Exploring sustainable electricity system development pathways in South

Here, we focus on the power system development of five countries – Argentina, Brazil, Paraguay, Uruguay, and Chile (collectively referred to as a ''sub-region'' in this paper) –

Get a quote

South America Solar Growth in 2024: Achievements

Brazil is the leader in solar energy in South America as it surpassed 50 GW of installed capacity in 2024. South America continued its

Get a quote

Renewable Solar Energy Facilities in South America—The Road

In this context, South American countries are developing sustainable actions/strategies linked to implementing solar photovoltaic (PV) and concentrated solar power

Get a quote

South America estimated to add 160 GW of PV by 2034

In its latest report on the South American solar PV market, Wood Mackenzie has revealed that the region will add 160 GW of photovoltaic (DC)

Get a quote

Top five solar power producers of South America profiled

Brazil, Chile, Argentina, Peru and Uruguay currently lead the solar power parade in the continent, as the climatic conditions in these countries support high irradiation, which is

Get a quote

Solar energy in Latin America

Aligned with global trends, the installed solar photovoltaic capacity in Latin America and the Caribbean has greatly increased in the last decade, surpassing 85 gigawatts

Get a quote

South America Solar Growth in 2024: Achievements and Challenges

Brazil is the leader in solar energy in South America as it surpassed 50 GW of installed capacity in 2024. South America continued its steady solar growth over the last half

Get a quote

Brazil, Chile, Mexico Lead Renewable Energy in Latin America

Brazil, Chile, Mexico lead Latin America''s renewable energy markets. Detailed data and stats on energy consumption, generation, and key growth segments.

Get a quote

Solar Resource Data, Tools, and Maps | Geospatial Data Science

Solar Resource Maps and Data Find and download resource map images and data for North America, the contiguous United States, Canada, Mexico, and Central America.

Get a quote

The Sun Shines in South America: Colombia & Brazil

Today we look at the grids of Chile, Brazil, and Colombia, all of which have already made solar a cornerstone of their generation or are

Get a quote

South America to Add 160 GW of Solar PV Capacity

The report "South America Solar PV Market Outlook 2025" provides a comprehensive analysis of the region''s solar energy landscape, power

Get a quote

Global Market Outlook for Solar Power 2025-2029

The year 2024 was a true landmark year for solar power. Global solar installations reached nearly 600 GW – an impressive 33% increase over the previous year – setting yet

Get a quote

Global Market Outlook For Solar Power 2023

The annual Global Market Outlook for Solar Power is a project that comes to life with the support and in-depth knowledge of the world''s major regional and local solar industry associations.

Get a quote

Solar energy status in the world: A comprehensive review

A comparison of the solar power status among countries and territories has been provided, considering their concentrated solar power and PV installed capacities for each

Get a quote

The Sun Shines in South America: Colombia & Brazil Give Large

Today we look at the grids of Chile, Brazil, and Colombia, all of which have already made solar a cornerstone of their generation or are working to do so in the near future.

Get a quote

The State of the Solar Industry

"Net Generation" includes DPV generation. Net generation does not take into account imports and exports to and from each state and therefore the percentage of solar consumed in each state

Get a quote

The startling success of Latin America''s renewable

These ambitions translate to 319 GW of planned renewable energy projects. This would represent a 460% increase in the region''s utility-scale

Get a quote

Top five solar power producers of South America profiled

Brazil, Chile, Argentina, Peru and Uruguay currently lead the solar power parade in the continent, as the climatic conditions in these countries

Get a quote

SOUTH KOREA''S SOLAR POWER INDUSTRY: STATUS

Provide incentives for system deployment. Support domestic companies in achieving their renewable power goals through promotion of power purchase agreements and policies to

Get a quote

Photovoltaic energy in South America: Current state and grid

South America is seen as a region with great opportunities for the PV energy market due to the solar potential of the region, the growing demand for electricity, and new

Get a quote

South America to Add 160 GW of Solar PV Capacity by 2034

The report "South America Solar PV Market Outlook 2025" provides a comprehensive analysis of the region''s solar energy landscape, power sector dynamics, 10

Get a quote

(PDF) Solar Energy in Latin America and the Caribbean: The

Without a doubt, Latin America and the Caribbean will significantly contribute to the continuous global solar capacity expansion during the coming decades. The whole region could grow its

Get a quote

Enabling Central America''s energy transition through renewable

Despite substantial investments, system cost reductions could profoundly impact Central American economies and societies, yielding socio-economic and environmental

Get a quote

Argentina to have South America''s largest photovoltaic plant

Argentina has taken another step towards the future of renewable energy. All thanks to the inauguration of the largest photovoltaic plant in South America.

Get a quote

South America Renewable Energy Market Size | Mordor Intelligence

South America Renewable Energy Industry Segmentation Renewable energy is energy that comes from a source that doesn''t run out when it''s used, like solar or wind power.

Get a quote

South America estimated to add 160 GW of PV by 2034

In its latest report on the South American solar PV market, Wood Mackenzie has revealed that the region will add 160 GW of photovoltaic (DC) capacity between 2025 and

Get a quote

Hydropower in South America at a crossroads amid

Developed by Noria Energy, it encompasses a 1.5MW solar power system floating on the reservoir and will be a pilot project for IPP, URRÁ S.A.

