Bulgaria Steps Up to Supply Electricity Amid North Macedonia''s Power

In a significant display of regional solidarity, Bulgaria has stepped in to supply electricity to North Macedonia and Serbia following a power crisis that left many areas in the

Get a quote

Bulgaria: Energy Storage as a Catalyst for a Changing

The Current State of the Bulgarian Power Market: Why is Energy Storage More Relevant than Ever? The Bulgarian power sector is currently attracting significant interest from foreign and

Get a quote

A record year for Saint Nikola Wind Farm

Last year, the 52 turbines of Bulgaria''s largest wind farm produced over 5% more wind energy for Bulgarian consumers compared to 2022. The green energy generated by

Get a quote

The Ross Island Wind Farm Project, Antarctica

The Ross Island Wind Farm (RIWF) resulted from the construction and integration of a small three-turbine wind farm on Crater Hill, Ross Island,

Get a quote

Wind power in Bulgaria

Wind power generated 2% of electricity in Bulgaria in 2023. By the end of 2020 almost 1 GW of onshore wind power had been installed. It has been estimated that there is potential for at least another 2 GW by 2030. The total wind power grid-connected capacity in Bulgaria was 702 MW as of 2023. An energy island in the Black Sea has been suggested for joint development with wind power in Romania

Get a quote

Microsoft Word

Abstract The availability of electric energy source in nature such as wind and solar power have not been explored and used significantly as electric power sources for human need of energy.

Get a quote

New Record for AES Bulgaria: In 2022, St. Nikola

AES Bulgaria has set a new generation record. In 2022, St. Nikola Wind Farm, owned by the company, generated the largest amount of

Get a quote

Analysis: Is Bulgaria''s decade of dormancy giving way

Danish wind developer Eurowind and Bulgarian renewable investor Renalfa this September broke ground on a hybrid wind-solar-and-storage project in

Get a quote

Renewable Energy Solutions in Bulgaria | Enerons

Design and build high-efficiency solar and wind power systems with Enerons. Certified components, full installation, and smart energy solutions.

Get a quote

Wind Energy in Bulgaria: A Joint Venture by "Power to Wind" and

The first project is a substantial wind farm located in the municipality of Aytos, boasting an impressive capacity of 208 MW. This facility will be among the largest in Bulgaria,

Get a quote

Bulgaria

Installed wind energy capacity in Bulgaria is 705 MW, leaving a large untapped potential for this energy source. Bulgaria has set a goal of 29.9% share of renewable energy sources in its

Get a quote

Latest wind energy data for Europe: Autumn 2024

As the new European Parliament and Commission take office following the EU elections in June, this autumn update outlines the latest data

Get a quote

Wind energy is back on Bulgaria''s horizon shows the

Wind energy is back on Bulgaria''s horizon. After a long pause, efforts to expand wind energy are gaining momentum so SeeNext''s new analysis delves into

Get a quote

RWE installs HVDC Offshore Converter Platform

Operations and maintenance activities for Sofia will be managed from RWE''s new offshore wind operations base, the ''Grimsby Hub,'' which also supports RWE''s Triton Knoll

Get a quote

Wind Energy in Bulgaria: A Joint Venture by "Power to Wind" and "Power

The first project is a substantial wind farm located in the municipality of Aytos, boasting an impressive capacity of 208 MW. This facility will be among the largest in Bulgaria,

Get a quote

BTA :: Think Tank Finds Huge Wind Power Potential in Bulgaria

Bulgaria needs to address a number of governance deficiencies in order to unlock the huge investments in the wind power sector and thus accelerate the decarbonization of its

Get a quote

Wind Power Generation in Bulgaria

This study assesses the technical and economic potential of the Bulgarian Exclusive Economic Zone in the Black Sea identifying favorable deployment areas for ofshore wind power

Get a quote

Wind energy is back on Bulgaria''s horizon shows the 2024

Wind energy is back on Bulgaria''s horizon. After a long pause, efforts to expand wind energy are gaining momentum so SeeNext''s new analysis delves into the evolving role of wind power

Get a quote

Analysis: Is Bulgaria''s decade of dormancy giving way to a wind

Danish wind developer Eurowind and Bulgarian renewable investor Renalfa this September broke ground on a hybrid wind-solar-and-storage project in southeastern Bulgaria, the country''s first

Get a quote

New Record for AES Bulgaria: In 2022, St. Nikola Wind Farm

AES Bulgaria has set a new generation record. In 2022, St. Nikola Wind Farm, owned by the company, generated the largest amount of electricity since it was commissioned

Get a quote

List of power stations in Bulgaria | Detailed Pedia

Location of the major power plants in Bulgaria Units 5 and 6 of Kozloduy NPP Studen Kladenets Hydro plant Bobov dol TPP Kaliakra Wind Farm This is a list of power stations located in

Get a quote

Bulgaria

An increase is also expected with regard to biomass power plants by 222 MW. The availability for new electricity production capacities in PV and wind should also replace the current ineffective

Get a quote

Enery еxpands its portfolio in Bulgaria with 113 MW

With a capacity of 113 MW and an annual production of 177 GWh, Tsenovo Solar Park in Northern Bulgaria has become the largest power plant in Enery''s portfolio to date.

