Regional Growth Projections for Communication Base Station

The global market for communication base station energy storage batteries is experiencing robust growth, driven by the expanding telecommunications infrastructure and

Get a quote

Understanding Backup Battery Requirements for

Selecting the right backup battery is crucial for network stability and efficiency. Key Requirements: Capacity & Runtime: The battery should provide

Get a quote

Types of Batteries Used in Telecom Systems: A Guide

That''s where batteries come into play. They ensure that communication lines remain open, even during outages or emergencies. But not all batteries are created equal.

Get a quote

What Are the Key Considerations for Telecom Batteries in Base

Telecom batteries for base stations are backup power systems that ensure uninterrupted connectivity during grid outages. Typically using valve-regulated lead-acid

Get a quote

Telecom Base Station Backup Power Solution: Design

Designing a 48V 100Ah LiFePO4 battery pack for telecom base stations requires careful consideration of electrical performance, thermal

Get a quote

Emerging Markets for Communication Base Station Li-ion Battery

The Communication Base Station Li-ion Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced wireless communication networks. The

Get a quote

What Powers Telecom Base Stations During Outages?

Telecom batteries for base stations are backup power systems using valve-regulated lead-acid (VRLA) or lithium-ion batteries. They ensure uninterrupted connectivity

Get a quote

Selection and maintenance of batteries for communication base stations

Focused on the engineering applications of batteries in the communication stations, this paper introduces the selections, installations and maintenances of batteries for communication

Get a quote

Selection and maintenance of batteries for communication base

Focused on the engineering applications of batteries in the communication stations, this paper introduces the selections, installations and maintenances of batteries for communication

Get a quote

What is a base station energy storage battery?

Base station energy storage batteries play a pivotal role in modern telecommunication networks, particularly as demand for uninterrupted service

Get a quote

Communication Base Station Battery Market Research Report 2035

Communication Base Station Battery Market Size was estimated at 6.65 (USD Billion) in 2023. The Communication Base Station Battery Market Industry is expected to grow from 7.13 (USD

Get a quote

Japan Communication Base Station Li-ion Battery

The Japan Communication Base Station Li-ion Battery market is experiencing rapid growth due to the increasing demand for reliable power

Get a quote

Communication Base Station Li-ion Battery Market

Key Drivers Accelerating Li-ion Battery Adoption in Communication Base Stations The transition to lithium-ion (Li-ion) batteries in communication base stations is propelled by operational

Get a quote

Telecom Base Station PV Power Generation System Solution

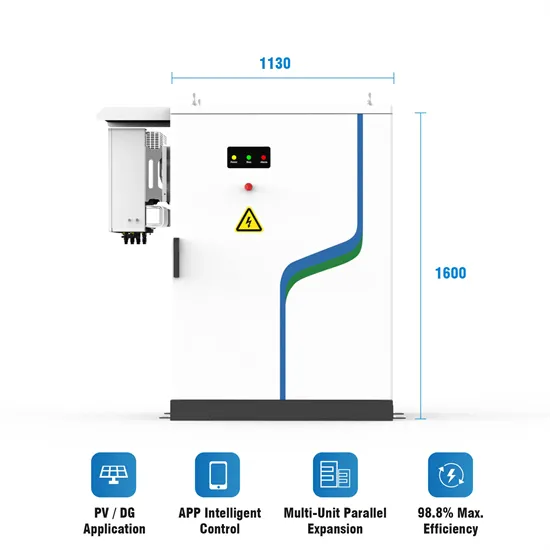

The communication base station installs solar panels outdoors, and adds MPPT solar controllers and other equipment in the computer room. The power generated by solar energy is used by

Get a quote

What are base station energy storage batteries used for?

Innovations in battery technologies, such as lithium-sulfur or solid-state batteries, promise higher energy densities and improved lifespan, thereby enhancing the operational

Get a quote

Communication Base Station Energy Solutions

Reducing Energy Costs Remote base stations often rely on independent power systems. Fuel generators are unsuitable for long-term use without on-site personnel. While the initial

Get a quote

What Are the Key Considerations for Telecom Batteries in Base Stations?

Telecom batteries for base stations are backup power systems that ensure uninterrupted connectivity during grid outages. Typically using valve-regulated lead-acid

Get a quote

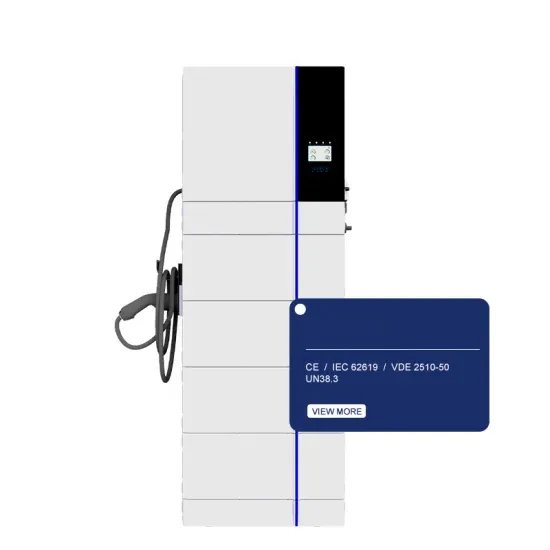

19-Inch Lithium Battery Cabinets for 4G/5G – KDST

The future development trend of 19-inch lithium batteries in 4G and 5G communication base stations With the further promotion of 5G networks and the research and development of 6G

Get a quote

Understanding Backup Battery Requirements for Telecom Base Stations

Selecting the right backup battery is crucial for network stability and efficiency. Key Requirements: Capacity & Runtime: The battery should provide sufficient energy storage to

Get a quote

What are base station energy storage batteries used for?

