In Morocco, mobile desalination stations quench the thirst of

In Beddouza, the Ministry of Interior has deployed three of the 44 « monobloc » mobile desalination stations that Morocco has installed since April 2023. Additionally, 219 more are

Get a quote

3 Mobile Operators in Morocco for Tourists with

This guide will provide an overview of all the mobile operators in Morocco, detail what you need to consider when choosing one, compare the main three

Get a quote

Morocco

The government of Morocco is preparing for a 5G tender, with an initial limited project expected to be announced in the 3rd quarter of 2025, followed by a nationwide rollout

Get a quote

mobile communication base stations

China''s mobile communication base station market is poised for significant growth, driven by the rapid expansion of 5G technology and the increasing demand for high-speed

Get a quote

Optimal location of base stations for cellular mobile network

This paper addresses the problem of locating BSs for a mobile cellular network to serve mobile users in a certain geographical area considering users'' movements within the

Get a quote

ziz

Proche des préoccupations quotidiennes de ses clients, ZIZ a développé un solide réseau de distribution de GPL qui assure un maillage serré du territoire. Le GPL est un produit vital pour

Get a quote

(PDF) Site Selection Planning of Urban Base Station

Based on the principle of priority business volume and the cost performance of base station, this paper establishes a set of models to solve

Get a quote

Morocco''s Base Station Market Report 2024

In 2022, base station imports into Morocco fell markedly to X units, which is down by X% against the previous year. Over the period under review, imports showed a sharp slump.

Get a quote

Mobile base station site as a virtual power plant for grid stability

The system consists of a live mobile base station site with a mobile connection to the site, local controller, an existing battery, and a power system that, in combination, can

Get a quote

Optimization Models for Selecting Base Station Sites for Cellular

Increasing number of base station sites with continuously growing customers not only lifted up the total cost of the cellular network but it also has radiation hazard issues

Get a quote

An Independent UAV-Based Mobile Base Station

We develop a prototype of a proposed mobile base station and test its operation in an outdoor environment. The experimental results provide a sufficient data rate to make an independent

Get a quote

Morocco

The information below is part of the Digital Ecosystem Evidence Map (DEEM) and displays up-to-date resources on digital development interventions and the digital ecosystem for Morocco.

Get a quote

BASE DISTRIBUTION Company Profile | Casablanca, Morocco

Find company research, competitor information, contact details & financial data for BASE DISTRIBUTION of Casablanca. Get the latest business insights from Dun & Bradstreet.

Get a quote

Mobile Base Station Architecture Evolution and Synchronization

PDF | Mobile Base Station Architecture Evolution and Synchronization Challenges: Role of IEEE 1588 PTP in 5G Networks | Find, read and cite all the research you need on

Get a quote

An Independent UAV-Based Mobile Base Station

We develop a prototype of a proposed mobile base station and test its operation in an outdoor environment. The experimental results provide

Get a quote

Mobile Petrol Station Manufacturing Insights in

Explore the feasibility study on mobile petrol station manufacturing in Morocco, highlighting market potential and strategic insights.

Get a quote

Morocco LTE Base Station System Market (2025-2031) | Trends,

Our analysts track relevent industries related to the Morocco LTE Base Station System Market, allowing our clients with actionable intelligence and reliable forecasts tailored to emerging

Get a quote

6 FAQs about [Morocco Mobile Base Station Site Distribution]

What is the mobile market like in Morocco?

Morocco’s mobile market is one of the more mature in the region, with a penetration rate of 137.5 percent. The three mobile network operators – Maroc Telecom, Orange, and Inwi – offer fixed-line and fixed-wireless services. They have developed mobile data services based on the extensive reach of LTE infrastructure.

How many mobile internet connections are there in Morocco?

Morocco’s mobile internet base is 33.18.7 million, representing 93 percent of the overall internet market. A total of 50.19 million cellular mobile connections were active in Morocco in early 2023, with this figure equivalent to 133.3 percent of the total population.

How many 4G subscribers are there in Morocco?

Regarding the number of 4G mobile subscribers, a recent report from ANRT shows an increase of more than 30 percent to approximately 20.5 million. Morocco Number of Internet Subscribers data was reported at 35,574,000.000 Unit in December 2022. and an internet penetration rate of 88.1 percent, .

What is the market size of Morocco Telecom market?

The Morocco telecom market size was valued at $3.5 billion in 2021 and is expected to grow at a CAGR of over 3% during the forecast period, 2021-2026. Three operators share the 2G-4G telecoms market: Maroc Telecom (42.9 percent), Orange Maroc (33.2 percent), and Inwi (23.9 percent).

Is Morocco ready for a 5G network?

The Government of Morocco is currently conducting international studies to better understand international safety and implementation standards and benchmarks before deploying Morocco’s 5G network. Morocco’s National Telecommunications Regulatory Agency (ANRT) expects to conduct its 5G spectrum auction by the end of 2023 or beginning of 2024.

Why is Morocco promoting foreign direct investment in telecommunications?

To establish itself as a leading hub in the field of digital technologies on the African continent, Morocco is encouraging foreign direct investment in the telecommunications sector, especially as it seeks to accelerate its whole-of-society digital transformation, promote new technologies, and develop telecommunications services.

Guess what you want to know

-

5G base station site distribution in Guyana

5G base station site distribution in Guyana

-

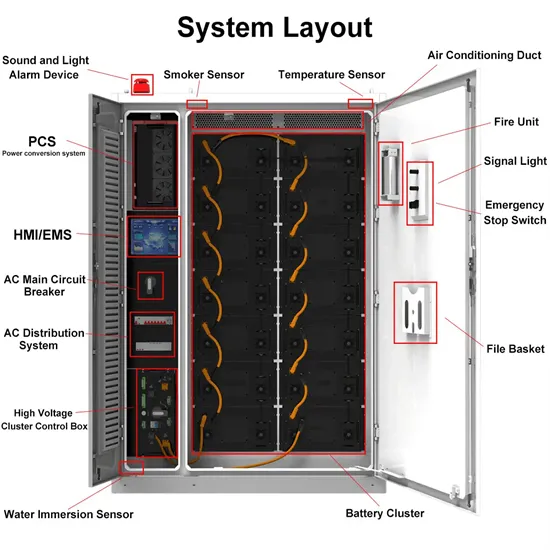

Power distribution cabinet of mobile base station

Power distribution cabinet of mobile base station

-

Morocco communication base station inverter grid distribution

Morocco communication base station inverter grid distribution

-

Cameroon 5G base station distribution

Cameroon 5G base station distribution

-

British base station power distribution cabinet tender

British base station power distribution cabinet tender

-

Solar Base Station Battery Distribution in the Netherlands

Solar Base Station Battery Distribution in the Netherlands

-

Venezuela base station constant temperature distribution cabinet

Venezuela base station constant temperature distribution cabinet

-

How to use the electric power remote mobile base station

How to use the electric power remote mobile base station

-

Mobile base station equipment power wind power generation

Mobile base station equipment power wind power generation

-

Base station power access distribution box outdoor

Base station power access distribution box outdoor

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.