2024 Energy Storage Battery Cell Shipment Rankings

In 2024, the global energy storage market continued its rapid growth, bolstered by policy support and increasing market demand. According to SMM statistics, global shipments

Get a quote

Portable Power Station Market Size | Research Report [2032]

Portable Power Station Market Size, Share & Industry Analysis, By Power Source (Hybrid Power Source and Single Power Source), By Capacity (Less than 500 Wh, 500 Wh to

Get a quote

卸売 ホットセール 48V-72V 1000W-5000W E-バイクキット

Best-selling 48V/52V/60V/72V e-bike conversion kits (1000W-5000W) with high-capacity batteries! Perfect for DIY e-bikes, fat tire builds, and high-speed commuting. Wholesale prices,

Get a quote

Building a Resilience US Lithium Battery Supply

What do US economic power, national security, and climate goals have in common? They are all critical to the health and well-being of the

Get a quote

US Battery Energy Storage System Market Analysis

The US Battery Energy Storage System (BESS) market represents a pivotal sector within the broader energy storage industry, playing a crucial role in

Get a quote

Wholesale Lithium Battery Storage | Solar Electric

Wholesale deals on lithium battery storage from Solar Electric Supply. Featuring Enphase, SolarEdge, Homegrid & more LFP systems for reliable backup

Get a quote

Four Companies Leading the Rise of Lithium & Battery

Date: March 1, 2024 Topic: Thematic, Disruptive Technology The ongoing paradigm shift in the mobility segment toward electric vehicles (EVs) created a need to build out the entire value

Get a quote

Lithium supply may far exceed demand from U.S. light

(Washington D.C.) February 21, 2024 — Today, the International Council on Clean Transportation (ICCT) released a study exploring the potential for the

Get a quote

Lithium battery oversupply, low prices seen through 2028 despite energy

Section 301 tariffs and the Inflation Reduction Act''s 45X tax credit could make U.S.-made lithium-ion battery energy storage systems cost-competitive with Chinese-made systems

Get a quote

US Battery Energy Storage System Market Analysis

The US Battery Energy Storage System (BESS) market represents a pivotal sector within the broader energy storage industry, playing a crucial role in facilitating the integration of

Get a quote

2021 2024 FOUR YEAR REVIEW SUPPLY CHAINS FOR

Lithium extraction and refining are other areas of the supply chain where the U.S. is well-positioned to compete given its substantial lithium reserves, and firms are taking the first steps

Get a quote

U.S. lithium Market Size And Share | Industry Report, 2030

The prevailing trend of adopting green energy worldwide is driving the usage of lithium in grid storage applications for electrification, further driving the global lithium market. This global

Get a quote

Falling prices, rising geopolitical risks define energy

Rosa Milano, sales director for energy storage at Fluence, said lithium-ion remains the most mature and commercially viable energy storage

Get a quote

Advanced Lithium-Ion Energy Storage Battery Manufacturing

This section considers sector-wide output and sales data alongside other sources to make inferences about trends in domestic production and sales of lithium-ion energy

Get a quote

Utility-Scale Battery Storage in the U.S.: Market Outlook, Drivers,

As the U.S. accelerates its transition toward a cleaner, more resilient energy grid, utility-scale battery energy storage systems (BESS) are emerging as a critical enabler of this

Get a quote

Lithium battery oversupply, low prices seen through

Section 301 tariffs and the Inflation Reduction Act''s 45X tax credit could make U.S.-made lithium-ion battery energy storage systems cost

Get a quote

US Energy Storage Monitor

The US Energy Storage Monitor is a quarterly publication of Wood Mackenzie Power & Renewables and the American Clean Power Association (ACP). Each quarter, new industry

Get a quote

Future Prospects and Market Analysis of Home Energy Storage

Home energy storage systems are usually combined with household photovoltaics, which can increase the proportion of self-generated and self-used photovoltaics, reduce

Get a quote

U.S. Energy Storage Market Size, Forecast 2025-2034

Lithium extraction and refining are other areas of the supply chain where the U.S. is well-positioned to compete given its substantial lithium reserves, and firms are taking the first steps

Get a quote

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get a quote

What You Need to Know about North American BESS Supply Chains | EVLO Energy

Here''s what you need to know. The Current State of North American BESS Supply Chains The BESS supply chain is made up of a range of components including battery cells,

Get a quote

U.S. Energy Storage Market Size, Forecast 2025-2034

The U.S. energy storage market size crossed USD 106.7 billion in 2024 and is expected to grow at a CAGR of 29.1% from 2025 to 2034, driven by increased renewable energy integration and

