Addressing Tariffs and Trade in Energy Storage Projects

Tariffs on Chinese-origin lithium-ion non-EV batteries are scheduled to increase to 25% effective January 1, 2026. Otherwise, batteries of non

Get a quote

Impacts of Trump Administration Tariffs on the Battery

Proposed tariff increases on Chinese lithium-iron-phosphate (LFP) battery imports threaten to disrupt the United States'' deployment of battery

Get a quote

US suppliers back Chinese lithium-ion battery tariff

The American Clean Power Association (ACP) has approved the Biden Administration''s decision to impose Section 301 tariffs on lithium-ion

Get a quote

Tariff Shockwave: U.S. Slaps 82% Duties on Chinese

US imposes 82.4% tariff on Chinese lithium-ion battery imports, sparking a global trade battle and reshaping the future of clean energy

Get a quote

What 2025 holds for the US energy storage market

Trump''s dampening effect on US investor sentiment could lead to a flight to quality, while tariffs will cause a surge in orders this year.

Get a quote

ESS Price Forecasting Report (Q1

This Interim Update of the Energy Storage System (ESS) Q1 2025 Price Forecasting Report highlights how newly imposed U.S. tariffs are reshaping the cost

Get a quote

US to raise tariffs on EVs, batteries, solar cells, and

The Biden administration announced significantly higher tariffs on EVs, batteries, semiconductors, solar cells, and critical minerals from China.

Get a quote

US increases tariffs on batteries from China to 25

The existing 7.5% rate for batteries rises to 10.89% when importing full containerised battery energy storage system (BESS) products

Get a quote

Battery Tariffs 2025: Impact on U.S. Energy and Trade

Explore how 2025 battery tariffs affect U.S. imports, energy storage, EV production, and sourcing strategies amid rising China tariffs and trade shifts.

Get a quote

Tariff uncertainty grips US battery development

CEA observes that lithium-ion battery imports into the US from China surged 10% from Q4 2024 to Q1 2025. At the same time, lithium-ion

Get a quote

Rule and Regulations for the Import of Batteries in India

For energy storage in renewable energy systems, Lithium-ion and lead-acid batteries are commonly used. Mobile Phone Batteries: India has a

Get a quote

48.4%! US Tariffs on Chinese Energy Storage Products Take Effect

By January 2026, the comprehensive tariff on Chinese-made batteries and energy storage systems in the US will reach an astonishing 48.4%. This figure will undoubtedly put

Get a quote

US increases tariffs on batteries from China to 25%

The existing 7.5% rate for batteries rises to 10.89% when importing full containerised battery energy storage system (BESS) products containing lithium-ion cells from

Get a quote

Tariff uncertainty grips US battery development

CEA observes that lithium-ion battery imports into the US from China surged 10% from Q4 2024 to Q1 2025. At the same time, lithium-ion battery imports from South Korea and

Get a quote

Vaduz energy storage lithium battery import tariff

These tariffs directly impact lithium-ion batteries'''' cost, supply chain, and competitiveness, essential for electric vehicles (EVs), renewable energy storage, and consumer electronics.

Get a quote

U.S. Solar Tariffs 2025 and Their Market Impact

Battery systems—especially lithium-ion—rely heavily on imports, so yes, costs may spike here too. But as we shared in our recent blog on 2025 solar and storage trends, the

Get a quote

Will tariffs help or hurt the US energy storage

Will tariffs help or hurt the US energy storage industry? It''s complicated, experts say Battery system costs have already soared past 2023

Get a quote

Battery Industry Braces for Impact as U.S. Slaps 82

The newly announced trade measures, part of Trump''s so-called ''Liberation Day'' global tariffs, will increase total duties on Chinese-made

Get a quote

Current Tariff Landscape for LiFePO4 Battery Imports from China

Current Tariff Landscape for Lithium-ion LiFePO4 Battery Imports from China to USA is a complex mix of tariffs. As of April 2025, total tariffs range from about 70% to over

Get a quote

Addressing Tariffs and Trade in Energy Storage Projects

Tariffs on Chinese-origin lithium-ion non-EV batteries are scheduled to increase to 25% effective January 1, 2026. Otherwise, batteries of non-Chinese origin storage batteries

Get a quote

US Imposes Up to 70% Tariffs on Chinese Solar Products and Lithium

In addition to solar products, lithium batteries—which are essential for electric vehicles and energy storage systems—are also targeted. This tariff increase will elevate the duties on lithium

Get a quote

Battery energy storage tariffs tripled; domestic content

Altogether, the full tariff paid by importers will increase from 10.9% to 28.4%. Lithium-ion battery modules, packs, and container blocks are

Get a quote

Battery energy storage tariffs tripled; domestic content rules

Altogether, the full tariff paid by importers will increase from 10.9% to 28.4%. Lithium-ion battery modules, packs, and container blocks are generally categorized under

Get a quote

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

This article comprehensively analyses U.S. tariffs on Chinese lithium batteries, exploring the latest tariff rates, their economic effects, and future implications for industries and

Get a quote

Impacts of Trump Administration Tariffs on the Battery Energy Storage

Proposed tariff increases on Chinese lithium-iron-phosphate (LFP) battery imports threaten to disrupt the United States'' deployment of battery energy storage systems (BESS), a

Get a quote

China Tariffs in Response to U.S. Trade Actions

This section outlines the key changes in battery-related import tariffs and their broader impact on the global energy and manufacturing

Get a quote

6 FAQs about [Vaduz energy storage lithium battery import tariffs]

What are China's new tariffs on lithium-ion batteries?

