Solar Panels Trade in the UAE from A to Z

Last year Solar panel export shipments from India to the United Arab Emirates amounted to 407 shipments. While the UAE makes solar panels at home, the country imports

Get a quote

Solar Pv Module Imports into UNITED ARAB EMIRATES

Find verified buyers and sellers of Solar Pv Module in 180+ countries along with their valid phone numbers and email ids. Home Global trade data solar pv module HSN Code 854149 import

Get a quote

United Arab Emirates Solar Energy Market Analysis

The United Arab Emirates (UAE) solar energy market has witnessed significant growth in recent years. As a country with abundant sunshine, the UAE has recognized the potential of solar

Get a quote

Photovoltaic module Exports from United Arab Emirates From United Arab

Create profitable strategy to export Photovoltaic module from United Arab Emirates From United Arab Emirates From United Arab Emirates From United Arab Emirates with Top

Get a quote

United Arab Emirates (UAE) Photovoltaic Market (2025-2031)

The UAE PV market is expected to continue expanding as the government promotes renewable energy adoption and as businesses and individuals recognize the economic and

Get a quote

United Arab Emirates Solar Photovoltaic (PV) Market

The United Arab Emirates Solar Photovoltaic (PV) Market is growing at a CAGR of greater than 12% over the next 5 years. Masdar (Abu

Get a quote

Solar module Exports from United Arab Emirates

Create profitable strategy to export Solar module from United Arab Emirates with Top Solar module exporting importing countries, Top Solar module importers & exporters

Get a quote

UAE Photovoltaics Market Share, Growth & Industry Analysis 2030

The United Arab Emirates (UAE) has been making remarkable strides in the photovoltaic (PV) solar energy market, with projections indicating that it will reach a value of USD 5.02 billion by

Get a quote

UAE Free Zones: Launch Your Solar Module Production Business

Discover how UAE free zones offer 100% foreign ownership, tax breaks & prime logistics for your solar module production. Your essential guide to success.

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

e UAE are also at the forefront of localising solar manufacturing in the region. In July, Saudi A. abia inked two major deals for a total of 30 GW of domestic production capacity. The

Get a quote

United Arab Emirates Solar Energy Market Analysis

The United Arab Emirates (UAE) solar energy market has witnessed significant growth in recent years. As a country with abundant sunshine, the UAE has

Get a quote

United Arab Emirates (UAE) Thin Film Solar PV Module Market

Historical Data and Forecast of United Arab Emirates (UAE) Thin Film Solar PV Module Market Revenues & Volume By Silicon crystal type module for the Period 2021- 2031

Get a quote

Solar Energy in the United Arab Emirates

While electricity has historically been generated from fossil fuels, the UAE is making rapid strides toward greening its electricity supply, primarily through the construction of large utility

Get a quote

United Arab Emirates | Imports and Exports | World | Diodes

Where does United Arab Emirates export Semiconductor devices (e.g. diodes, transistors, semiconductor based transducers); including photovoltaic cells assembled or not in modules

Get a quote

Solar Power Statistics in United Arab Emirates 2021

UAE Solar PV Segment Growth According to the Rystad Energy report, the total capacity of installed renewable resources in the United Arab

Get a quote

UAE Solar Energy Market

Photovoltaic (PV) is the most dominant form of solar energy technology in the United Arab Emirates (UAE), with many different projects being built and more currently under

Get a quote

The Meteoric Rise of Indian PV Module Exports

In fiscal 2023, an astounding 97% of Indian photovoltaic (PV) modules were exported to the US, with this figure increasing to 99% in fiscal 2024. Beyond the US, Indian PV

Get a quote

United Arab Emirates Solar photovoltaic module imports

Create profitable strategy to import Solar photovoltaic module in United Arab Emirates with Top Solar photovoltaic module exporting importing countries, Top Solar

Get a quote

Solar Module Exports Under Sub Chapter 8541 From United-arab-emirates

Information and reports on Solar Module Exports Under Sub Chapter 8541 From United-arab-emirates along with detailed shipment data, import price, export price, monthly trends, major

Get a quote

United Arab Emirates Solar Energy Market Analysis

The United Arab Emirates solar energy market has witnessed significant growth, driven by favorable government policies, declining costs of solar technologies,

Get a quote

Solar Energy in the United Arab Emirates

The United Arab Emirates has emerged rapidly as a hot spot for solar energy development and has invested heavily in solar projects as part of its broader economic program of diversification