Get a quote

United States Battery Market

Rapid growth of EV industry and an increasing demand for renewable energy storage and portable electronic devices are expected to drive United States Battery Market during the

Get a quote

U.S. lithium Market Size And Share | Industry Report,

The prevailing trend of adopting green energy worldwide is driving the usage of lithium in grid storage applications for electrification, further driving the global

Get a quote

Executive summary – Batteries and Secure Energy Transitions –

Lithium-ion chemistries represent nearly all batteries in EVs and new storage applications today. For new EV sales, over half of batteries use chemistries with relatively high nickel content that

Get a quote

U.S. Battery Storage Hits a New Record Growth in 2024

The U.S. battery storage market achieved unprecedented growth in 2024, fueled by the need for renewable energy integration and improved

Get a quote

6 FAQs about [US lithium energy storage power supply sales]

Are lithium-ion batteries a viable solution for utility-scale deployment?

Technology Landscape While lithium-ion batteries—particularly LFP (LiFePO₄)—dominate the market, other technologies are emerging for specific use cases, including: Nonetheless, lithium-based systems remain the most commercially viable and scalable solution for utility-scale deployment today.

How is the US positioned to compete in the lithium market?

cell production as the market continues to develop.Lithium RefiningLithium extraction and refining are other areas of the supply chain where the U.S. is well-positioned to compete given its substantial lithium reserves, and firms are taki

What is a utility-scale battery energy storage project?

Utility-Scale Deployments: Utility-scale battery energy storage projects offer opportunities for grid-scale applications, such as frequency regulation, capacity firming, and renewable energy integration, supported by utility procurement programs, competitive solicitations, and grid services markets.

What is the US energy storage monitor?

A few tips before you get started... The US Energy Storage Monitor is a quarterly publication of Wood Mackenzie Power & Renewables and the American Clean Power Association (ACP). Each quarter, new industry data is compiled into this report to provide the most comprehensive, timely analysis of energy storage in the US.

What companies are investing in lithium?

Companies like Tesla and General Motors are leading the charge, with Tesla's Gigafactory driving down battery costs and GM investing USD 35 billion in EVs and autonomous vehicles. Lithium remains a critical component, with GM securing a USD 650 million investment in Lithium Americas to strengthen its supply chain.

Are battery energy storage systems a good investment?

Energy Cost Savings: Battery energy storage systems offer opportunities for energy cost savings through peak shaving, demand charge management, time-of-use optimization, and participation in energy markets, enabling consumers to reduce electricity bills and improve economic competitiveness. Market Restraints

Guess what you want to know

-

Macedonia lithium energy storage power supply manufacturer direct sales

Macedonia lithium energy storage power supply manufacturer direct sales

-

Gabon lithium energy storage power supply direct sales price

Gabon lithium energy storage power supply direct sales price

-

Chad lithium energy storage power supply sales price

Chad lithium energy storage power supply sales price

-

Somalia lithium energy storage power supply direct sales price

Somalia lithium energy storage power supply direct sales price

-

Namibia lithium battery energy storage power supply model

Namibia lithium battery energy storage power supply model

-

Palau lithium energy storage power supply

Palau lithium energy storage power supply

-

Brazilian lithium energy storage power supply custom manufacturer

Brazilian lithium energy storage power supply custom manufacturer

-

Egyptian lithium energy storage power supply manufacturer

Egyptian lithium energy storage power supply manufacturer

-

Congo Kinshasa lithium iron phosphate portable energy storage emergency power supply

Congo Kinshasa lithium iron phosphate portable energy storage emergency power supply

-

Sao Tome and Principe lithium energy storage power supply manufacturer

Sao Tome and Principe lithium energy storage power supply manufacturer

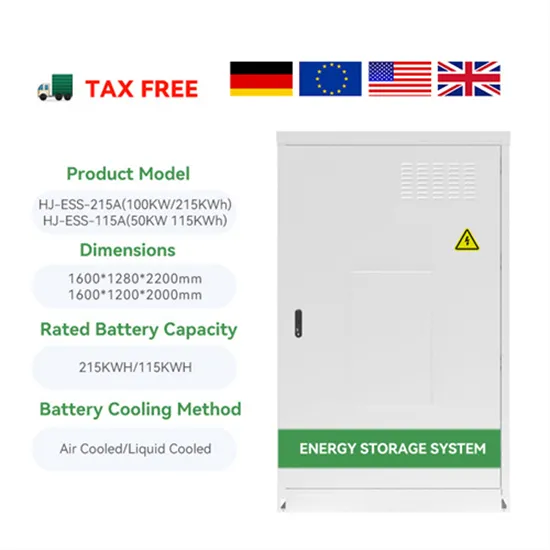

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.