United States and Brazil Expand Clean Energy

Secretary of Energy of the United States Jennifer Granholm and the Federative Republic of Brazil''s Minister of Mines and Energy, Alexandre

Get a quote

Battery energy storage systems in Brazil: current regulatory and

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Get a quote

brazil energy storage subsidies

The new policy can accommodate approximately 13,000 residential applications with an average storage of 8 kWh, offering subsidies of EUR 600-890/kWh for energy storage capacity and 90

Get a quote

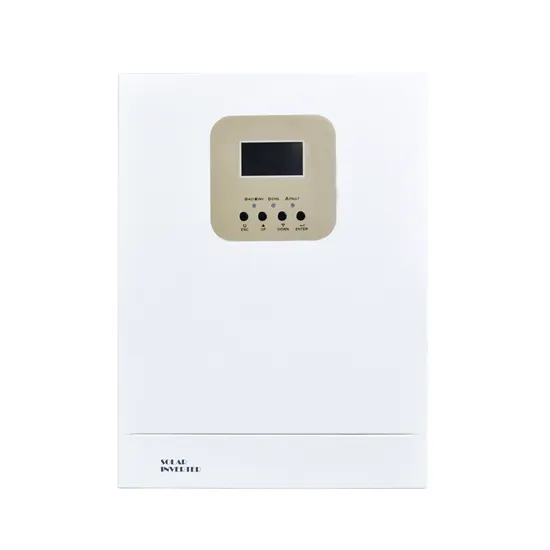

Sungrow equips one of Brazil''s largest solar projects

Global solar inverter and energy storage solutions provider, Sungrow, is expanding its presence in Brazil by supplying advanced equipment for one of the country''s largest photovoltaic (PV)

Get a quote

Brazil''s energy storage auction to attract $450m in investments

Interest in the auction has been expressed by power companies such as Portugal''s EDP and Brazil''s ISA Energia. The auction will enhance Brazil''s power grid reliability by

Get a quote

Brazil''s energy storage auction to attract $450m in investments

Brazil is set to conduct its first auction for adding batteries and storage systems to the national power grid, as reported by Reuters. The auction, to take place in June 2025, will

Get a quote

Brazil Energy Storage System (ESS) Containers Market Size

Brazil Energy Storage System (ESS) Containers Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of

Get a quote

Storage will be key to modernizing Brazil''s electricity

The absence of a specific regulatory framework for energy storage is one of the main barriers, generating uncertainties about tariffs, grant

Get a quote

How much government subsidies do energy storage projects

1. Government subsidies for energy storage projects can be substantial, varying by location and project scope, and are designed to enhance grid reliability, integrate renewable

Get a quote

Investing in the Energy Storage Revolution

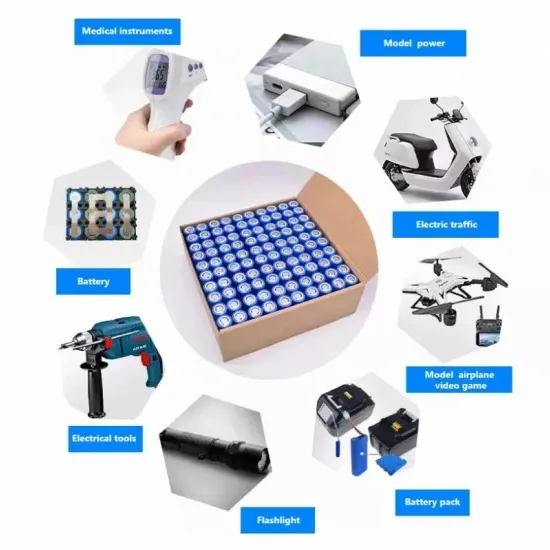

Their high energy density, longevity and efficiency underscores their significance as a transformative technology in a sustainable and interconnected energy future. This pivotal role

Get a quote

Brazil energy storage subsidy policy 2025

From this perspective,Brazil''s energy and electricity matrices are constantly gaining strength; as an example,in July 2023,Brazil has reached the goal of 23 GW of capacity only from

Get a quote

Brazil | Green Hydrogen Organisation

Green hydrogen will have a relevant role in achieving the Brazilian vision for energy transition and net zero economy. Focusing on low carbon hydrogen in Brazil will also allow the development

Get a quote

Storage will be key to modernizing Brazil''s electricity sector

The absence of a specific regulatory framework for energy storage is one of the main barriers, generating uncertainties about tariffs, grant schemes, and revenue sources.

Get a quote

Brazil''s Energy Storage Subsidy Landscape: Opportunities,

It''s 40°C in Rio de Janeiro, air conditioners are working overtime, and suddenly—blackout. Sound familiar? Brazil''s energy grid has more plot twists than a

Get a quote

Energy Storage Solutions Revolutionizing Brazil

Why Brazil''s Energy Grid Needs Storage Now Brazil''s renewable energy sector''s growing at 14% annually, but here''s the kicker – solar and wind projects now face grid instability during peak

Get a quote

EU approves €180m for 1.2GWh energy storage rollout in Lithuania

European Commission delegation visiting a Fluence battery storage project in Lithuania. Image: Energy Cells via LinkedIn. Lithuania can move ahead with a scheme to

Get a quote

Government incentive schemes in Brazil

In large-scale renewables projects, the most common funding sources are two government-controlled Brazilian development banks, BNDES (Banco Nacional de

