Distributed Energy Resources in Russia: Development Potential

Distributed energy resources are currently ignored in the long-term planning for Russian power system develop-ment, except in remote and isolated areas. Despite this, some changes are

Get a quote

How is Russia''s energy storage technology? | NenPower

Russia is investing in a range of energy storage technologies to enhance its energy infrastructure. Primarily, lithium-ion batteries represent a significant focus due to their

Get a quote

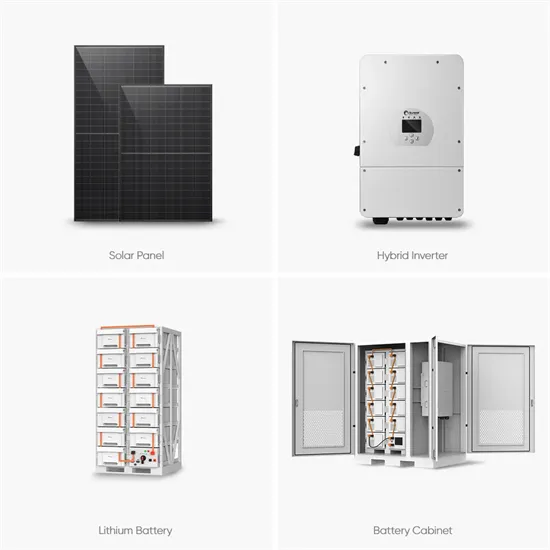

Solutions for energy storage systems (ESS)

In 2021, MKC Group of Companies signed an agreement on the exclusive distribution of products in Russia and MENA (the Middle East and North Africa region) for the preparation of energy

Get a quote

Provides distribution cabinets distribution box distribution panel

We have successfully completed the installation of 10 customized distribution cabinets designed for Russia today. The distribution cabinet is equipped with a heat dissipation system and

Get a quote

Russia Distributed Energy Storage Systems Market | Size, Share,

This report by Blackridge Research and Consulting provides detailed insights into market dynamics, storage technologies, regulatory frameworks, and challenges influencing the

Get a quote

Russian equipment reserves (2024)

Since 2022, both Russia and Ukraine have lost enormous amounts of heavy equipment. Many militaries would have been burned out having suffered the kinds of losses

Get a quote

The distribution network in Russia

Learn about the distribution market in Russia. Find out information on the evolution of the retail sector in Russia and the retail organisations in charge.

Get a quote

The Logistics System of Russia: Storage Facilities

Thus, in a protracted war, Russia is left relying to a large extent on its stored armaments from the Soviet era. With this in mind, let''s review

Get a quote

Russia Residential Energy Storage Market Report, 2030

The Russian residential energy storage market will generate an estimated revenue of USD 13.7 million in 2024, advancing at a CAGR of 27.5% during

Get a quote

Electronmash JSC

Electronmash was one of the first among Russian manufacturers of electrical equipment to offer solutions for new generation digital substations. The Monetnaya substation 35 kV is the first of

Get a quote

Innovation and modernization of the Russian energy sector

In support of economic growth and social development, the 2003 Energy Strategy made substantial investments in energy infrastructure, such as the construction of new power

Get a quote

Overview of energy storage systems in distribution networks:

The deployment of energy storage systems (ESSs) is a significant avenue for maximising the energy efficiency of a distribution network, and overall network performance

Get a quote

Comprehensive review of energy storage systems technologies,

The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Get a quote

Russia says gigafactory plan first step for ''batteries independence''

Kaliningrad, which lies between Poland and Lithuania, does not border mainland Russia but is home to Russia''s Baltic fleet. Rosatom says the Kaliningrad gigafactory will

Get a quote

Russian Energy Storage Solutions High-Power Supply for

As Russia accelerates its energy transition, high-power storage systems will play a pivotal role in balancing grid stability with industrial growth. The right solution combines rugged construction

Get a quote

Keeping the lights on: How Ukraine can build a resilient energy

More than ever, Ukraine needs support to transition towards a long-term energy system that is resilient, flexible and secure. The EU has the expertise, the ability and the will to

Get a quote

Russian Energy Storage Power Station: From Soviet-Era Giants

When you think of Russian energy, gargantuan oil pipelines might come to mind first. But here''s a plot twist worthy of Tolstoy: the world''s largest country is quietly becoming a playground for

