Top 18 Battery Storage Companies in Chile (2025) | ensun

Information about Battery Storage in Chile When exploring the battery storage industry in Chile, several key considerations come into play. The country has excellent renewable energy

Get a quote

Energy storage is a challenge and an opportunity for Chile

"Battery storage is efficient, but very short term," says Enzo Sauma, a professor in industrial and systems engineering at Chile''s Pontifical Catholic University. "If you store energy

Get a quote

Chile Energy Storage Project Tender Announcement: What You

Why Chile''s Latest Tender Is a Big Deal for Renewable Energy Buffs If you''re in the energy storage game, Chile''s 2025 tender announcement is like spotting a rare bird in the

Get a quote

Chile seeks multi-gigawatts of large-scale storage for

Gabriel Boric (front row centre), president of Chile since 2022. Image: Biblioteca del Congreso Nacional de Chile. The government of Chile

Get a quote

Chile Focuses on Solar and Storage as Generation

Chile is rapidly moving to build more power generation capacity, with much of that effort focused on renewable energy resources and battery energy

Get a quote

Chile: BESS as an answer to solar curtailment, grid constraints

However, in recent years, Chile has been facing some serious issues: curtailment and marginal costs nearing zero. With solar project owners needing to find a solution to make

Get a quote

Chile: Battery Storage

The SCF is providing Technical Assistance to a large-scale Battery Energy Storage System (BESS) in northern Chile''s Antofagasta region to address solar energy curtailment and

Get a quote

Chile''s Energy Storage Price Trends: Where the Desert Meets

Chile''s energy storage prices aren''t just numbers on a spreadsheet; they''re the heartbeat of South America''s clean energy revolution. Current market data shows vanadium flow batteries

Get a quote

Chile Energy Storage

Despite the current low level of installed energy capacity and high cost per MW, the opportunities for battery storage are promising. The Chilean Ministry of Energy projects that

Get a quote

Energy storage is a challenge and an opportunity for

"Battery storage is efficient, but very short term," says Enzo Sauma, a professor in industrial and systems engineering at Chile''s Pontifical

Get a quote

Chile accelerates battery storage with 5 GW planned by 2030

Chile plans to deploy five gigawatts of battery storage capacity by 2030, together with the commissioning of the 3 GW Kimal-Lo Aguirre high-voltage direct current transmission

Get a quote

Banking on batteries in Chile

Henrique Ribeiro, principal analyst for batteries and energy storage at S&P Global Commodity Insights, said battery revenues in Chile have, until now, been driven by arbitrage –

Get a quote

Battery Energy Storage Systems (BESS) in Chile

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged

Get a quote

South america smart energy storage battery quote

He has extensive experience in innovative projects in technology and infrastructure for national and multinational organizations. He is currently leading UCB Power''''s positioning from a

Get a quote

Chile to become second-largest battery market in

Chile is now on track to become the second-largest battery market in the Americas, following the United States. As of this year, the Latin

Get a quote

Chile: BESS as an answer to solar curtailment, grid

However, in recent years, Chile has been facing some serious issues: curtailment and marginal costs nearing zero. With solar project owners

Get a quote

METLEN Powers Chile: Solar Power and Energy

Expansion of solar power and energy storage capacity can support Chile''s energy transition for a sustainable energy future. This growth

Get a quote

Powin | Integrated Solutions for Battery Energy Storage

Unlimited possibility Energy storage is essential for the transition to a sustainable, carbon-free world. As one of the leading global energy platform providers, we''re at the forefront of the

Get a quote

Chile Energy Storage Industry Holds Promise | EMIS

In March 2024, Atlas Renewable Energy announced it has signed a power purchase agreement (PPA) with Chilean mining giant Codelco for the supply of 375 GWh of energy per

Get a quote

Grenergy plans ''world''s largest'' 4.1GWh Chile battery

Grenergy''s Matarani solar plant in Peru. Image: Grenergy Renovelables. Spain-based developer and IPP Grenergy has detailed its

Get a quote

Chilean Battery Energy Storage Systems Stabilize Energy

We expect price differentials in Chile to fall as BESS-installed capacity grows and new transmission comes online adding more uncertainty to long term arbitrage revenues.