Get a quote

Advancing Energy Storage Regulation in Brazil

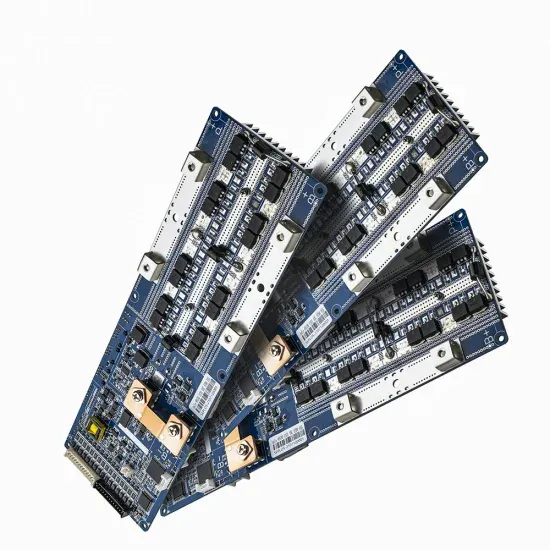

The Brazilian National Electric Energy Agency (ANEEL) is entering a new phase of dialogue on energy storage regulation. On December 10, 2024, ANEEL presented the results

Get a quote

2030 Brazil Roadmap

Project overview Focus: Scaling up clean energy investment through financial intermediaries in emerging markets Global energy transition investment and sustainable debt issuance reached

Get a quote

Brazil Energy Storage Regulatory Framework

The document highlights challenges such as the high upfront cost of storage technologies and prioritizes policies to integrate storage with renewables, aiming to reduce

Get a quote

Brazil Subsidies

Brazil—$59.3 billion per annum from subsidies to private companies. Infrastructure incentive grants and state-owned energy company investments Subsidies to fossil fuels

Get a quote

Brazil renewable energy to get bigger subsidy on 2024 electric

The subsidy for renewable energy sources in Brazil will surpass that of the fossil fuel bill for thermoelectric plants by 2024, potentially increasing taxpayers electricity bill,

Get a quote

How much subsidy is provided for new energy storage projects?

How much subsidy is provided for new energy storage projects? 1. New energy storage projects receive a range of subsidies based on regional and national policies, typically

Get a quote

Economic analysis of industrial energy storage systems in Brazil:

This paper proposes a methodology for stochastic economic analysis/optimization of industrial battery energy storage systems in Brazil or other regions with a similar tariff

Get a quote

Financing the Energy Transition in Brazil: instruments and

Until 2019 The Brazilian Development Bank (BNDES) was the main source of debt funding for energy infrastructure in the country and developed a range of financing lines for almost all

Get a quote

6 FAQs about [Brazil s energy storage project subsidies]

How will energy storage regulation shape Brazil's energy future?

By advancing energy storage regulation, the agency seeks to enhance system efficiency, accommodate renewable energy growth, and empower stakeholders across the energy sector. ANEEL opens the second phase of Public Consultation on energy storage regulation to shape Brazil’s energy future.

Should Brazil invest in energy storage?

Brazil’s energy storage sector must attract R47 billion ($7 billion) in investments by 2030, according to the Brazilian Energy Storage Solutions Association (Absae). Stakeholders are in the process of creating a regulatory framework for energy storage.

How can infrastructure projects be funded in Brazil?

en emerged as an instrument for funding infrastructure projects in Brazil. As energy infrastructure is a strategic priority, these projects enjoy tax benefits and constitute a long-term funding mechanism via the capital market, as an alternative to traditional sources of financing. The number of infrastructure bonds emit ed

Will Brazil's energy auction improve power grid reliability?

Interest in the auction has been expressed by power companies such as Portugal’s EDP and Brazil’s ISA Energia. The auction will enhance Brazil’s power grid reliability by integrating energy storage solutions for electricity generated from renewable sources such as wind and solar. US Tariffs are shifting - will you react or anticipate?

Will Brazil conduct the first energy storage auction?

Brazil is set to conduct the country's first-ever energy storage auction for adding batteries and storage systems to the national power grid.

What new business models are emerging in the Brazilian energy sector?

and the emerging of new business models in the Brazilian energy sector. According to the international Energy Agency, among 26 identified innovation areas, only solar PV and onshore wind, energy storage and electric vehicles are mature enough and commercially competitive to conventional energy sou ces and are on track to deliver their contribu

Guess what you want to know

-

Belgian energy storage project subsidies

Belgian energy storage project subsidies

-

Brazil Industrial Energy Storage Project

Brazil Industrial Energy Storage Project

-

Vanuatu energy storage project 2 billion subsidies

Vanuatu energy storage project 2 billion subsidies

-

Tonga Energy Storage Container Project Construction

Tonga Energy Storage Container Project Construction

-

Chad Energy Storage Battery Project

Chad Energy Storage Battery Project

-

Algeria Oran Steel Structure Energy Storage Project

Algeria Oran Steel Structure Energy Storage Project

-

Qatar Energy Storage Power Station Construction Project

Qatar Energy Storage Power Station Construction Project

-

Beiya Huijue Lithium Battery Energy Storage Project

Beiya Huijue Lithium Battery Energy Storage Project

-

Panama Industrial Energy Storage Project

Panama Industrial Energy Storage Project

-

Energy Storage System Special Project

Energy Storage System Special Project

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.