On May 14, 2024, the Biden Administration announced changes to section 301 tariffs on Chinese products. For energy storage, Chinese lithium-ion batteries for non-EV applications from 7.5% to 25%, more than tripling the tariff rate. This increase goes into effect in 2026. There is also a general 3.4% tariff applied lithium-ion battery imports.

What are the tariffs on batteries?

Tariffs have been levied on batteries and other clean energy technology products, particularly solar cells, since 2018 under the previous Trump Administration. The existing 7.5% rate for batteries rises to 10.89% when importing full containerised battery energy storage system (BESS) products containing lithium-ion cells from China.

What is the US tariff policy on lithium ion batteries?

In April 2025, the U.S. government updated its tariff policy on lithium-ion batteries imported from China. The current tariff structure includes: A 3.4% global tariff on lithium-ion batteries, regardless of origin. A Section 301 tariff targeting Chinese imports, currently at 7.5%, is scheduled to rise to 25% by January 2026.

Which countries import lithium-ion batteries?

Lithium-ion batteries power various technologies, from smartphones to electric vehicles and grid storage. China dominates the global lithium battery supply chain, producing over 75% of the world’s lithium-ion battery cells. The U.S. imports nearly 70% of its lithium batteries from China, making tariffs on these products highly impactful.

How many lithium batteries did the US import in 2024?

This marks a significant increase compared to the average 20.8% rate recorded in 2024. Recent trade data shows that the U.S. imported approximately $1.9 billion lithium batteries from China in 2024. With the implementation of Trump’s China tariffs in 2025, these imports now face a much higher cost structure.

What is the import code for lithium-ion batteries?

Lithium-ion battery modules, packs, and container blocks are generally categorized under import code 8507.6020, and it said the tariff change will likely apply to imports under this code. CEA said further clarity is needed for the correct import code for lithium-ion cells.

Guess what you want to know

-

Angola energy storage battery import tariffs

Angola energy storage battery import tariffs

-

Vaduz lithium battery energy storage cabinet system

Vaduz lithium battery energy storage cabinet system

-

Finland iron energy storage lithium battery manufacturer

Finland iron energy storage lithium battery manufacturer

-

Portugal container energy storage lithium battery factory

Portugal container energy storage lithium battery factory

-

100 kWh lithium battery for energy storage

100 kWh lithium battery for energy storage

-

Panama energy storage lithium battery price

Panama energy storage lithium battery price

-

Lithium battery energy storage industry concentration area

Lithium battery energy storage industry concentration area

-

48v lithium energy storage battery

48v lithium energy storage battery

-

Energy storage lithium battery 220v

Energy storage lithium battery 220v

-

Indonesia energy storage lithium battery manufacturer

Indonesia energy storage lithium battery manufacturer

Industrial & Commercial Energy Storage Market Growth

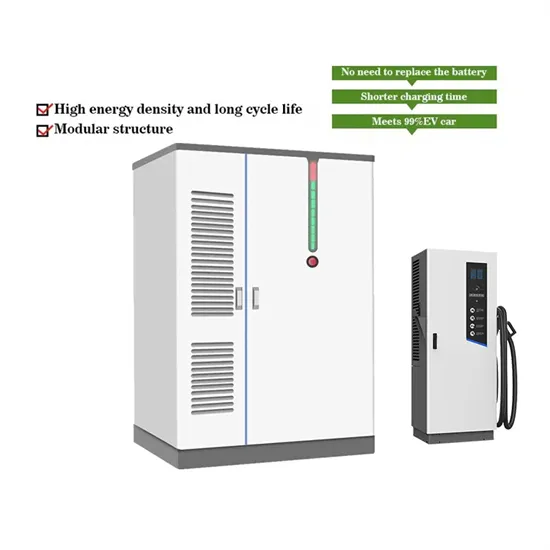

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

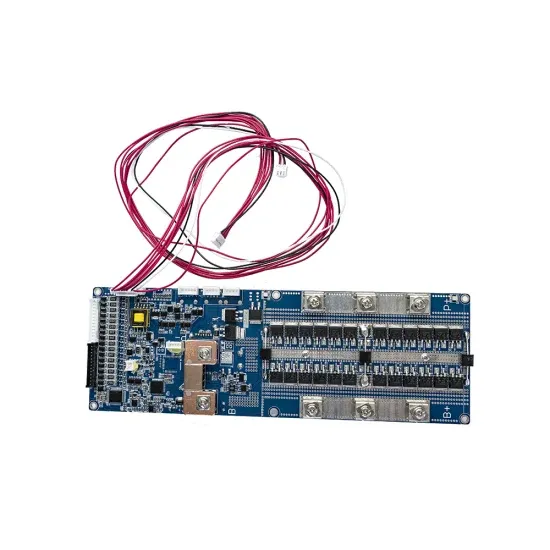

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.