How Morocco could benefit from the Honeywell-Tinci lithium-ion battery

Since 2023, Tinci has committed to investing $280 million in the construction of a lithium-ion battery material production plant in Morocco. This initiative reinforces the country''s

Get a quote

Morocco Emerges as a LFP Battery Hub for Chinese Companies

In addition to abundant phosphate reserves, Morocco also possesses metal resources like cobalt and lithium needed for battery production and has cost advantages.

Get a quote

"From Mine to Car": Morocco Aims to Lead the Battery

Costing 14 billion dirhams, this plant will manufacture lithium-iron-phosphate (LFP) batteries and is projected to generate 17,000 direct and

Get a quote

Africa''s Competitiveness in Global Battery Supply Chains

Demand Global battery demand is projected to reach 7.8 TWh by 2035, with China, the US, and Europe representing 80%; Lithium-ion is ~80% of the demand. In Africa, majority of demand

Get a quote

Thanks to phosphates, Morocco poised to become an

The evolution of technology indicates a significant development of LFP based batteries towards longer life and efficiency. This puts Morocco at

Get a quote

Morocco becomes a hotspot for China''s new energy

In recent years, Morocco has gradually become a hotspot for China''s new energy battery industry, thanks to its unique geographical location, abundant resource

Get a quote

COBCO starts EV battery material production in Morocco

Sino-Moroccan joint venture COBCO has commenced production of nickel-manganese-cobalt (NMC) and precursor cathode (pCAM) materials for lithium-ion batteries at

Get a quote

Morocco''s green mobility revolution: The geo-economic factors

Rabat''s recent announcement that it would soon sign an agreement for the construction of a "gigafactory" to make electric vehicle (EV) batteries has placed Morocco in

Get a quote

Moroccan OCP Eyes LFP Battery Market as Global Demand to

This project aims to produce 1 GWh of fully Moroccan-made LFP batteries by 2026. In early 2025, Moroccan outlet Barlamane reported that OCP had entered discussions

Get a quote

CNGR to Build Battery Materials Factory in Morocco

CNGR Advanced Material, Chinese manufacturer of precursors for active cathode materials of lithium-ion batteries, collaborates with Moroccan

Get a quote

Morocco energy storage lithium battery factory

Could Morocco produce a lithium ion battery? If extracted in sufficient quantities, Morocco could locally source all of the major metals used in NMC Li-ion batteries. The

Get a quote

Unlocking Morocco''s Lithium Potential: Rachid Yazami''s Vision

With growing global demand for lithium-ion batteries in applications ranging from electric vehicles to renewable energy storage, the timing is ripe for Morocco to capitalize on

Get a quote

Morocco : the country aims to become a key hub in the global

Among the flagship initiatives is the electric battery gigafactory in Kénitra, supported by the Sino-European group Gotion High-Tech and the CNGR-Al Mada alliance.

Get a quote

"From Mine to Car": Morocco Aims to Lead the Battery Industry

Costing 14 billion dirhams, this plant will manufacture lithium-iron-phosphate (LFP) batteries and is projected to generate 17,000 direct and indirect jobs. This ambitious project

Get a quote

How Morocco could benefit from the Honeywell-Tinci

Since 2023, Tinci has committed to investing $280 million in the construction of a lithium-ion battery material production plant in Morocco. This

Get a quote

LG Energy Solution to Produce Lithium Hydroxide in Morocco

South Korean battery manufacturer, LG Energy Solution, has announced its plans to produce lithium hydroxide in Morocco in partnership with the Chinese Yahua Industrial Group.

Get a quote

China is building Europe battery supply in Morocco,

China is building a battery supply chain for Europe in Morocco, as the continent struggles to develop its own industry to feed electric-car

Get a quote

The New Lithium of the Sahara: How Morocco is Rewriting the EV Battery

Its 70 gigawatt-hour (GWh) annual capacity—enough to power over one million EVs—catapults Morocco into the upper ranks of battery-producing nations. But the real magic

Get a quote

Like New LiTime 16V 100Ah Fish Finder Lithium Battery for

Say goodbye to these frustrations with just one LiTime 16V 100Ah fish finder lithium battery! The separated 16V battery eliminates interference from trolling motors or other on-board electrical

Get a quote

Sino-Moroccan COBCO starts producing EV batteries

The Sino-Moroccan Company COBCO announced on Wednesday that it has begun production of lithium-ion batteries components at its plant in Jorf Lasfar. This is located

