Hoymiles Launches HoyUltra 2 Next-Gen All-in-One Liquid-Cooling Energy

About Hoymiles Founded in 2012, Hoymiles is a global power electronics company that is well-versed in microinverters and energy storage solutions. With a vision of a

Get a quote

How Brazil''s first capacity reserve auction of 2025

Changes to Brazil''s first capacity reserve auction of 2025 could undermine the expansion of the procurement regime to include battery energy

Get a quote

Top 60 Battery Storage Companies in Brazil (2025) | ensun

Identify and compare relevant B2B manufacturers, suppliers and retailers. Sunred Energy specializes in lithium battery energy storage systems, offering solutions for various

Get a quote

UCB Energia

Meeting the rising demand for electric mobility, UCB Power produces batteries for two-wheelers and leads in developing storage and charging infrastructure, advancing sustainable transport

Get a quote

Storage will be key to modernizing Brazil''s electricity

The Brazilian energy storage market will be one of the main pillars of the national plan to update the country''s electricity sector. This was one of

Get a quote

TBEA expects 3 GWh demand for storage projects in

Brazil''s planned 2025 Capacity Reserve Auction (LRCAP) – intended to contract energy storage to meet electricity demand during peak

Get a quote

UCB & Powin Boost Brazil''s Utility-Scale Energy Storage

With a proven track record of delivering over 17 gigawatt-hours (GWh) of energy storage projects worldwide, Powin has built a reputation for providing high

Get a quote

EnerSys Bonsucesso, Brazil | Industrial Battery Manufacturing

We are proudly making batteries in Brazil since 2002 and expanded our operations to a larger site in 2018 in Bonsucesso – Guarulhos. The plant produces heavy-duty and reliable tubular plates

Get a quote

Energy Storage Companies in Brazil: Key Players, Trends, and

This article dives into the top energy storage companies in Brazil, their game-changing projects, and why this market could soon outpace even the World Cup in global

Get a quote

Lithium batteries made in Brazil : Revista Pesquisa

Brazil is soon to join the ranks of countries producing batteries for electric mobility, a segment led by China, the US, Japan, and South Korea. At least

Get a quote

brazilian energy storage battery air transport

Al−Air Batteries for Seasonal/Annual Energy Storage: Progress The combination of a low-cost, high-energy-density Al air battery with inert-anode-based Al electrolysis is a promising

Get a quote

Brazilian capacitor energy storage company

The growing demand for high-power-density electric and electronic systems has encouraged the development of energy-storage capacitors with attributes such as high energy density, high

Get a quote

Top 10 energy storage companies in Brazil

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its global headquarters, and

Get a quote

Top 10 Battery Manufacturers In Brazil

In this article, we will explain about top 10 battery manufacturers in Brazil, such as CBMM, Baterias Moura, Sunred Energy, Sigma Lithium, Electrocell, etc.

Get a quote

Brazil Battery Energy Storage Systems Market Size and

In Brazil Battery Energy Storage Systems Market is projected to grow from USD 3.1 billion in 2025 to USD 9.8 billion by 2031, at a CAGR of 21.5%

Get a quote

Top 60 Battery Storage Companies in Brazil (2025)

Identify and compare relevant B2B manufacturers, suppliers and retailers. Sunred Energy specializes in lithium battery energy storage systems, offering

Get a quote

Moura – Solar microgrid in Brazil

About the Company Moura has seven industrial plants, six in Brazil and one in Argentina, with around 6,000 employees. Initially focused on the automotive

Get a quote

Top 10 energy storage companies in Brazil

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its global headquarters, and its primary

Get a quote

Brazil launching auction for battery storage projects in 2025

The Brazilian Minister of Energy and Mining has unveiled an auction for battery energy storage projects to be held in 2025. A public consultation regarding the auction should

Get a quote

Top 7 Brazilian Solar Lithium Battery Suppliers | 2025 Guide

Discover Brazil''s top solar lithium battery suppliers for 2025. Compare trusted Brazilian manufacturers of renewable energy storage solutions

Get a quote

Battery makers bullish about Brazilian market prospects

Chinese and Brazilian battery energy storage system (BESS) manufacturers and installers are preparing to invest in a promising market beset by rising energy costs and

Get a quote

Providing Reliable Energy Storage Solutions for Brazil:

Looking Ahead LuxpowerTek will continue to strengthen its presence in Latin America and deliver practical, high-performance solar and storage solutions. The company

Get a quote

Top 10 energy storage companies in France

Company profile: Saft, founded in 1918 and headquartered in France, is a leading battery manufacturer specializing in the design and development of high

Get a quote

Battery makers bullish about Brazilian market prospects

Chinese and Brazilian battery energy storage system (BESS) manufacturers and installers are preparing to invest in a promising market

Get a quote

top 10 brazilian energy storage companies

ATLAS POWER is a Brazilian energy tech startup that makes battery energy storage systems with new lithium-ion battery cells and second-life batteries from electric vehicles.

