Overview of vanadium redox flow battery (VRFB) and supply

Establishment of Flow Batteries Europe, an industry association representing the voice of flow battery stakeholders in Europe While the majority of large VRFB sites and supply chain

Get a quote

Impact of cell design and maintenance strategy on life cycle costs

Stationary battery systems are gaining importance with the increasing use of renewable and fluctuating energy sources. Among available technologies, the all-vanadium

Get a quote

White Paper on Vanahium Redox Flow Batteries

Vanadium Redox flow battery is a part of flow battery family which offers a distinct advantage in the stationary energy storage application space. Flow battery becomes very competitive in

Get a quote

Why Vanadium? The Superior Choice for Large-Scale

April 3, 2025 Why Vanadium? The Superior Choice for Large-Scale Energy Storage As renewable energy adoption continues to grow, so does the

Get a quote

Comparing the Cost of Chemistries for Flow Batteries

Researchers from MIT have demonstrated a techno-economic framework to compare the levelized cost of storage in redox flow batteries with

Get a quote

Update on Vanadium Flow Battery market, supply chain and

The Vanadium Flow Battery ("VFB") is the simplest and most developed flow battery in mass commercial operation for long duration energy storage The flow battery was first developed by

Get a quote

Vanadium Redox Flow Batteries

The price of the vanadium for the electrolyte solution can make up a significant percentage of the required capital cost for the overall system (30-50% depending on the price of vanadium and

Get a quote

Principle, Advantages and Challenges of Vanadium Redox Flow Batteries

Reproduction of the 2019 General Commissioner for Schematic diagram of a vanadium flow-through batteries storing the energy produced by photovoltaic panels.

Get a quote

Electrolyte tank costs are an overlooked factor in flow battery

Based on electrolyte storage tank prices quoted by globally distributed manufacturers, it challenges the prevailing narrative and highlights that tank costs are severely

Get a quote

Vanadium batteries to ride price spike, fight lithium

Flow batteries based on vanadium will increasingly challenge lithium-ion technology as developers look for storage systems to back up wind and solar

Get a quote

Vanadium Flow Battery Cost per kWh: Breaking Down the

As renewable energy adoption accelerates globally, the vanadium flow battery cost per kWh has become a critical metric for utilities and project developers. While lithium-ion dominates short

Get a quote

The Increasing Market Potential of Vanadium and Vanadium Flow Batteries

Recent Vanadium price increases signal that large battery storage projects are having an impact on the market. We think investors should watch the success of projects in

Get a quote

(PDF) Prospective Life Cycle Assessment of Chemical Electrolyte

In particular, the vanadium flow battery (VFB) is mentioned as a promising day storage technology. Nevertheless, its high cost and environmental impacts are attributed to its

Get a quote

Life cycle assessment of an industrial‐scale vanadium

The vanadium flow battery (VFB) can make a significant contribution to energy system transformation, as this type of battery is very

Get a quote

Comparing the Cost of Chemistries for Flow Batteries

Researchers from MIT have demonstrated a techno-economic framework to compare the levelized cost of storage in redox flow batteries with chemistries cheaper and

Get a quote

Evaluating the profitability of vanadium flow batteries

Researchers in Italy have estimated the profitability of future vanadium redox flow batteries based on real device and market parameters and found that market evolutions are

Get a quote

The Increasing Market Potential of Vanadium and Vanadium

Ever wondered why utilities and renewable energy developers are suddenly obsessed with vanadium redox flow batteries (VRFBs)? a battery that can outlive your

Get a quote

Elucidating Effects of Faradaic Imbalance on Vanadium Redox Flow

Abstract Long-term performance and lifetime of vanadium redox flow batteries (VRFBs) are critical metrics in widespread implementation of this technology. One challenging

Get a quote

Vanadium flow battery sector gets boost with trio of

The vanadium flow battery sector received a boost this week with news of a rental partnership between Invinity and Dawsongroup plc, a new

Get a quote

New Redox Flow Battery Design Will Cost $25 Per

Researchers modified redox flow battery electrodes with nanomaterials, achieving efficient grid-scale electricity storage at 1/5th the cost.

Get a quote

Vanadium batteries to ride price spike, fight lithium

Flow batteries based on vanadium will increasingly challenge lithium-ion technology as developers look for storage systems to back up wind and solar projects and support the grid –-

Get a quote

Techno-economic assessment of future vanadium flow batteries

Capital cost and profitability of different battery sizes are assessed. The results of prudential and perspective analyses are presented.

Get a quote

VANADIUM FLOW BATTERIES

These long-duration, utility-scale Vanadium Flow Bateries reliably store energy from wind and solar to overcome renewable energy intermitency challenges. This helps to unlock the full

Get a quote

The Cost of Large-Scale Vanadium Energy Storage: Trends,

Ever wondered why utilities and renewable energy developers are suddenly obsessed with vanadium redox flow batteries (VRFBs)? a battery that can outlive your

Get a quote

Evaluating the profitability of vanadium flow batteries

Researchers in Italy have estimated the profitability of future vanadium redox flow batteries based on real device and market parameters

Get a quote

Market impact of Vanadium Redox Flow Batteries

Over the next 5 years, the vast majority of that is forecast to be in China, with faster growth in other regions in the second half of this decade. The annual growth rate of over 40% has

Get a quote

6 FAQs about [The impact of vanadium prices on flow batteries]

What is a vanadium flow battery?