Innovations in battery technologies, such as lithium-sulfur or solid-state batteries, promise higher energy densities and improved lifespan,

Get a quote

Battery technology for communication base stations

In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade batteries with high energy density and high charge and

Get a quote

Telecom Base Station Backup Power Solution: Design Guide for

Designing a 48V 100Ah LiFePO4 battery pack for telecom base stations requires careful consideration of electrical performance, thermal management, safety protections, and

Get a quote

Global Communication Base Station Energy Storage Battery

The rapid evolution of communication technologies, including the deployment of 5G and the proliferation of Internet of Things (IoT) devices, is driving the demand for reliable and efficient

Get a quote

Use of Batteries in the Telecommunications Industry

ATIS Standards and guidelines address 5G, cybersecurity, network reliability, interoperability, sustainability, emergency services and more...

Get a quote

Base Station Batteries

REVOV''s lithium iron phosphate (LiFePO4) batteries are ideal telecom base station batteries. These batteries offer reliable, cost-effective backup power for communication networks. They

Get a quote

What is a base station energy storage battery? | NenPower

Base station energy storage batteries play a pivotal role in modern telecommunication networks, particularly as demand for uninterrupted service intensifies.

Get a quote

6 FAQs about [Things to note when using batteries in communication base stations]

What makes a telecom battery pack compatible with a base station?

Compatibility and Installation Voltage Compatibility: 48V is the standard voltage for telecom base stations, so the battery pack’s output voltage must align with base station equipment requirements. Modular Design: A modular structure simplifies installation, maintenance, and scalability.

Which battery is best for telecom base station backup power?

Among various battery technologies, Lithium Iron Phosphate (LiFePO4) batteries stand out as the ideal choice for telecom base station backup power due to their high safety, long lifespan, and excellent thermal stability.

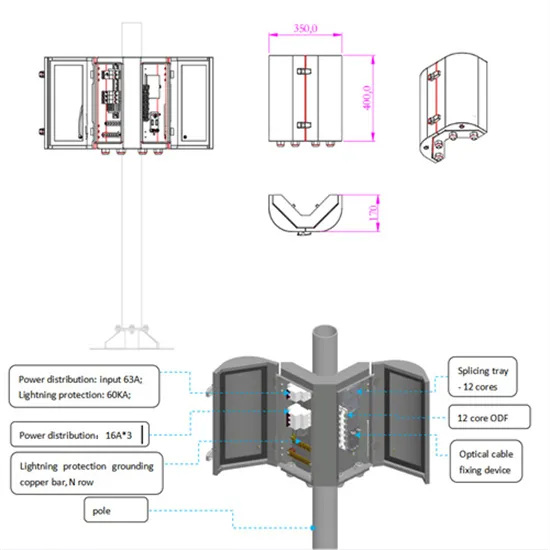

How do you protect a telecom base station?

Backup power systems in telecom base stations often operate for extended periods, making thermal management critical. Key suggestions include: Cooling System: Install fans or heat sinks inside the battery pack to ensure efficient heat dissipation.

What type of battery does a telecom system need?

Beyond the commonly discussed battery types, telecom systems occasionally leverage other varieties to meet specific needs. One such option is the flow battery. These batteries excel in energy storage, making them ideal for larger installations that require consistent power over extended periods.

How do I choose the right battery for my telecom system?

Choosing the right battery for your telecom system involves several critical factors. Start by assessing the energy requirements of your equipment. Different devices will have different power needs, which can influence battery capacity. Next, consider the operating environment. Is it indoors or outdoors?

Are lithium-ion batteries a good choice for a telecom system?

Lithium-ion batteries have rapidly gained popularity in telecom systems. Their efficiency is unmatched, providing higher energy density compared to traditional options. This means they can store more power in a smaller footprint.

Guess what you want to know

-

Main equipment cost of lead-acid batteries for communication base stations

Main equipment cost of lead-acid batteries for communication base stations

-

Where are the lead-acid batteries for communication base stations in Uzbekistan

Where are the lead-acid batteries for communication base stations in Uzbekistan

-

Are energy storage batteries for communication base stations useful

Are energy storage batteries for communication base stations useful

-

Batteries and standards for communication base stations

Batteries and standards for communication base stations

-

Tender for batteries for communication base stations

Tender for batteries for communication base stations

-

Are there Chinese flow batteries for communication base stations in France

Are there Chinese flow batteries for communication base stations in France

-

What is the construction scope of liquid flow batteries for communication base stations

What is the construction scope of liquid flow batteries for communication base stations

-

Standards for lithium batteries used in communication base stations

Standards for lithium batteries used in communication base stations

-

What are the batteries for small communication base stations in Mauritania

What are the batteries for small communication base stations in Mauritania

-

How are lead-acid batteries installed in communication base stations on high-rise buildings

How are lead-acid batteries installed in communication base stations on high-rise buildings

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.