Electricity prices

Taxes and surcharges: On top of the above, Estonian consumers pay two statutory charges per kWh: a renewable energy surcharge and an excise, plus VAT on those charges.

Get a quote

Estonia: first grid-scale BESS to be replicated in

This is a pilot project to make sure the solution is suitable both in Estonia and the company''s other retail markets. Estonia and the Baltics is

Get a quote

Tariffs spell harm to US energy storage industry

A report by consultant Wood Mackenzie examines two possible tariff scenarios and concludes costs will skyrocket for battery energy storage

Get a quote

Electricity Prices in Estonia and Beyond: What Affects Them and

We brought together experts from Estonia''s energy sector to discuss electricity prices in Estonia and nearby, what drives them, and how they can be reduced.

Get a quote

Estonia Energy Market Report | Energy Market

This analysis includes a comprehensive Estonia energy market report and updated datasets. It is derived from the most recent key economic indicators,

Get a quote

Estonia Just Fixed a Massive Roadblock for Batteries

Estonia has taken a major step toward fairer grid economics by removing double grid fees for batteries. Until now, battery owners paid grid fees twice: once when charging from the grid and

Get a quote

Donald Trump''s tariffs threaten US renewable energy

US President Donald Trump''s new tariffs, ranging from 10% to 49% on electrical components, battery storage and other equipment from China,

Get a quote

Electricity Prices in Estonia and Beyond: What Affects Them and

Andres Maasing, Member of the Management Board and Chief Development Officer at Enefit Green, highlighted the importance of local energy production to reduce dependence on

Get a quote

Tesla Energy Storage Business Powers On Amidst Tariff Challenges

While Tesla is widely recognized for its electric vehicles, its energy generation and storage business is rapidly emerging as a significant and increasingly vital component of its

Get a quote

Estonia: Electricity storage to be freed from double fees

Under the amendments, renewable energy and grid transmission fees for storage equipment would only be charged on net consumption for the calendar month. Owners of

Get a quote

Estonia moves forward with a groundbreaking energy

The €100M project, led by Baltic Storage Platform, will deliver some of Europe''s largest battery storage complexes with a combined capacity of 200 MW and a

Get a quote

ENERGY-HUB

We hear from utility Eesti Energia about its 25MW/50MWh BESS project in Estonia, including what it hopes to achieve with the project and why it needed a second procurement to launch

Get a quote

Estonia Trade | WITS | Text

The top five imported HS 6 digit level products from world by Estonia along with trade value are Estonia imported Petroleum oils, etc, (excl. crude); preparation, worth 2,162,060.98 (US$

Get a quote

How Trump''s Tariffs Could Hobble the Fastest-Growing Energy

Across the country, companies have been installing giant batteries that help them use more wind and solar power. That''s about to get much harder. By Brad Plumer The

Get a quote

Green light for construction of Estonia''s first pumped storage project

Construction work is set to start in summer 2024 on the first pumped storage project in Estonia, with developer Energiasalv announcing it has received an official permit to

Get a quote

Estonia grid-scale BESS to come online in 2025 with LG batteries

Eesti Energia is a state-owned utility operating in Estonia but also in abroad. Image: Eesti Energia. Eesti Energi has completed the procurement for its 26.5MW/51MWh

Get a quote

Electricity sector in Estonia

According to the International Energy Agency ''s (IEA) 2023 Energy Policy Review for Estonia, the country is assessing the potential adoption of nuclear power into its energy portfolio, with a

Get a quote

Estonia Energy Market Report | Energy Market Research in Estonia

This analysis includes a comprehensive Estonia energy market report and updated datasets. It is derived from the most recent key economic indicators, supply and demand factors, oil and gas

Get a quote

Ministry forecast: 10 years from now, electricity to cost 14.9

A Ministry of Climate forecast predicts the end price of electricity in Estonia in 2035 will be 14.9 cents per kilowatt-hour (KWh). The calculations involved, however, assume that

Get a quote

Estonia moves forward with a groundbreaking energy storage

The €100M project, led by Baltic Storage Platform, will deliver some of Europe''s largest battery storage complexes with a combined capacity of 200 MW and a total storage capacity of 400

Get a quote

How much is the tariff for energy storage power

Hence, ongoing research and development efforts are vital in driving competitive pricing strategies while ensuring that energy storage

Get a quote

Estonia: first grid-scale BESS to be replicated in Baltics/Poland

This is a pilot project to make sure the solution is suitable both in Estonia and the company''s other retail markets. Estonia and the Baltics is scheduled to be decoupled from the

Get a quote

6 FAQs about [What is the tariff for energy storage power in Estonia ]

How much energy does Estonia use?

Estonia's all-time peak consumption is 1591 MW (in 2021). In 2021 the electricity generated from renewable energy sources was 29.3 %, being 38% of the share of renewable energy in gross final energy consumption. Oil-based fuels, including oil shale and fuel oils, accounted for about 80% of domestic production in 2016.

Who regulates the energy sector in Estonia?

The Estonian Competition Authority regulates the energy sector and reports to the Ministry of Economic Affairs and Communications. Four main operators are involved in the supply, trading, and logistics of oil: Alexela, Vopak EOS, Scantrans (Ireland) and Eurodek (Denmark).

How much wind power does Estonia have?

Total installed wind power was 149 MW at end of 2010 and grew to 303 MW in 2014 and 329 MW in 2016. Record production of wind parks is 279 MW in 2014. Estonia has target of 14% (1.5 TWh) and total renewable electricity 1.9 TWh (17.6%). According to the national Energy Action Plan (2020) planned shares are onshore 9% and offshore 5%.

How can Estonia reduce its dependence on oil shale?