Image: University of Padua, Applied Energy, Creative Commons License CC BY 4.0 Vanadium flow batteries are one of the most promising large-scale energy storage technologies due to their long cycle life, high recyclability, and safety credentials.

What is the economic model for vanadium redox flow battery?

A techno-economic model for vanadium redox flow battery is presented. The method uses experimental data from a kW-kWh-class pilot plant. A market analysis is developed to determine economic parameters. Capital cost and profitability of different battery sizes are assessed. The results of prudential and perspective analyses are presented.

Why are vanadium batteries so expensive?

Vanadium makes up a significantly higher percentage of the overall system cost compared with any single metal in other battery technologies and in addition to large fluctuations in price historically, its supply chain is less developed and can be more constrained than that of materials used in other battery technologies.

Are there any vanadium flow batteries in the United States?

The United States has some vanadium flow battery installations, albeit at a smaller scale. One is a microgrid pilot project in California that was completed in January 2022.

Will flow battery suppliers compete with metal alloy production to secure vanadium supply?

Traditionally, much of the global vanadium supply has been used to strengthen metal alloys such as steel. Because this vanadium application is still the leading driver for its production, it’s possible that flow battery suppliers will also have to compete with metal alloy production to secure vanadium supply.

How can flow battery research reduce costs?

Standardization of flow battery components and the development of high-voltage chemistries are highlighted as paths towards decreasing costs and achieving greater market penetration. Electrolyte tank costs are often assumed insignificant in flow battery research.

Guess what you want to know

-

Sodium batteries and vanadium flow batteries

Sodium batteries and vanadium flow batteries

-

Wholesale prices of flow batteries in Iraq

Wholesale prices of flow batteries in Iraq

-

The necessity of building vanadium flow batteries

The necessity of building vanadium flow batteries

-

Zinc-based flow batteries and vanadium batteries

Zinc-based flow batteries and vanadium batteries

-

Zinc and vanadium flow batteries

Zinc and vanadium flow batteries

-

Will the capacity of flow batteries fade

Will the capacity of flow batteries fade

-

Flow batteries need to flow

Flow batteries need to flow

-

Estonian flow battery prices

Estonian flow battery prices

-

Vanadium batteries will become the first choice for energy storage

Vanadium batteries will become the first choice for energy storage

-

Vanadium flow battery configuration

Vanadium flow battery configuration

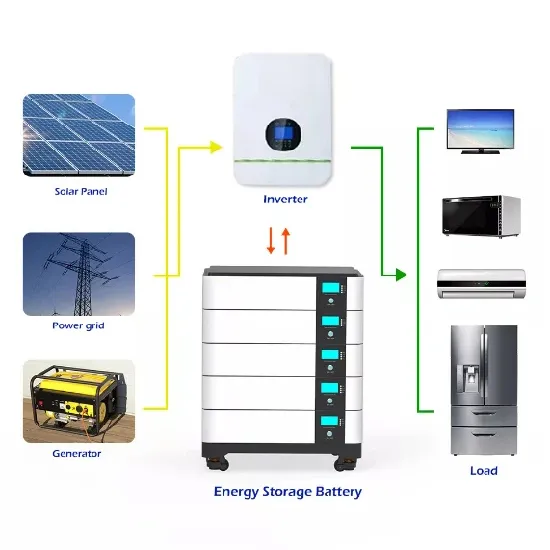

Industrial & Commercial Energy Storage Market Growth

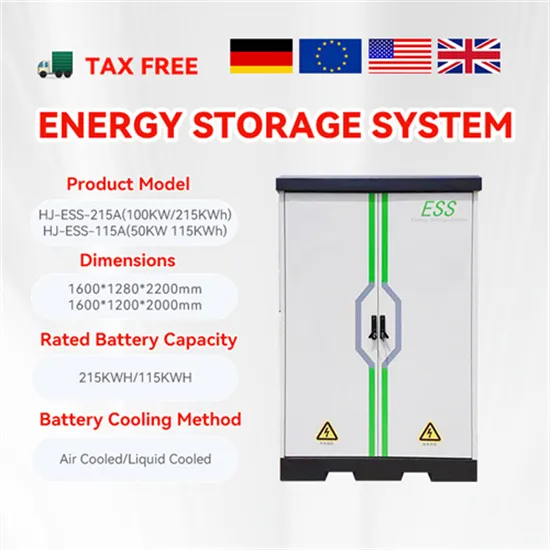

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

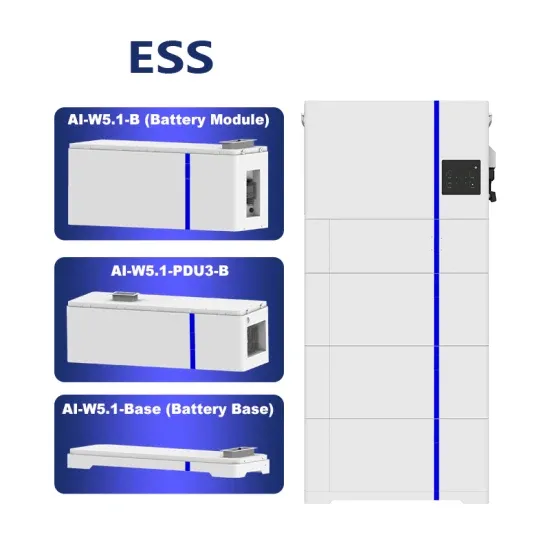

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.