Get a quote

Morocco, the future regional hub for lithium and

Thanks to its natural resources, advantageous geographical position and strategic partnerships with global players, Morocco aims to

Get a quote

Thanks to phosphates, Morocco poised to become an EV battery

The evolution of technology indicates a significant development of LFP based batteries towards longer life and efficiency. This puts Morocco at the center of investments by

Get a quote

The New Lithium of the Sahara: How Morocco is Rewriting the

Its 70 gigawatt-hour (GWh) annual capacity—enough to power over one million EVs—catapults Morocco into the upper ranks of battery-producing nations. But the real magic

Get a quote

Morocco, the future regional hub for lithium and electric batteries

Thanks to its natural resources, advantageous geographical position and strategic partnerships with global players, Morocco aims to become a regional hub for sustainable

Get a quote

Outdoor Lithium Ion Battery Power Supply Market Research

The "Outdoor Lithium Ion Battery Power Supply Market" reached a valuation of USD xx.x Billion in 2023, with projections to achieve USD xx.

Get a quote

Scientist Rachid Yazami: Morocco Can Lead in Lithium Battery

Moroccan scientist and engineer Rachid Yazami has emphasized Morocco''s "significant" potential in the lithium battery industry, including the production and subsequent export of these...

Get a quote

Best Battery Supplier [Updated On: September 2025]

9 hours ago· A report from the National Renewable Energy Laboratory (NREL, 2020) highlights that lithium-ion batteries can supply bursts of power exceeding their standard output,

Get a quote

Unlocking Morocco''s Lithium Potential: Rachid

With growing global demand for lithium-ion batteries in applications ranging from electric vehicles to renewable energy storage, the

Get a quote

Lithium-Ion Battery Generators: Features, Benefits

A lithium-ion battery generator is a portable power station that uses lithium-ion batteries as its main energy storage component. Unlike

Get a quote

6 FAQs about [Morocco uses lithium batteries to produce outdoor power supplies]

Is Morocco a good country for battery production?

In addition to abundant phosphate reserves, Morocco also possesses metal resources like cobalt and lithium needed for battery production and has cost advantages. Industry estimates suggest that producing lithium batteries in Morocco offers a 36% cost advantage compared to other countries.

Does Morocco have a battery supply chain?

This initiative reinforces the country’s growing role in the renewable energy sector and its ambition to integrate itself into the global battery supply chain. Rather than merely exporting raw materials like cobalt and phosphates, Morocco aims to develop a full-fledged industrial ecosystem around battery technology.

Why is Morocco a key player in the lithium-ion battery industry?

The lithium-ion battery industry is experiencing rapid growth, driven by the global shift toward clean energy and the increasing demand for electric vehicles. In this evolving landscape, Morocco is emerging as a key player, attracting major industrial investments.

Which Chinese lithium battery companies are based in Morocco?

Since 2023, several Chinese lithium battery industry chain companies, including CATL, Gotion High-Tech, Sunwoda, BTR, Huayou Cobalt, CNGR Advanced Material and Tinci Materials, have collectively invested in Morocco and built factories. The battery industry chain centered around LFP is forming rapidly.

Why is Morocco a good place to invest in lithium-ion batteries?

Several factors position Morocco as an attractive hub for this burgeoning industry. Its geographical proximity to Europe, government-driven push for green industrialization, and rich reserves of strategic raw materials make it an appealing destination for lithium-ion battery investments.

Does CATL have a battery production base in Morocco?

CATL has already planned over 100 GWh of production capacity at its European factories. Additionally, Sunwoda is also setting up a battery production base in Morocco. The number of material manufacturers investing in Morocco is even larger.

Guess what you want to know

-

New uses for Huawei s outdoor power supplies

New uses for Huawei s outdoor power supplies

-

What Batteries Are Used in Outdoor Power Supplies

What Batteries Are Used in Outdoor Power Supplies

-

How much amperage is suitable for outdoor power supply when using lithium batteries

How much amperage is suitable for outdoor power supply when using lithium batteries