Estonia is increasingly focusing on renewable energy sources to reduce its dependence on oil shale. This shift is driven by environmental concerns and the global trend towards sustainable energy. Investments in wind, solar, and biomass technologies are part of Estonia's commitment to reducing greenhouse gas emissions.

Why is Eesti Energia building a large-scale storage system?

Eesti Energia will build the company’s first large-scale storage system at the Auvere industrial complex later this year to balance the fluctuations in electricity prices caused by the growth in renewable energy production and to support the stability of the electrical system.

What is the largest power plant in Estonia?

The largest power complex in the country, Narva Power Plants, consists of the world's two largest oil shale -fired thermal power plants. The complex used to generate about 95% of total power production in Estonia in 2007. Falling to 86% in 2016 and 73% in 2018.

Guess what you want to know

-

What are the high-power energy storage power stations

What are the high-power energy storage power stations

-

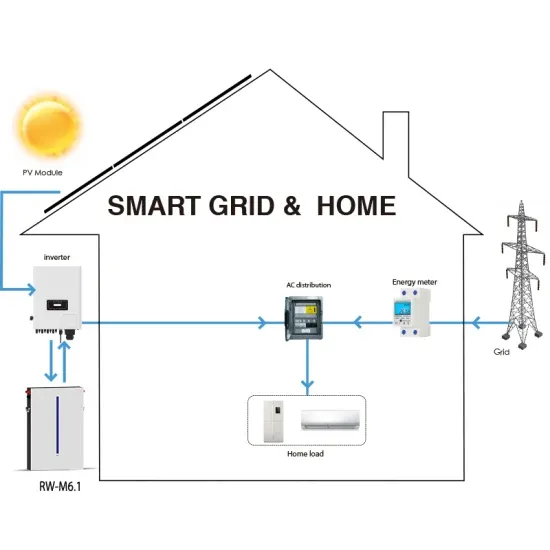

Estonia photovoltaic energy storage power direct sales

Estonia photovoltaic energy storage power direct sales

-

What is a large energy storage power station

What is a large energy storage power station

-

What are new energy storage power stations generally like

What are new energy storage power stations generally like

-

What does the power plant energy storage system include

What does the power plant energy storage system include

-

What are the manufacturers of Lebanese power energy storage cabinets

What are the manufacturers of Lebanese power energy storage cabinets

-

What does 8MW energy storage power station refer to

What does 8MW energy storage power station refer to

-

What are the energy storage power sources in Colombia

What are the energy storage power sources in Colombia

-

What are the gravity energy storage power stations in Vietnam

What are the gravity energy storage power stations in Vietnam

-

What are the energy storage power sources in Georgia

What are the energy storage power sources in Georgia

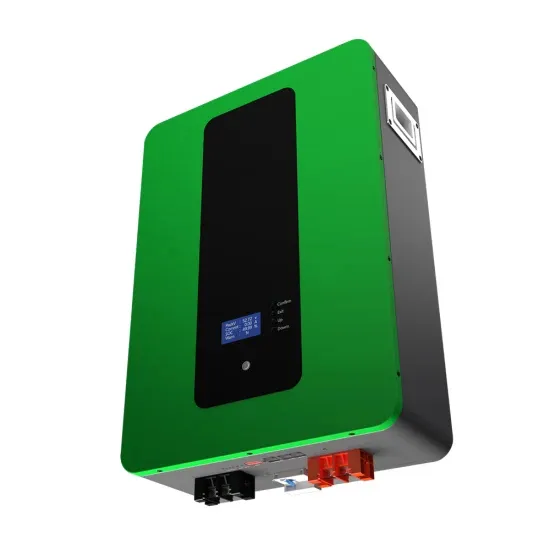

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

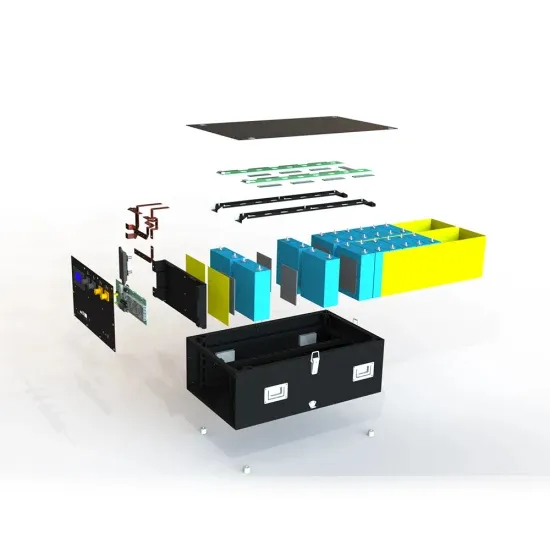

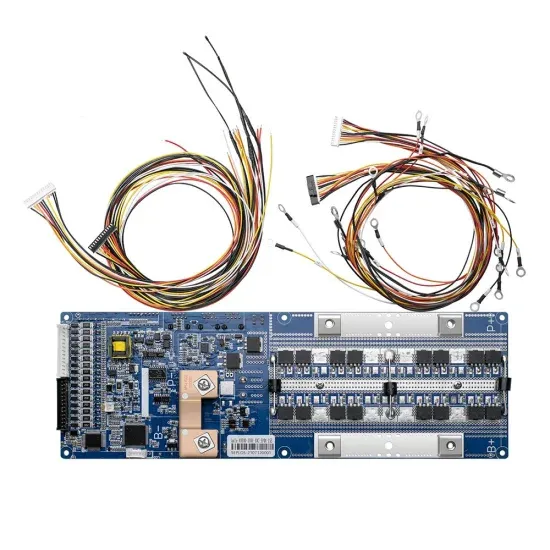

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.