Get a quote

Guess what you want to know

-

Huawei South America Solar Power Generation and Energy Storage

Huawei South America Solar Power Generation and Energy Storage

-

South Korea Solar Panel Photovoltaic Power Generation Project

South Korea Solar Panel Photovoltaic Power Generation Project

-

South China Power Grid Solar Power Generation System

South China Power Grid Solar Power Generation System

-

South Africa s solar power generation for home use

South Africa s solar power generation for home use

-

Photovoltaic power generation installed on solar panels

Photovoltaic power generation installed on solar panels

-

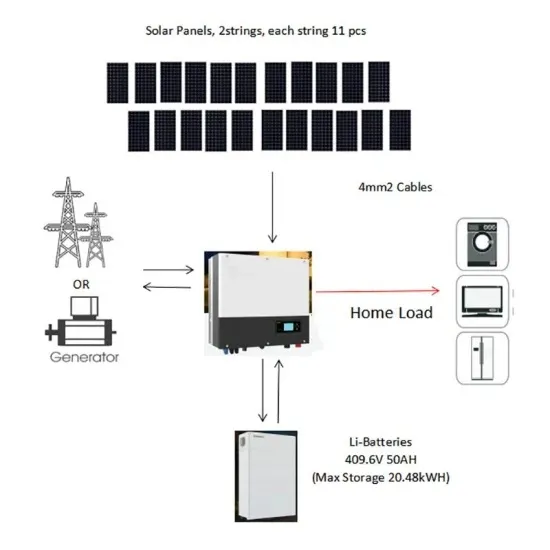

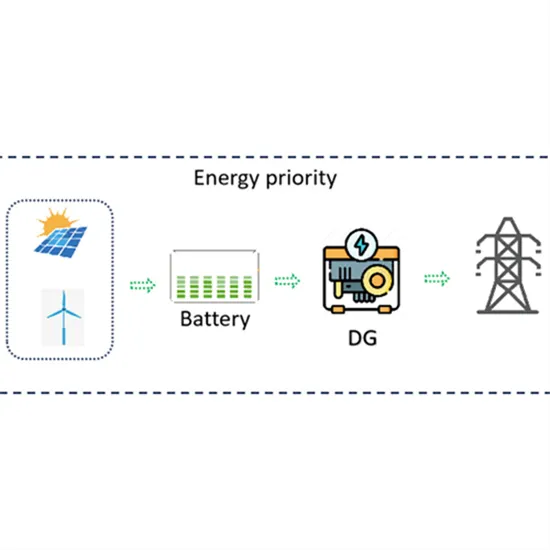

South America Photovoltaic Power Generation 100kw Off-Grid Inverter

South America Photovoltaic Power Generation 100kw Off-Grid Inverter

-

South America Off-grid Photovoltaic Power Generation System

South America Off-grid Photovoltaic Power Generation System

-

Is solar power generation useful for home use in Luxembourg

Is solar power generation useful for home use in Luxembourg

-

Solar power generation 500W

Solar power generation 500W

-

Samoa civilian solar power generation system

Samoa civilian solar power generation system

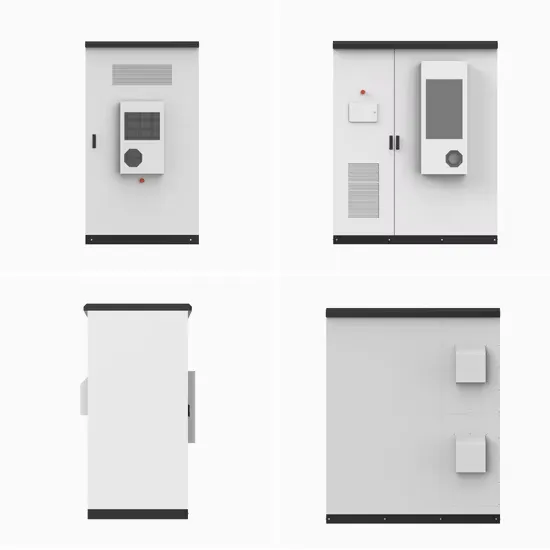

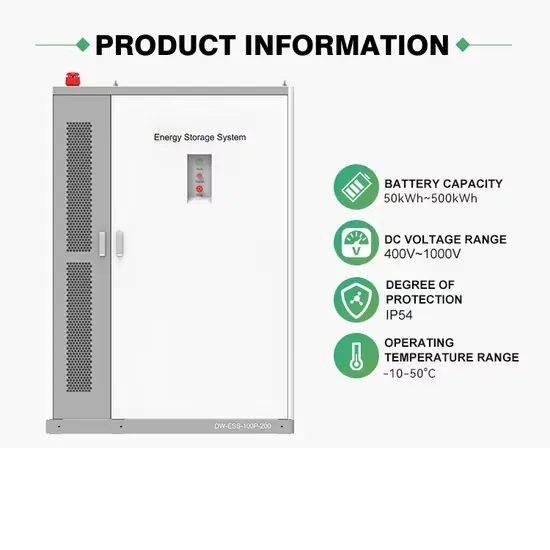

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.