-

Companies that produce outdoor power supplies in Belize

Companies that produce outdoor power supplies in Belize

-

Companies that produce outdoor power supplies

Companies that produce outdoor power supplies

-

Botswana lithium battery outdoor power supply

Botswana lithium battery outdoor power supply

-

Outdoor power supply uses company electricity

Outdoor power supply uses company electricity

-

New energy batteries for outdoor power supply

New energy batteries for outdoor power supply

-

Lithium batteries and power storage systems

Lithium batteries and power storage systems

-

Lithium iron phosphate battery connected to outdoor power supply

Lithium iron phosphate battery connected to outdoor power supply

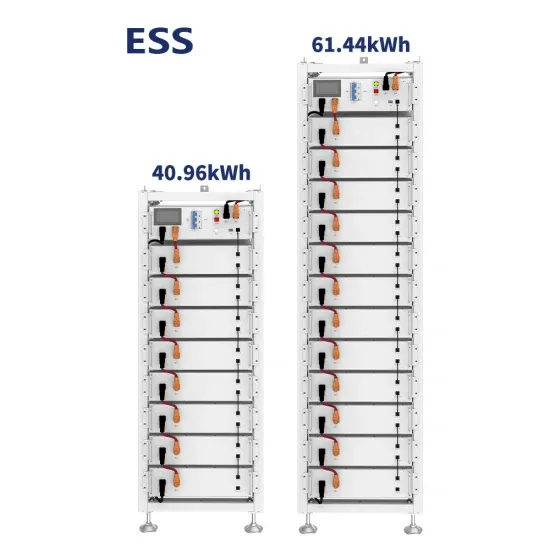

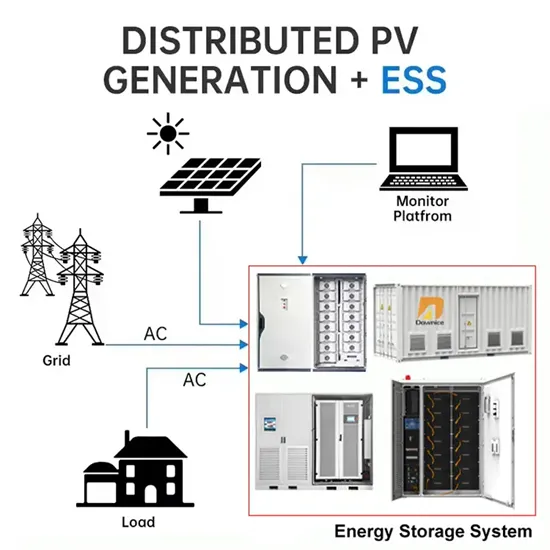

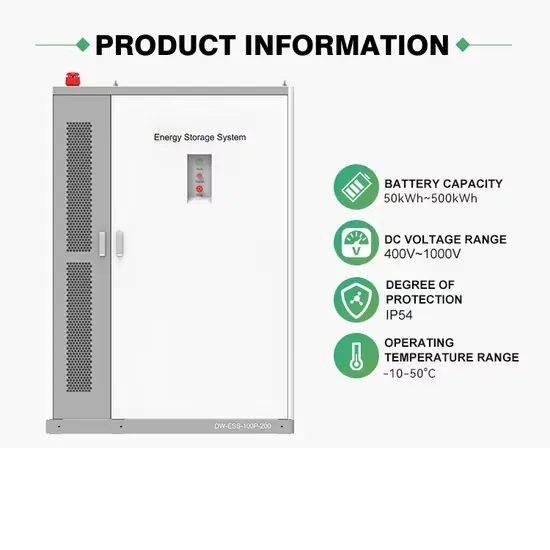

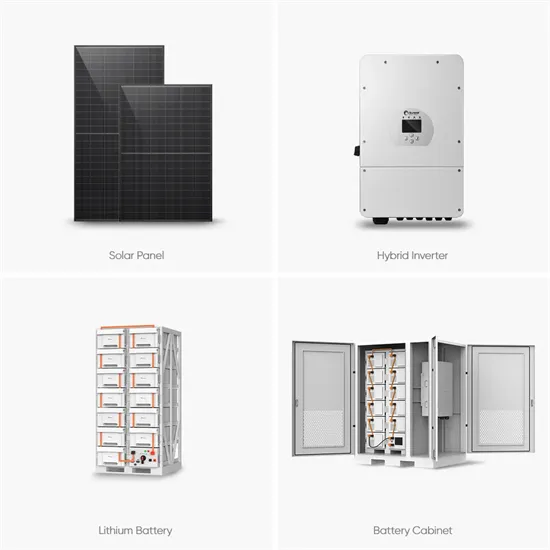

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.