Get a quote

6 FAQs about [Brazilian high-performance energy storage battery company]

What are the top 10 energy storage companies in Brazil?

Due to various incentives and policies, Brazil's optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage companies including Baterias Moura, BYD, Freedom Won, Blue Nova Energy, Intelbras, Huntkey, FIMER, SMA Solar, Sungrow, and SolarEdge.

Who is the largest battery supplier in Brazil?

BYD (002594.SZ) is Brazil’s largest battery supplier and has two factories in Brazil, producing lithium-ion batteries and solar modules respectively. BYD will start producing new N-type TOPCON photovoltaic modules in Brazil in December 2022, with a power capacity of 575W.

What factors influence the battery storage industry in Brazil?

When exploring the battery storage industry in Brazil, several key considerations come into play. The regulatory environment is essential, as the Brazilian government has been increasingly supportive of renewable energy initiatives, which can influence market dynamics.

What are Brazil's potential energy storage opportunities?

However, the opportunities are substantial, especially with Brazil's vast renewable energy resources, particularly in hydropower and solar energy, creating a demand for efficient energy storage solutions. Environmental concerns are also pertinent, as the production and disposal of batteries can have ecological impacts.

Who makes Heliar batteries in Brazil?

Heliar is the first battery brand in Brazil, founded in 1931. In 2019, it became a subsidiary of Clarios, following Clarios’ separation from Johnson Controls. With over 90 years experience, Heliar maintains a prominent presence in Brazil until today, supported by an extensive distribution network.

Where is Brazil's first commercial wind power & energy storage project located?

In March 2021, Acumuladores Moura and Baterias Duran jointly developed Brazil’s first commercial wind power + energy storage project and put it into operation. It is located in the state of Bahia in northeastern Brazil, with a total capacity of 1.5MW/3MWh, aiming to provide local Agricultural irrigation provides stable and clean energy.

Guess what you want to know

-

Brazilian energy storage cabinet battery company introduces base station

Brazilian energy storage cabinet battery company introduces base station

-

French high-performance energy storage battery company

French high-performance energy storage battery company

-

Marshall Islands High Performance Energy Storage Battery Company

Marshall Islands High Performance Energy Storage Battery Company

-

Solar power station energy storage battery company

Solar power station energy storage battery company

-

Island Quality Energy Storage Battery Company

Island Quality Energy Storage Battery Company

-

Moldova battery energy storage box customization company

Moldova battery energy storage box customization company

-

Slovakia battery energy storage company

Slovakia battery energy storage company

-

Tuvalu Energy Storage Battery Customization Company

Tuvalu Energy Storage Battery Customization Company

-

Peruvian photovoltaic energy storage battery company

Peruvian photovoltaic energy storage battery company

-

Congo Brazzaville energy storage lithium battery customization company

Congo Brazzaville energy storage lithium battery customization company

Industrial & Commercial Energy Storage Market Growth

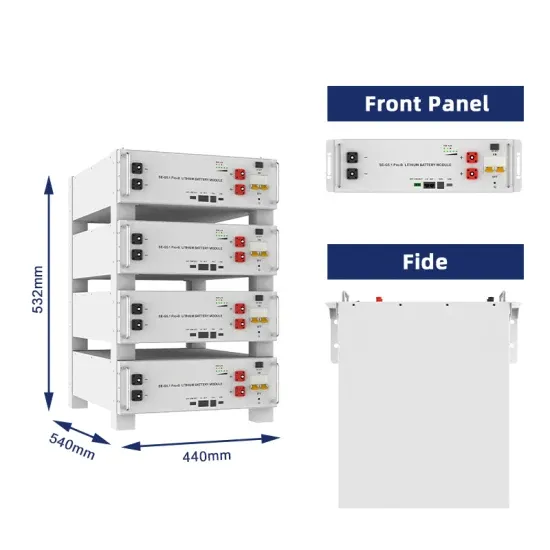

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.