Get a quote

Russia says gigafactory plan first step for ''batteries

Kaliningrad, which lies between Poland and Lithuania, does not border mainland Russia but is home to Russia''s Baltic fleet. Rosatom says the

Get a quote

Russian Energy Storage Power Station: From Soviet-Era Giants

But here''s a plot twist worthy of Tolstoy: the world''s largest country is quietly becoming a playground for energy storage innovation. From Soviet-era pumped hydro giants to cutting

Get a quote

Solutions for energy storage systems (ESS)

MKC Group of Companies is an official partner in energy storage devices built on CATL battery systems — a world leader in the production of lithium energy sources for electric transport and

Get a quote

The Government of the Russian Federation and RUSNANO will

The Government of the Russian Federation and RUSNANO will develop a roadmap for the development of energy storage systems. The corresponding agreement was

Get a quote

How is Russia''s energy storage technology? | NenPower

Russia is investing in a range of energy storage technologies to enhance its energy infrastructure. Primarily, lithium-ion batteries represent a

Get a quote

DC Distribution System for Improved Power System

With the expanding introduction of renewable energy sources and advances in semiconductor and energy storage technologies, direct current (DC) distribution systems that combine renewable

Get a quote

Energy storage systems: a review

The world is rapidly adopting renewable energy alternatives at a remarkable rate to address the ever-increasing environmental crisis of CO2 emissions.

Get a quote

Analysis of Energy Storage Systems Application in the Russian

In this article authors carried out the analysis of the implemented projects in the field of energy storage systems (ESS), including world and Russian experience.

Get a quote

6 FAQs about [Russian distribution room energy storage equipment]

Are distributed energy resources a problem in Russia?

Distributed energy resources are currently ignored in the long-term planning for Russian power system develop-ment, except in remote and isolated areas. Despite this, some changes are taking place in the country, albeit rather slowly.

Should Russia create an infrastructure for EV charging stations?

Russia must also “create an infrastructure for charging stations” for EVs, he said. Rosatom announced on November 23 that it had established a new subsidiary — Renera — dedicated to the manufacture of energy storage systems.

What is distributed generation (DG) in Russia?

Distributed Generation (DG), unlike other types of distributed energy resource, is applied to some extent in Russia. In Russia, power plants with a larger capacity than is common in Europe or the United States are classified as DG.

What is the capacity of distributed generation in Russia?

Table 1. Typical cases of distributed generation in Russia Capacity of 25-600 MW Technology – steam power (for stations launched in the XX century) and gas or reciprocated gas tur-bine (XXI century). Most often - co-generation. Capacity - usually from 500 kW to 10 MW. The technology - mainly recipro-cated gas turbine, less often micro-tur-bine.

What are the types of distributed generation in Russia?

Typical cases of distributed generation in Russia Capacity of 25-600 MW Technology – steam power (for stations launched in the XX century) and gas or reciprocated gas tur-bine (XXI century). Most often - co-generation. Capacity - usually from 500 kW to 10 MW. The technology - mainly recipro-cated gas turbine, less often micro-tur-bine. eration.

Is distributed co-generation a good idea in Russia?

At the same time, the most promising approach in Russia is distributed co-generation (a technology that shows a high level of efficiency in the northern coun-tries of Europe). According to the most conservative estimates, its poten-tial is about 17 GW.

