making it ideal for the high-frequency requirements for 5G. But GaN is expensive with some challenges in the fab.

Will RF Gan chips capture the next wave of 5G base stations?

The first wave of 5G base stations have been deployed. Now device makers are developing new GaN-based power amp chips, hoping to capture the next wave of 5G base station deployments. Cree, Fujitsu, Mitsubishi, NXP, Qorvo, Sumitomo and others compete in the RF GaN device market.

Are GaN-based power amps gaining steam in 5G?

Nonetheless, GaN-based power amps also are gaining steam in 5G. As in 4G, China’s base station vendors are adopting GaN-based power amp devices for their initial deployments of 5G systems in China. Other base station vendors are following suit.

How much power does a 5G antenna use?

For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts. On the RRH board, you have various devices such as power amps, low-noise amplifiers (LNAs), transceivers and others. The RF process is complex with several steps.

Guess what you want to know

-

5G base station power supply ratio

5G base station power supply ratio

-

South Africa 5G base station power supply

South Africa 5G base station power supply

-

5g communication base station power consumption calculation

5g communication base station power consumption calculation

-

Huawei s only 5G base station power supply supplier

Huawei s only 5G base station power supply supplier

-

What is the problem with the 5G base station input power failure

What is the problem with the 5G base station input power failure

-

5G base station new wind power supply design

5G base station new wind power supply design

-

5G base station power consumption in Kazakhstan

5G base station power consumption in Kazakhstan

-

Power consumption of a single 5G base station

Power consumption of a single 5G base station

-

How much hybrid power supply does a 5G communication base station have

How much hybrid power supply does a 5G communication base station have

-

Which German 5G base station power supply manufacturers are there

Which German 5G base station power supply manufacturers are there

Industrial & Commercial Energy Storage Market Growth

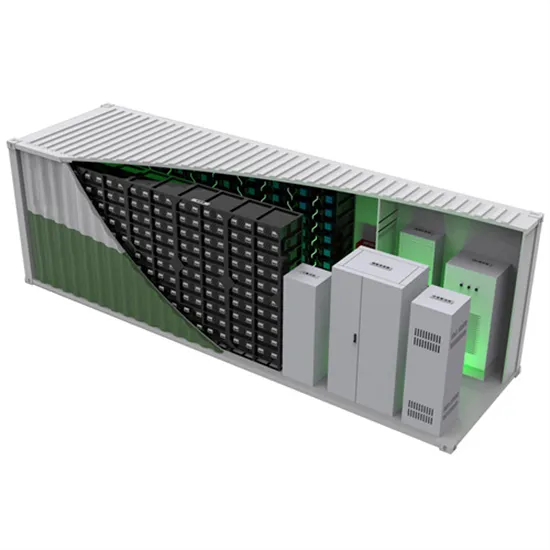

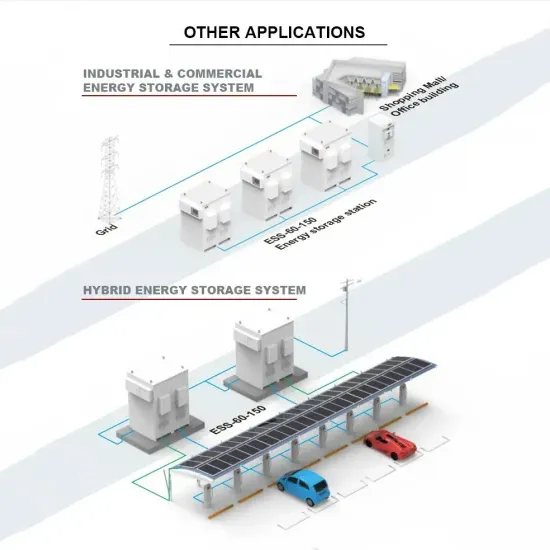

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.