EnerSys Bonsucesso, Brazil | Industrial Battery Manufacturing

We are proudly making batteries in Brazil since 2002 and expanded our operations to a larger site in 2018 in Bonsucesso – Guarulhos. The plant produces heavy-duty and reliable tubular plates

Get a quote

About us

UCB is the first manufacturer of lithium batteries in Brazil. It is a leader in the production of stationary batteries, portable batteries for cell phones and laptops, and batteries for electric

Get a quote

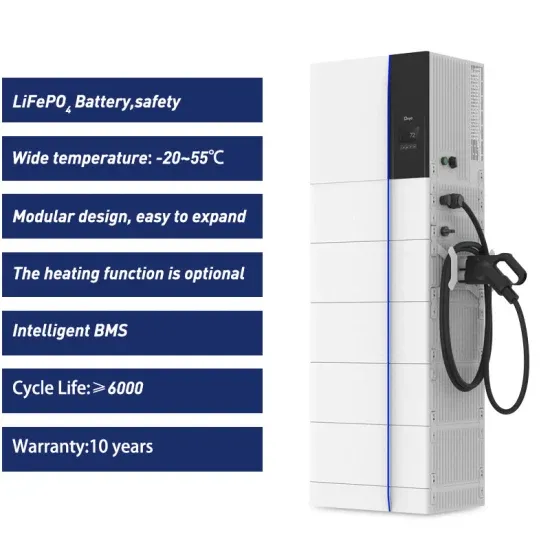

Power Up Your Investment: Essential LiFePO4 Battery

LiFePO4 batteries power Brazil''s solar farms, fishing fleets, and telecom towers with 5,000+ cycles and zero maintenance —but tropical conditions demand vigilance.

Get a quote

48V LiFePO4 Server Rack Battery Lifespan: 10-15 Years for Brazil

Brazil data centers extend LiFePO4 battery life to 15 years with DLCPO''s INMETRO-certified 48V 100Ah racks. 10-year warranty. Get tropical climate maintenance guide.

Get a quote

Guide to compliance solutions for lithium battery imports into Brazil

As a manufacturer deeply involved in the lithium battery industry for 16 years, we have seen too many Brazilian importers unable to clear customs and collect their goods due to

Get a quote

Lithium batteries made in Brazil : Revista Pesquisa Fapesp

Among the OEMS that have expressed interest in sourcing batteries from the new plant are Brazilian aircraft manufacturer Embraer, Boeing, Lockheed Martin, Airbus, Mercedes-Benz,

Get a quote

Top 10 energy storage companies in Brazil

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its global headquarters, and its primary

Get a quote

Brazil: FNM To Produce 1,000 Electric Trucks For

Brazil: FNM To Produce 1,000 Electric Trucks For Anheuser-Busch''s Ambev The vehicles will be equipped with Octillion Power Systems''s lithium-ion battery

Get a quote

Battery Packs Suppliers In Brazil

Find the top Battery Packs suppliers & manufacturers in Brazil from a list including Hangzhou Livoltek Power Co.,ltd, Dürr Systems, Inc. & Lighthouse Worldwide Solutions (LWS)

Get a quote

Brazilian lithium iron phosphate battery custom manufacturer

Experience the best energy solutions with lithium battery suppliers in the USA, trusted battery pack manufacturers, and high-performance electric battery packs.

Get a quote

List of electric vehicle battery manufacturers

List of electric vehicle battery manufacturers List of world''s largest EV cell manufacturers in 2023 List of other large EV battery manufacturers List of smaller (<1GWh) EV battery and

Get a quote

Tudor Baterias

Tudor Industries Ltd. was founded in Brazil in 1993 by a group of highly experienced Brazilian entrepreneurs with expertise of more than 40 years in the battery business. Production

Get a quote

The Rise of Sodium-Ion Batteries: Powering Brazil''s Energy

Explore sodium-ion batteries—Brazil''s key to affordable, safe energy storage. Ideal for solar farms, agro-industry & backup power. Partner with DLCPO for tailored solutions.

