Energy storage fever has gripped Romania. More and more large

In an accelerated wave of investments, companies in Romania are combining battery energy storage systems (BESS) with solar, hydro or wind energy, or building

Get a quote

Romania Energy Storage Market (2025-2031) | Competitive

Key market players include Tesla, Fluence, and Northvolt, alongside local companies like Exide Technologies. The market is expected to continue growing as Romania aims to achieve its

Get a quote

Romania''s Energy Stora

Based on its renewable energy potential and considering the national energy sector''s current characteristics – generation assets, interconnections, market design, regulatory landscape –

Get a quote

Romania''s Energy Storage: Assessment of Potential and

This report analyses the potential of some of the main energy storage technologies, presenting their respective advantages and disadvantages that need to be considered when evaluating

Get a quote

Motives of future growth of the Romanian energy

In recent years, multinational capital investment in Romania''s new energy sector has grown significantly, and is expected to lead 1.2-1.5GW of

Get a quote

Lithium Battery Energy Storage Solutions in Romania Trends and

This article explores the growing demand, key applications, and innovative solutions shaping Romania''''s energy storage sector—with insights into how businesses and households can

Get a quote

Romania''s Energy Stora

An advanced draft of the present report was critically discussed with relevant Romanian stakeholders (TSO, energy regulator, Ministry of Economy, Energy and the Business

Get a quote

Renewable energy in Romania: Potential for development by

Given Romania''s balanced energy mix and technological developments in the field of renewable energy sources, a careful examination of how to use this renewable energy potential is

Get a quote

China s energy storage equipment exports

The publisher''''s analysis shows that the average price of China''''s lithium-ion battery exports grows continuously from 2018-2022.The average price of China''''s lithium-ion battery exports

Get a quote

(PDF) An Analysis of Romania''s Energy Strategy:

This study aims to study the energy strategy of Romania in correlation with the EU strategy in the turbulent period of pandemics and

Get a quote

Romanian Energy Retrospective 2024: A Year of

The year 2024 marked a pivotal moment for Romania''s energy sector, defined by major developments and strategic decisions that shaped the nation''s energy future. With total

Get a quote

Romania, between energy exports and increasing storage capacity

The National Energy System is taking important steps towards sustainability, with high-performance wind turbines and investments in local batteries. After an episode of record

Get a quote

Romania''s Energy Storage: Assessment of Potential

This report analyses the potential of some of the main energy storage technologies, presenting their respective advantages and disadvantages that

Get a quote

Document heading in Calibri Light green

Examples of tightened deadlines include maximum 6 months for repowering renewable energy projects, maximum 3 months for solar energy equipment and co-located energy storage

Get a quote

Romania gives impetus to the development of storage capacities

The Romanian Energy Regulatory Authority (ANRE) has approved the rules that remove double taxation on electricity stored and later fed back into the grid. The decision aims

Get a quote

Motives of future growth of the Romanian energy storage market

In recent years, multinational capital investment in Romania''s new energy sector has grown significantly, and is expected to lead 1.2-1.5GW of integrated landscape and

Get a quote

2025 Romania Industrial & Commercial Energy Storage Market:

EV-driven demand: With EV sales projected to hit 410,000 by 2029, Romania is expanding 5,000 public EV chargers by 2027, creating hybrid "storage + charging" opportunities.

Get a quote

Energy Storage in the European Union and Romania

The Storage Resolution underlines the high potential of hydrogen, especially green hydrogen for seasonal energy storage in high volumes and as an energy carrier, as fuel and

Get a quote

Green Power Summit 2024

The 2nd edition of the Green Power Summit, organized by Energy Industry Review in Bucharest, focused on clean energy investment, energy security and affordability, scaling up

Get a quote

Romanian Minister of Energy Sebastian Burduja

The Ministry of Energy has obtained EUR 14 billion in total to back renewable energy and storage projects and equipment production The

Get a quote

Residential energy storage romania

About Residential energy storage romania As the photovoltaic (PV) industry continues to evolve, advancements in Residential energy storage romania have become critical to optimizing the

Get a quote

Romania: Funds for battery storage projects, major

In its first, the Romanian government has allocated EU funds for two major battery energy storage projects via the National Recovery and

Get a quote

Romanian energy storage equipment sales company

The Ministry of Energy of Romania will provide just over €103 million in financial support for battery energy storage system (BESS) deployments in the country.