Get a quote

SOLAR PANEL EXPORTS FROM UNITED ARAB EMIRATES

Around 135 MW of solar energy production capacity is expected to be operational by the end of 2013, and a similar capacity is either operational or under construction outside the UAE

Get a quote

United Arab Emirates (UAE) Solar PV Module Market (2025-2031

United Arab Emirates (UAE) Solar PV Module Competitive Benchmarking By Technical and Operational Parameters United Arab Emirates (UAE) Solar PV Module Company Profiles

Get a quote

United Arab Emirates'' solar market

Currently, the UAE is one of the fastest-growing utility-scale markets in the Middle East and North Africa region, with approximately 2,000 MW of renewable energy being

Get a quote

6 FAQs about [Does the United Arab Emirates export photovoltaic modules ]

Is solar energy a viable source of energy in the UAE?

The United Arab Emirates (UAE) solar energy market has witnessed significant growth in recent years. As a country with abundant sunshine, the UAE has recognized the potential of solar energy as a clean and renewable source of power. This has led to the implementation of various initiatives and investments in the solar energy sector. Meaning

What are the market opportunities for solar PV in the UAE?

Market Opportunities Distributed Generation: The UAE has a growing market for distributed generation, where solar PV systems installed on rooftops or small-scale installations can meet the energy needs of individual buildings or communities.

How much does a solar PV system cost in the UAE?

Solar PV system prices in the United Arab Emirates have dropped by more than 76% since 2018. Furthermore, the UAE has the world’s lowest tariffs and power purchase agreements (PPA) pricing at AED 4.97 fils (USD 1.35) /kWh. Nearly, every year, the UAE establishes a new record for the lowest solar purchase power agreements.

How does the UAE promote solar energy?

Government Support: The UAE government has implemented several initiatives and policies to promote solar energy, including feed-in tariffs, power purchase agreements, and renewable energy targets. Energy Security: Solar energy helps diversify the UAE’s energy mix, reducing its reliance on fossil fuel imports and enhancing energy security.

What is solar energy in the United Arab Emirates?

Solar energy is heat and radiant light from the Sun that can be harnessed with technologies such as solar power (used to generate electricity) and solar thermal energy (used for applications such as water heating). The United Arab Emirates solar energy market is segmented by technology and deployment.

How solar technology is affecting the UAE economy in 2020?

In 2020, solar technologies created around 7800 sustainable jobs in the UAE economy which contributes to lowering the prices of solar systems’ maintenance. With this overview of the solar industry supply and demand in the UAE, you can observe how this market is flourishing in the UAE.

Guess what you want to know

-

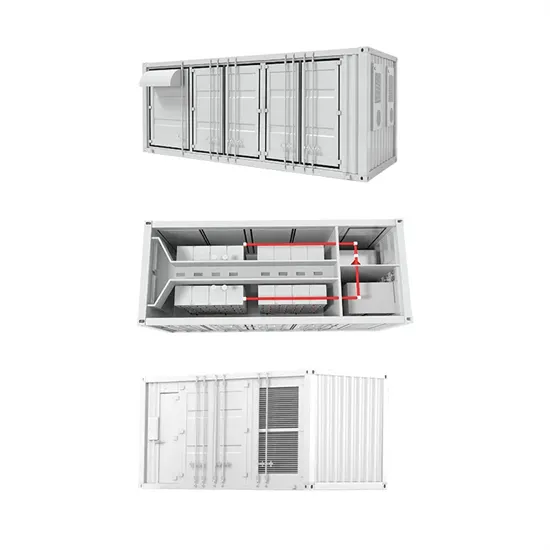

BESS photovoltaic folding container wholesale in the United Arab Emirates

BESS photovoltaic folding container wholesale in the United Arab Emirates

-

Photovoltaic power generation equipment inverter in the United Arab Emirates

Photovoltaic power generation equipment inverter in the United Arab Emirates

-

What are the containerized energy storage manufacturers in the United Arab Emirates

What are the containerized energy storage manufacturers in the United Arab Emirates

