Malaysia can be major energy storage supplier – ASEAN Energy

UAE-based energy company Masdar and PLN Nusantara Power (PLN NP) have reached an agreement to expand phase II of the Cirata floating photovoltaic (FPV) power plant

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth Outlook 2025

Nations within ASEAN, including Thailand, Indonesia, and the Philippines, are channeling investments into energy storage solutions to achieve their renewable energy

Get a quote

How is the outdoor energy storage power supply market?

The outdoor energy storage power supply market is witnessing significant growth and transformation, influenced by multiple factors and

Get a quote

ASEAN Energy Storage

The ASEAN energy storage market is moderately fragmented. Some of the key players in the market include (in no particular order) GS Yuasa Corporation, Wartsila Oyj Abp,

Get a quote

Outdoor Energy Storage Power Supply: How to Choose the Right

When it comes to harnessing energy from the great outdoors, many people are turning to outdoor energy storage power supplies. These systems allow us to capture and store energy from

Get a quote

ASEAN Energy Storage Market

Competitive Landscape The ASEAN energy storage market is moderately fragmented. Some of the key players in the market include GS Yuasa Corporation, Wartsila

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The ASEAN Energy Storage Market is expected to reach USD 3.55 billion in 2025 and grow at a CAGR of 6.78% to reach USD 4.92 billion by 2030. GS Yuasa Corporation,

Get a quote

Top 3 Energy Storage Suppliers in Southeast Asia

The energy storage companies leading change across Southeast Asia Luckily for us, most of the world''s best storage companies are in Southeast Asia. These companies store

Get a quote

ASEAN Energy Storage Market Size, Competitors

The ASEAN energy storage market is moderately fragmented. Some of the key players in the market include (in no particular order) GS Yuasa Corporation,

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth

Nations within ASEAN, including Thailand, Indonesia, and the Philippines, are channeling investments into energy storage solutions to

Get a quote

Grid-Scale Battery Storage: SynVista Backs ASEAN Solutions

SynVista Energy, a leading integrated energy storage system provider and the first Southeast Asian company on the BloombergNEF (BNEF) Tier 1 list, today reflected on its

Get a quote

How much does outdoor energy storage power supply cost

Outdoor energy storage power supply solutions are increasingly being explored as renewable energy gains traction. The costs associated with these systems can vary

Get a quote

What are the outdoor energy storage power supply companies?

1. The outdoor energy storage power supply market features numerous companies that focus on providing innovative solutions for energy storage systems designed for outdoor

Get a quote

8th ASEAN Energy Outlook

ASEAN''s power generation is expected to make a substantial shift towards renewable energy, particularly solar and wind, with the RAS and CNS leading this transition.

Get a quote

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

CATL Signs Southeast Asia''s Largest Solar + Storage Project,

Contemporary Amperex Technology Co., Ltd. (CATL), a global leader in innovative new energy technologies, has officially signed an agreement to supply a 2.2 GWh battery

Get a quote

Why exhibit_ASEE–ASEAN Smart Energy & Energy Storage

At the ASEAN Energy Storage & Smart Energy Expo (Solar PV & Battery & Power Supply, Wind Energy, Air Energy, Hydrogen Energy, Biomass Energy), you can: Obtain Entry Into New

Get a quote

ASEAN Energy Storage Market Size, Competitors & Forecast

The ASEAN energy storage market is moderately fragmented. Some of the key players in the market include (in no particular order) GS Yuasa Corporation, Wartsila Oyj Abp, BYD Co. Ltd.,

Get a quote

Enabling Policies for Promoting Battery Energy Storage in ASEAN

To reveal the enabling policies of battery energy storage (BES) application for higher renewable energy systems in ASEAN, this policy brief identifies the challenges and opportunities in each

Get a quote

ASEAN Energy Storage Market Analysis

The ASEAN energy storage market has been experiencing robust growth due to several factors, including the increasing deployment of renewable energy, growing energy demand, and

Get a quote

ASEAN Solar PV and Energy Storage Expo 2025: IMPACT Bangkok

ASEAN Solar PV and Energy Storage Expo 2025: Overview ASEAN Solar PV and Energy Storage Expo 2025 is a premier event dedicated to the advancement of solar

Get a quote

6 FAQs about [ASEAN outdoor energy storage power supplier]

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

What will ASEAN's Energy Future look like?

ASEAN’s power generation is expected to make a substantial shift towards renewable energy, particularly solar and wind, with the RAS and CNS leading this transition. Energy storage technologies, including Battery Energy Storage Systems, will play a critical role in stabilising the grid and supporting the ASEAN Power Grid.

How can ASEAN improve energy security?

Energy security remains a concern due to geopolitical tensions, market volatility, and the low-carbon transition. To strengthen energy resilience, ASEAN must prioritise optimising and decarbonising its energy sector, ensuring access, affordability, efficiency, and security, while contributing to economic growth and global climate goals.

How is ASEAN transforming its energy landscape?

The ASEAN region is witnessing a significant transformation in its energy landscape, driven by ambitious renewable energy storage targets and the need for grid modernization.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Can ASEAN reshape its energy landscape?

The post-Covid-19 recovery presents a key opportunity to reshape ASEAN’s energy landscape. With nearly one-tenth of the world’s population and rapid urbanisation driving energy demand, the region saw a 15.2% annual rise in energy consumption in 2022, surpassing pre-pandemic levels.

Guess what you want to know

-

Djibouti outdoor energy storage power supplier

Djibouti outdoor energy storage power supplier

-

Slovenia Energy Storage Cabinet Outdoor Power Station Supplier Recommendation

Slovenia Energy Storage Cabinet Outdoor Power Station Supplier Recommendation

-

Austria Energy Storage Cabinet Outdoor Power Station Supplier Recommendation

Austria Energy Storage Cabinet Outdoor Power Station Supplier Recommendation

-

Panama Outdoor Energy Storage Power Supply

Panama Outdoor Energy Storage Power Supply

-

Uruguay Outdoor Energy Storage Power Supply

Uruguay Outdoor Energy Storage Power Supply

-

Portable outdoor mobile energy storage power supply

Portable outdoor mobile energy storage power supply

-

Kiribati outdoor energy storage power OEM

Kiribati outdoor energy storage power OEM

-

Outdoor energy storage mobile power supply for local Finnish warehouse

Outdoor energy storage mobile power supply for local Finnish warehouse

-

Large outdoor energy storage power station

Large outdoor energy storage power station

-

Outdoor Energy Storage Power Conversion

Outdoor Energy Storage Power Conversion

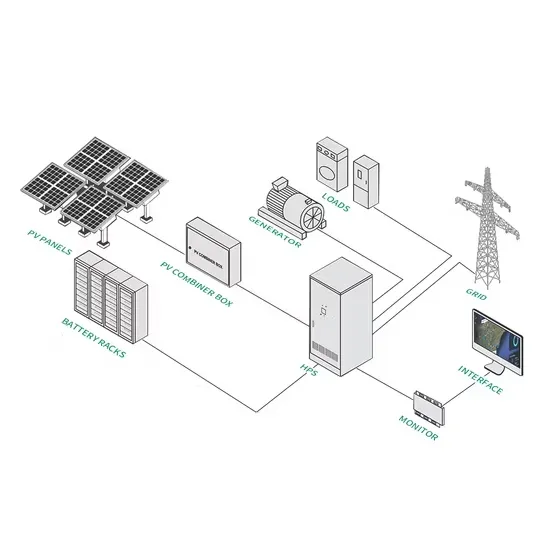

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.