Get a quote

Comparative assessment of anticipated wind power

This analysis underscores the varied approaches taken by Bulgaria and Kazakhstan in capitalizing on their geographic and political contexts to expand wind power, reflecting broader

Get a quote

6 FAQs about [Bulgaria s latest base station wind power supply]

How has the wind energy sector changed in Bulgaria?

Markova says the investment climate for wind energy has improved, as has the awareness of policymakers that “Bulgaria needs clean and affordable energy.” Compared to 14 years ago, Bulgaria’s wind energy sector is also now “more for professionals,” she says.

How much wind power does Bulgaria have?

In 2019 Bulgaria had 708 MW of wind power capacity, with the European Wind Energy Association stating that Bulgaria has the potential to generate up to 3.4 GW of wind power. Generating over 10% of Bulgaria's electricity, most hydropower plants are owned by NEK EAD and located in the Rhodope Mountains and Rila.

Is Bulgaria ready for a hybrid wind-solar-and-storage project?

Danish wind developer Eurowind and Bulgarian renewable investor Renalfa this September broke ground on a hybrid wind-solar-and-storage project in southeastern Bulgaria, the country’s first hybrid project – and one sign of the country’s renewed interest in wind energy.

Who is developing onshore wind projects in Bulgaria?

Other international players including CWP Global and Wpd are also developing onshore wind projects in the country, alongside local developers working for institutional investors or for companies seeking a source of green energy. Bulgaria’s cumulative wind capacity now stands at just over 700MW, almost all built more than 10 years ago.

Are Bulgarian wind projects ready to build?

As once dormant projects are brought back to life, Vladimirov estimates some 4GW of onshore Bulgarian onshore wind project are at or near the ready-to-build stage. Developing wind projects in the country nonetheless remains problematic. “As in many places, the biggest constraint is the grid,” says Markova.

When will Eurowind's Bulgarian wind turbines be installed?

Markova expects the project to use turbines from Eurowind’s usual suppliers – Vestas or Siemens Gamesa – with the first of to be installed in late 2024 or early 2025 and a target of end 2025 to complete the project. Eurowind’s Bulgarian wind pipeline is approaching 2GW, notes Markova.

Guess what you want to know

-

Wind power supply for communication base station room

Wind power supply for communication base station room

-

5G base station new wind power supply design

5G base station new wind power supply design

-

Base station power supply centralized wind power generation network

Base station power supply centralized wind power generation network

-

Base station wind power principle power supply

Base station wind power principle power supply

-

Base station wind power supply equipment model

Base station wind power supply equipment model

-

Algeria base station wind power supply

Algeria base station wind power supply

-

Base station wind power supply replacement continues

Base station wind power supply replacement continues

-

Base station wind power supply circuit

Base station wind power supply circuit

-

Composition of base station high-frequency wind power supply

Composition of base station high-frequency wind power supply

-

Base station replaces wind power supply and wind power generation screen

Base station replaces wind power supply and wind power generation screen

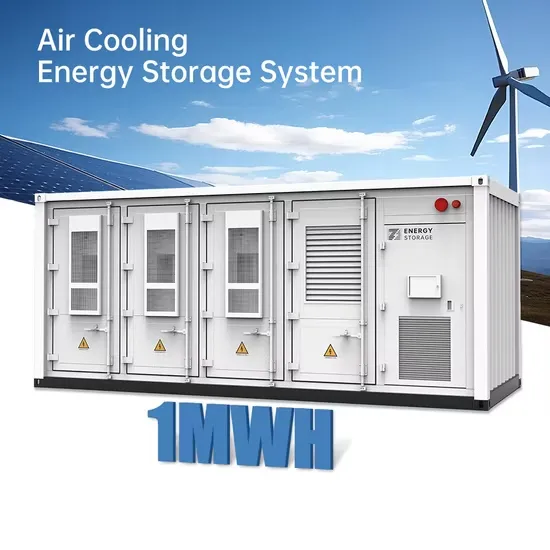

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

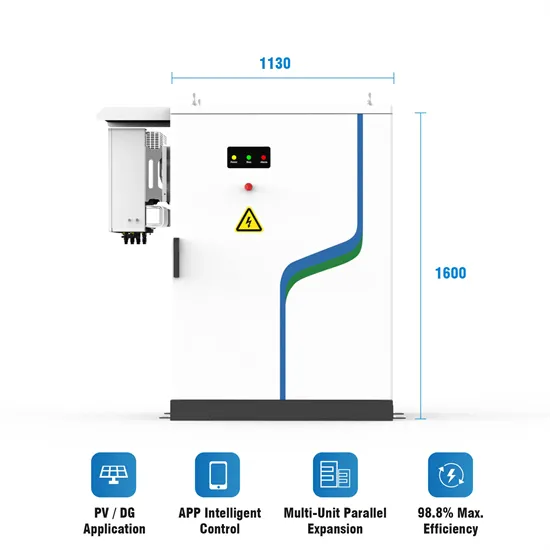

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.