Get a quote

WEG invests to increase battery pack production capacity in Brazil

WEG announces investments to expand the production capacity of lithium battery packs in Brazil. In addition to increasing the size of the current manufacturing building, the

Get a quote

BYD Starts Operations at its Lithium Iron Phosphate Battery

Manaus, Brazil – Global clean energy giant BYD recently began operations at its third plant in Brazil, which is also the South American country''s very first factory for lithium iron

Get a quote

Powering Brazilian Homes Without Solar: DLCPO''s Battery

DLCPO supplies solar-free home battery backup for Brazil – INMETRO-certified NMC/LFP/LTO systems for distributors. Explore residential solutions.

Get a quote

Top 10 energy storage companies in Brazil

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its

Get a quote

Lithium batteries made in Brazil : Revista Pesquisa

Among the OEMS that have expressed interest in sourcing batteries from the new plant are Brazilian aircraft manufacturer Embraer, Boeing, Lockheed Martin,

Get a quote

BYD to manufacture EVs, chassis and battery

The plants in Bahia are not BYD''s first production facilities in Brazil. The company already manufactures electric bus chassis in Campinas in the

Get a quote

Top 49 Battery Suppliers in Brazil (2025) | ensun

Powersafe is one of the largest manufacturers and distributors of batteries for special applications in South America, offering a wide range of high-quality solutions, including Ventilated

Get a quote

Top 10 Battery Manufacturers In Brazil

In this article, we will explain about top 10 battery manufacturers in Brazil, such as CBMM, Baterias Moura, Sunred Energy, Sigma Lithium, Electrocell, etc.

Get a quote

Top 7 Brazilian Solar Lithium Battery Suppliers | 2025 Guide

This article explores the current state of the industry, profiles seven top Brazilian suppliers, and provides essential insights for buyers looking to invest in solar lithium batteries.

Get a quote

6 FAQs about [Brazilian pack battery manufacturer]

Who are the top 10 battery manufacturers in Brazil?

In this article, we will explain about top 10 battery manufacturers in the Brazil, such as CBMM, Baterias Moura, Sunred Energy Brazil, Sigma Lithium, and Electrocell. Battery industry continues to experience growing demand.

Who makes Heliar batteries in Brazil?

Heliar is the first battery brand in Brazil, founded in 1931. In 2019, it became a subsidiary of Clarios, following Clarios’ separation from Johnson Controls. With over 90 years experience, Heliar maintains a prominent presence in Brazil until today, supported by an extensive distribution network.

Who is launching a battery company in Brazil?

Brazilian battery manufacturer Moura, fuel-cell producer Electrocell, and a consortium formed by Companhia Brasileira de Metalurgia e Mineração (CBMM) and Japanese Toshiba, also plan to establish a presence in the segment.

Where are Intelbras batteries made?

Intelbras has over 40 years of experience manufacturing batteries in Brazil. Founded in 1976, they focused on their main products such as photovoltaic modules, inverters, energy storage batteries, etc. Their products can be used for various customers, from household applications to industrial applications.

Is Brazil a good place to invest in batteries?

Environmental concerns are paramount, particularly regarding the ecological impact of mining and battery disposal. Furthermore, Brazil's strategic position in the global market for batteries, particularly as a supplier of raw materials, adds another layer of complexity and potential for growth.

Why is the battery industry booming in Brazil?

When exploring the battery industry in Brazil, several key considerations emerge. The country is witnessing a surge in demand for batteries, particularly in electric vehicles and renewable energy storage, driven by government incentives and a commitment to sustainability.

Guess what you want to know

-

Which lithium battery pack manufacturer in Peru is the best

Which lithium battery pack manufacturer in Peru is the best

-

Battery pack 12v 100ah manufacturer

Battery pack 12v 100ah manufacturer

-

Lithium battery pack source manufacturer

Lithium battery pack source manufacturer

-

Tajikistan lithium battery pack processing manufacturer

Tajikistan lithium battery pack processing manufacturer

-

Macedonia lithium battery pack source manufacturer

Macedonia lithium battery pack source manufacturer

-

Which lithium battery pack manufacturer is best in Uganda

Which lithium battery pack manufacturer is best in Uganda

-

Kyrgyzstan energy storage lithium battery manufacturer system battery pack

Kyrgyzstan energy storage lithium battery manufacturer system battery pack

-

Romania pack battery manufacturer

Romania pack battery manufacturer

-

German lithium battery pack custom manufacturer

German lithium battery pack custom manufacturer

-

Mongolia lithium battery pack source manufacturer

Mongolia lithium battery pack source manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.