Get a quote

Innergex Chile Uses N3uron to Integrate Its First Battery Energy

The challenge Innergex Chile wanted to provide PV Salvador with energy storage capabilities by integrating a Battery Energy Storage System (BESS). This would be Innergex''s

Get a quote

BYD signs new deal to supply energy storage systems for project in Chile

BYD Energy Storage recently signed an order agreement with Spanish renewable energy company Grenergy to supply 3.5 GWh of energy storage systems for phase 6 of the

Get a quote

CHISAGE ESS | Professional Energy Storage System

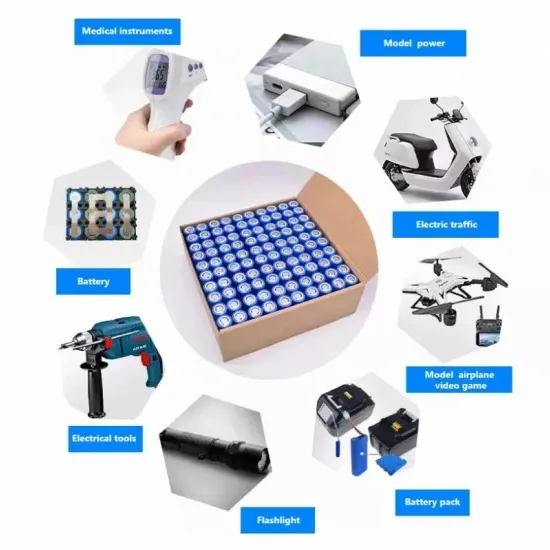

Our C&I energy storage system solution has a superior-quality battery that provides the storage capacity needed to support the application.

Get a quote

Chile To Deploy 5 GW Of Battery Storage Capacity By 2030 To

The report notes that Chile is set to become the first country in South America to achieve competitive battery storage pricing within the next decade. The integration of

Get a quote

6 FAQs about [Chile Smart Energy Storage Battery Quote]

Are battery energy storage systems a viable alternative for Chilean power producers?

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged as a profitable alternative for Chilean power producers.

How much battery storage capacity does Chile have?

According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity. AES Andes, a subsidiary of U.S. company AES Corp. operates all 64MW at their Angamos and Los Andes substations.

Is lithium ion battery storage available in Chile?

While many projects are under development, lithium - ion battery storage is still limited. According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity.

Is Chile ready for a standalone energy storage project?

This project alone nears the capacity (13GWh) the Chilean Ministry of Energy sought in a public land bidding auction for standalone energy storage projects in May of 2024. Chile has been one of the countries at the forefront of the renewable energy transition in Latin America, first with solar PV and now with BESS.

How much does a battery cost in Chile?

In fact, batteries charged at nearly $0/MWh during the day in the sunny, northern desert regions of Chile, sell energy at night for over $100/MWh. Although projects such as Engie’s BESS Coya are already enjoying these large spreads, this capacity payment will partially de-risk Chile’s dependence on volatile, but still profitable, merchant revenues.

Does Engie Chile have a lithium-ion battery storage system?

Engie Chile, meanwhile, has two lithium-ion battery storage systems in operation, with a total capacity of 141 MW. At the beginning of next year, the company will inaugurate a 264 megawatt-hour, 96-battery facility, taking its total BESS portfolio in Chile to 371 MW.

Guess what you want to know

-

Oman smart energy storage battery manufacturer

Oman smart energy storage battery manufacturer

-

Danish smart energy storage battery company

Danish smart energy storage battery company

-

Mongolia smart energy storage battery price

Mongolia smart energy storage battery price

-

Syria smart energy storage battery prices

Syria smart energy storage battery prices

-

Huawei South Sudan Smart Energy Storage Battery Application

Huawei South Sudan Smart Energy Storage Battery Application

-

How to use the liquid-cooled energy storage smart battery cabinet

How to use the liquid-cooled energy storage smart battery cabinet

-

Serbia smart energy storage battery company

Serbia smart energy storage battery company

-

North Korea Smart Battery Energy Storage System

North Korea Smart Battery Energy Storage System

-

Uzbekistan smart energy storage battery company

Uzbekistan smart energy storage battery company

-

Liberia energy storage battery price quote

Liberia energy storage battery price quote

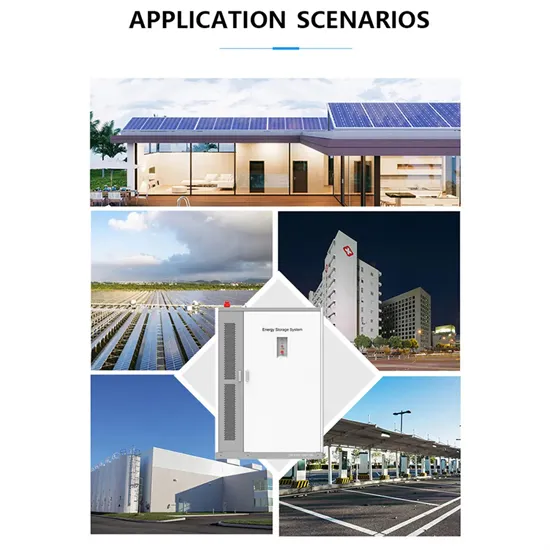

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.