-

United Arab Emirates communication base station energy storage dual power

United Arab Emirates communication base station energy storage dual power

-

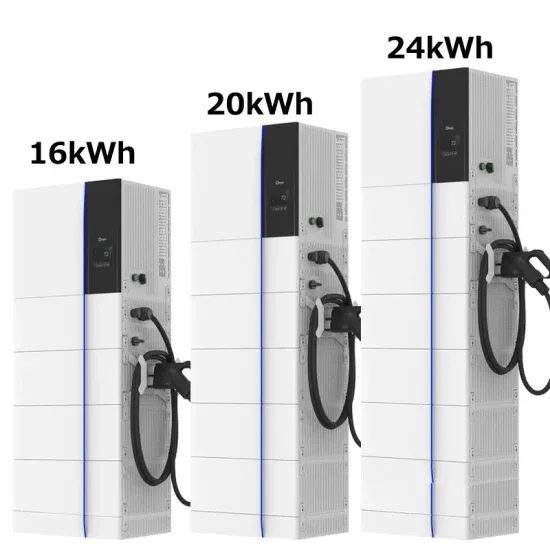

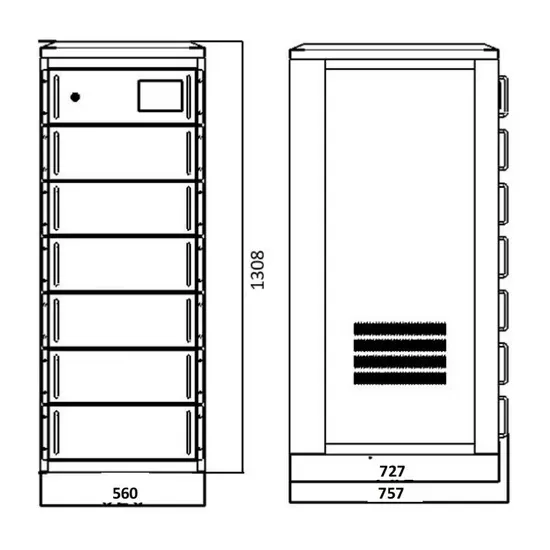

What is the price of a small energy storage cabinet factory in the United Arab Emirates

What is the price of a small energy storage cabinet factory in the United Arab Emirates

-

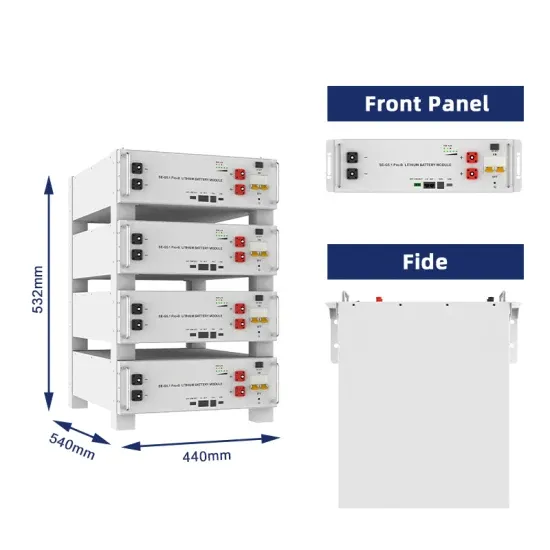

Price of large-capacity energy storage batteries in the United Arab Emirates

Price of large-capacity energy storage batteries in the United Arab Emirates

-

Customized solar water pump inverter price in the United Arab Emirates

Customized solar water pump inverter price in the United Arab Emirates

-

United Arab Emirates wind energy storage battery

United Arab Emirates wind energy storage battery

-

United Arab Emirates energy storage battery capacity share

United Arab Emirates energy storage battery capacity share

-

What battery cabinet integration systems are available in the United Arab Emirates

What battery cabinet integration systems are available in the United Arab Emirates

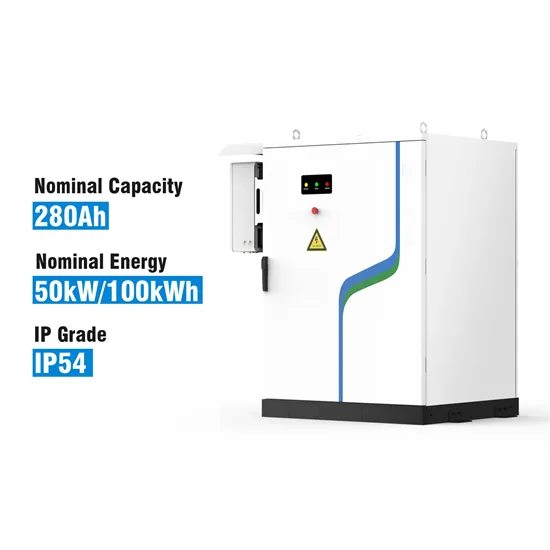

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.