Energy industry in Myanmar

About 62% of Myanmar''s electricity is generated by power plants running on fossil fuels, most of which are gas-fired. The largest gas-fired power plants are located around the

Get a quote

Myanmar Energy Statistics 2019

Having good energy statistics will allow Myanmar to contribute to and share data with ASEAN, International Energy Agency, Joint Organization Data Initiative (JODI), and other

Get a quote

Energy Supply Security Study for Myanmar

Coal consumption in Myanmar is limited and its share to total primary energy supply (TPES) was 2.6% in 2017. But coal will be a strategic energy source in order to diversify power generation

Get a quote

Myanmar Energy Storage Equipment Company Ranking

1Q24 Energy-storage cell shipment ranking: CATL retained lead; The world shipped 38.82 GWh of energy-storage cells in the first quarter this year, with utility-scale and C&I projects

Get a quote

Myanmar Advanced Energy Storage Systems Market (2024-2030

How does 6W market outlook report help businesses in making decisions? 6W monitors the market across 60+ countries Globally, publishing an annual market outlook report that

Get a quote

Myanmar Energy Storage Solutions Market (2025-2031) | Trends,

Our analysts track relevent industries related to the Myanmar Energy Storage Solutions Market, allowing our clients with actionable intelligence and reliable forecasts tailored to emerging

Get a quote

Myanmar Energy Storage Market (2024-2030) | Trends, Growth,

Historical Data and Forecast of Myanmar Energy Storage Market Revenues & Volume By Industrial for the Period 2020- 2030 Myanmar Energy Storage Import Export Trade Statistics

Get a quote

Full Report

To fill the gap regarding energy data and statistics of Myanmar, the Ministry of Electricity and Energy requested the Economic Research Institute for ASEAN and East Asia (ERIA) to

Get a quote

21 Best Energy Storage Companies & Manufacturers

21 Best Energy Storage Companies & Manufacturers As the world increasingly turns to renewable energy sources to combat climate change,

Get a quote

Myanmar Data Center Energy Storage Market (2024-2030)

Myanmar Data Center Energy Storage Industry Life Cycle Historical Data and Forecast of Myanmar Data Center Energy Storage Market Revenues & Volume By Data Center Type for

Get a quote

ENERGY PROFILE Myanmar

primary energy supply. Energy trade includes all commodities in Chapter 27 of the armonised System (HS). Capacity utilisation is calculated as annual generation divided by year-end

Get a quote

Myanmar Solar Energy and Battery Storage Market (2025-2031)

Historical Data and Forecast of Myanmar Solar Energy and Battery Storage Market Revenues & Volume By >500 kWh for the Period 2021-2031 Myanmar Solar Energy and Battery Storage

Get a quote

GMS Energy Sector Strategy 2024-2030

GMS country updates that have regional implications Developments that have implications for GMS countries Singapore will establish the Future Energy Fund by the end of 2024 to finance

Get a quote

MYANMAR COUNTRY REPORT

Myanmar''s proven energy reserves in 2017 comprised 105 million barrels of oil, 6.58 trillion cubic feet of gas, and 542.56 million metric tons of coal. The country is a net exporter of energy,

Get a quote

Energy in Myanmar

[5] Myanmar''s abundant energy resources have made it a net energy exporter in Southeast Asia. Hydropower potential is estimated for a generation capacity of 140 TWh annually, though

Get a quote

Burma (MMR) Exports, Imports, and Trade Partners

This visualization shows the participation rate of a country in the global export market for each product it exports. It highlights the extent to which the country

Get a quote

Myanmar Energy Storage Market (2024-2030) | Trends, Growth,

Historical Data and Forecast of Myanmar Energy Storage Market Revenues & Volume By Industrial for the Period 2020- 2030 Myanmar Energy Storage Import Export Trade Statistics

Get a quote

Energy Outlook and Energy-Saving Potential in East Asia

Myanmar''s proven energy reserves in 2017 comprised of 94 million barrels of oil, 4.552 trillion cubic feet of gas, and over 500 million metric tons of coal. The country is a net exporter of

Get a quote

Myanmar Battery Energy Storage Market (2022-2031)

Myanmar Battery Energy Storage market currently, in 2023, has witnessed an HHI of 7870, Which has increased slightly as compared to the HHI of 7244 in 2017. The market is moving towards

Get a quote

Myanmar

Total energy supply (TES) includes all the energy produced in or imported to a country, minus that which is exported or stored. It represents all the energy required to supply end users in the