Guess what you want to know

-

Russian energy storage equipment companies

Russian energy storage equipment companies

-

Energy storage and distribution equipment

Energy storage and distribution equipment

-

Russian rechargeable energy storage vehicle equipment manufacturer

Russian rechargeable energy storage vehicle equipment manufacturer

-

Energy storage device in distribution room

Energy storage device in distribution room

-

Container complete energy storage equipment configuration

Container complete energy storage equipment configuration

-

Lithuanian container energy storage equipment company

Lithuanian container energy storage equipment company

-

Samoa energy storage equipment

Samoa energy storage equipment

-

Finland Industrial Energy Saving and Storage Equipment Solution

Finland Industrial Energy Saving and Storage Equipment Solution

-

Equipment required for energy storage

Equipment required for energy storage

-

Operational price of low voltage energy storage equipment

Operational price of low voltage energy storage equipment

Industrial & Commercial Energy Storage Market Growth

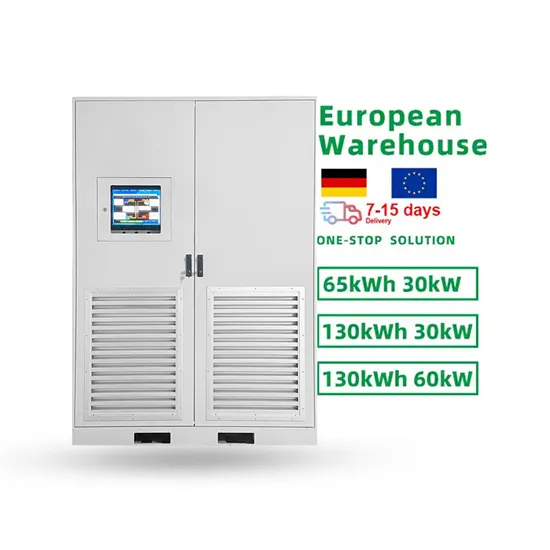

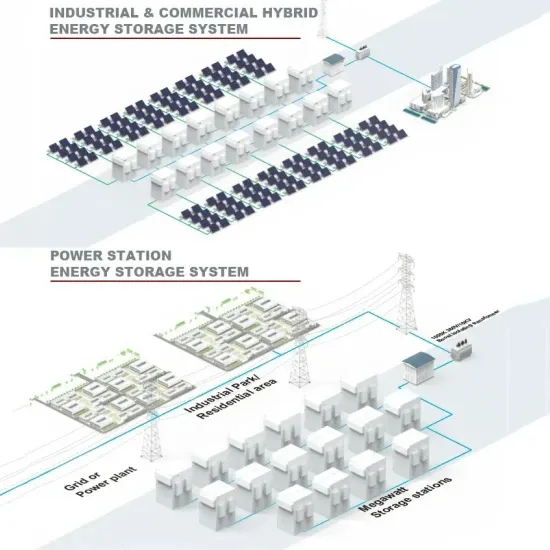

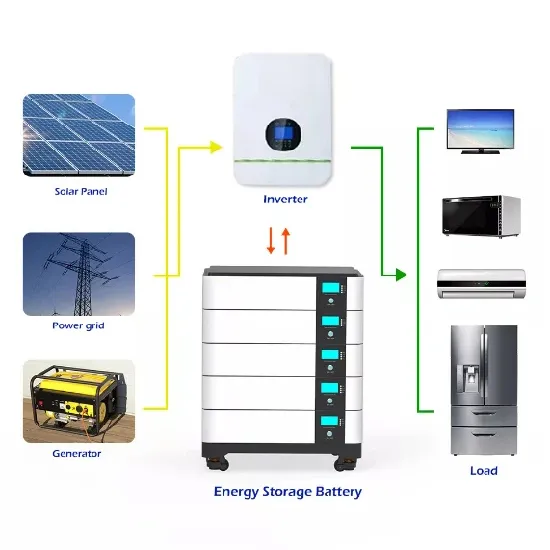

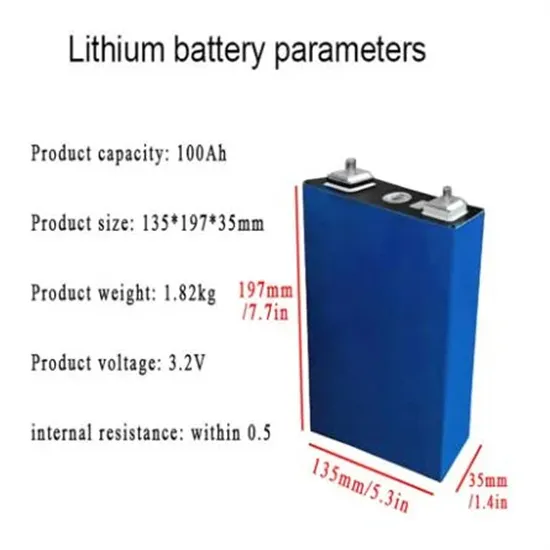

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.