Get a quote

Romania, between energy exports and increasing

The National Energy System is taking important steps towards sustainability, with high-performance wind turbines and investments in local

Get a quote

6 FAQs about [Romanian energy storage equipment exports]

Where does Romania import electricity?

Romania exports and imports electricity to and from neighboring countries, including Hungary, Bulgaria, Serbia, Ukraine, and Moldova, and is also part of the European Union’s internal energy market, which aims to create a single, competitive market for electricity and gas across EU member states.

Who manages the electricity transmission system in Romania?

The electricity transmission system in Romania and the interconnection system with its neighboring countries is managed and operated by Transelectrica SA company (the Romanian TSO). They also manage the market operation, the grid and market infrastructure development, and the security of the national energy transmission system.

What is the Romanian Energy Center?

The Romanian Energy Center (CRE) is a non-profit, non-governmental organization with the main objective to promote the active participation of Romanian state-owned and private companies in the Energy Market towards European partnerships, in European co-financed projects, and, most importantly, in the European decision-making process.

How much energy does Romania produce in 2022?

According to the National Energy Regulatory Agency (ANRE), the energy output in Romania in 2022 was 53 TWh (terawatt-hour), while imports were 5.9 TWh. Electricity consumption by household end-users was 13.5 TWh, while non-household end-users were 36.7 TWh. Furthermore, energy exports were 4.6 TWh.

How big is Romania's natural gas distribution network?

Romania’s natural gas distribution network has increased four times in the last three decades, from 10,772 km in 1990 to 43,563 km in 2020 and 45,449.9 km in 2021, according to data synthesized by the National Institute of Statistics (INS), with an average annual growth rate of 4.8%. The main offshore titleholders in the Black Sea are BSOG.

How will small modular reactor technology help Romania achieve national decarbonization goals?

Small Modular Reactor (hereinafter “SMR”) technology will help Romania and other EU member nations achieve national decarbonization goals by promoting a fair transition to carbon neutrality. Romania has expedited its decarbonization goals to 2030 from 2050.

Guess what you want to know

-

Romanian energy storage equipment

Romanian energy storage equipment

-

El Salvador high-power energy storage equipment

El Salvador high-power energy storage equipment

-

Zambia Valley Power Energy Storage Equipment Manufacturer

Zambia Valley Power Energy Storage Equipment Manufacturer

-

Huawei Ireland Energy Storage Equipment

Huawei Ireland Energy Storage Equipment

-

Cote d Ivoire Container Energy Storage Equipment Company

Cote d Ivoire Container Energy Storage Equipment Company

-

Energy storage equipment 200 kWh

Energy storage equipment 200 kWh

-

Balcony energy storage integrated equipment

Balcony energy storage integrated equipment

-

Energy Storage Equipment Lagong

Energy Storage Equipment Lagong

-

Icelandic industrial energy-saving energy storage equipment

Icelandic industrial energy-saving energy storage equipment

-

Nicaragua Photovoltaic Energy Storage Equipment Factory

Nicaragua Photovoltaic Energy Storage Equipment Factory

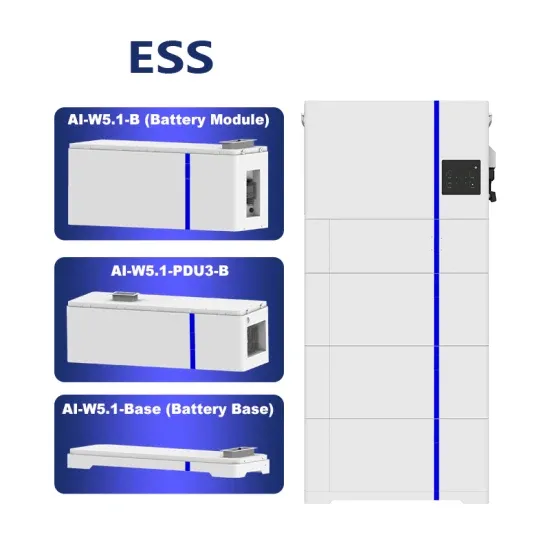

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.