Get a quote

Myanmar: Energy Assessment, Strategy, and Road Map

In terms of energy intensity, Myanmar was ranked 191 in 2011, making it one of the least energy consuming countries in the world.2 Traditional biomass (mainly firewood and agricultural

Get a quote

Energy Outlook and Energy-Saving Potential in East Asia

Myanmar is endowed with rich natural resources used for the production of commercial energy. The current available sources of energy found in Myanmar are crude oil, natural gas,

Get a quote

Myanmar Battery Energy Storage Market (2022-2031) | Companies

Myanmar Battery Energy Storage market currently, in 2023, has witnessed an HHI of 7870, Which has increased slightly as compared to the HHI of 7244 in 2017. The market is moving towards

Get a quote

6 FAQs about [The proportion of Myanmar s energy storage export companies]

How much energy does Myanmar have?

Myanmar’s proven energy reserves in 2017 comprised of 94 million barrels of oil, 4.552 trillion cubic feet of gas, and over 500 million metric tons of coal. The country is a net exporter of energy, exporting substantial amounts of natural gas and coal to neighbouring countries. However, it imports around 90% of its total oil requirements. 1.2.

What is the energy demand supply situation in Myanmar?

The Myanmar energy demand supply situation indicates that power generation mix must shift to more coal and hydropower, continued use of biomass, natural gas consumption, and appropriate increase of renewable energy such as solar PV and wind power generation.

How to estimate the total energy consumption of Myanmar industries?

At the national level, this will also need the total production of the sub-sector to estimate its energy consumption. In conclusion, the national production or gross value added of the sub-sectors is very important in estimating the total energy consumption of Myanmar industries. The parking lot survey was conducted in several areas of Yangon.

How is transport energy consumption projected in Myanmar?

Source: Author’s calculations. In Myanmar, transport energy consumption is projected based on the energy requirements of major sectors (industry, transport, agriculture, and households). The choice of fuel type is determined by available supply, since energy demands must be met mainly by domestic sources.

Is there a value-added ratio for industry intensities in Myanmar?

Some surveyed samples exclude revenue data; the exact value-added ratio is also not available. These limitations of the survey and Myanmar’s national account statistics afected the estimation of industry intensities. This energy consumption survey of the industry sector is the first of its kind for the OGPD.

What is Myanmar's indigenous energy production?

In addition to crude oil, Myanmar indigenous production also includes coal, gas, hydro, biomass, and other renewables (solar and wind). Compared with energy imports, Myanmar’s total indigenous energy production grew more slowly at an average rate of 5.1% per year.

Guess what you want to know

-

Congo Kinshasa energy storage export companies

Congo Kinshasa energy storage export companies

-

Ranking of energy storage battery container export companies

Ranking of energy storage battery container export companies

-

Colombian energy storage export companies

Colombian energy storage export companies

-

Yemeni energy storage export companies

Yemeni energy storage export companies

-

Kazakhstan export energy storage cabinet companies

Kazakhstan export energy storage cabinet companies

-

Danish energy storage battery companies

Danish energy storage battery companies

-

How many companies are involved in energy storage power stations in Papua New Guinea

How many companies are involved in energy storage power stations in Papua New Guinea

-

Turkish photovoltaic supporting energy storage companies

Turkish photovoltaic supporting energy storage companies

-

British lithium power energy storage companies

British lithium power energy storage companies

-

Egypt s outdoor energy storage battery companies

Egypt s outdoor energy storage battery companies

Industrial & Commercial Energy Storage Market Growth

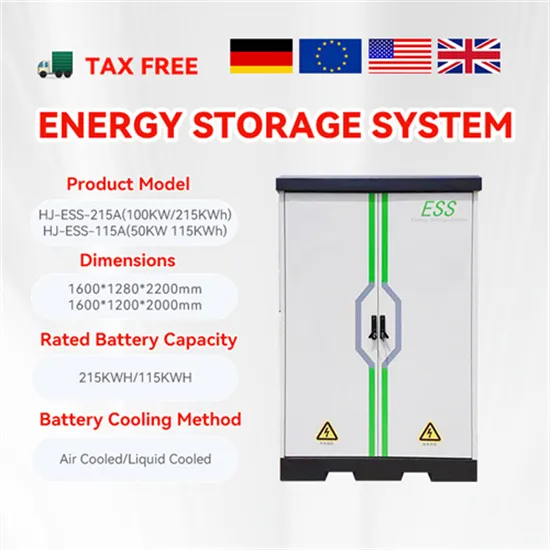

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.