Maximizing Your Photovoltaic Energy Storage Return: A Smart

Spoiler: The ROI is real, but only if you play your cards right. Calculating photovoltaic energy storage return isn''t rocket science, but it''s not exactly tic-tac-toe either. Let''s break it down:

Get a quote

How much profit does a photovoltaic energy storage project have?

The return on investment (ROI) for photovoltaic energy storage projects can vary extensively based on a multitude of factors. Typically, a well-structured project can expect an

Get a quote

Solar Integration: Solar Energy and Storage Basics

Short-term storage that lasts just a few minutes will ensure a solar plant operates smoothly during output fluctuations due to passing clouds, while longer-term

Get a quote

HiTHIUM Launches AI Data Center Energy Storage Solution at

1 day ago· HiTHIUM, a leading global provider of integrated energy storage products and solutions, today unveiled its AI data center ESS solution at RE+ 2025. The portfolio includes

Get a quote

Quantifying Returns: Does Energy Storage Coupled with PV Offer

However, a recently released National Renewable Energy Laboratory (NREL) report by Jeremy Neubauer and Mike Simpson investigates the economic returns of grid

Get a quote

Integrating distributed photovoltaic and energy storage in 5G

This paper explores the integration of distributed photovoltaic (PV) systems and energy storage solutions to optimize energy management in 5G base stations. By utilizing IoT

Get a quote

Energy Storage Sizing Optimization for Large-Scale PV Power Plant

The optimal configuration of energy storage capacity is an important issue for large scale solar systems. a strategy for optimal allocation of energy storage is proposed in this paper. First

Get a quote

Return, Benbros team on 500 MW of battery storage projects in

The two companies have entered into a joint venture with the initial aim to develop 10 standalone battery energy storage projects with a cumulative power output of 210 MW. The

Get a quote

Solar-Plus-Storage Analysis | Solar Market Research & Analysis | NREL

For solar-plus-storage—the pairing of solar photovoltaic (PV) and energy storage technologies—NREL researchers study and quantify the unique economic and grid benefits

Get a quote

How does energy storage work with photovoltaics? Advantages

Energy storage facilities are becoming an increasingly popular solution among owners of photovoltaic installations. They allow the storage of surplus electricity, which contributes to

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Integrated PV Energy Storage Systems | EB BLOG

Learn about integrated PV energy storage and charging systems, combining solar power generation with energy storage to enhance reliability

Get a quote

Solar Integration: Solar Energy and Storage Basics

Short-term storage that lasts just a few minutes will ensure a solar plant operates smoothly during output fluctuations due to passing clouds, while longer-term storage can help provide supply

Get a quote

Solar Market Insight Report Q3 2025 – SEIA

4 days ago· Photovoltaic (PV) solar accounted for 56% of all new electricity-generating capacity additions in the first half of 2025, remaining the dominant form of new electricity-generating

Get a quote

Solar-Plus-Storage Analysis | Solar Market Research

For solar-plus-storage—the pairing of solar photovoltaic (PV) and energy storage technologies—NREL researchers study and quantify the

Get a quote

Sungrow Unveils Breakthrough Solar and Energy Storage

2 days ago· Sungrow, the global leading PV inverter and energy storage system provider, is showcasing a suite of cutting-edge innovations at RE+ 2025. The lineup of new products

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

Journal of Energy Storage

To this extent, an explicit overview of Battery Energy Storage is provided, especially as a Distributed Energy Resource, while a detailed description of hybrid PV-BESS

Get a quote

Solar Energy Storage: Technologies, Costs & ROI Explained

1 day ago· Learn how energy storage in solar plants works, compare technologies, and discover key cost and ROI metrics to guide investment decisions.

Get a quote

Techno-economic feasibility analysis of a commercial grid

Grid connected Photovoltaic (PV) plants with battery energy storage system, are being increasingly utilised worldwide for grid stability and sustainable electricity supplies. In

Get a quote

MACSE auction: A game changer for Italy''s energy

With the first auctions for procuring new storage capacity in Italy expected in the second quarter of 2025, Aurora Energy Research has

Get a quote

PVWatts Calculator

NREL''s PVWatts ® Calculator Estimates the energy production of grid-connected photovoltaic (PV) energy systems throughout the world. It allows homeowners, small building owners,

Get a quote

6 FAQs about [PV Energy Storage Return]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is energy storage a viable option for utility-scale solar energy systems?

Energy storage has become an increasingly common component of utility-scale solar energy systems in the United States. Much of NREL's analysis for this market segment focuses on the grid impacts of solar-plus-storage systems, though costs and benefits are also frequently considered.

What is storage NPV in terms of kWh?

The storage NPV in terms of kWh has to factor in degradation, round-trip efficiency, lifetime, and all the non-ideal factors of the battery. The combination of these factors is simply the storage discount rate. The financial NPV in financial terms has to include the storage NPV, inflation, rising energy prices, and cost of debt.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Is energy storage a good investment?

The return of investment is an important metric about how attractive an investment may be. However this is an important note that energy storage usually does not generate electricity savings directly, but allows the transport or trading of electricity. This usually results in storage not having a high ROI like solar investments, for example.

Should energy storage be undervalued?

The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true estimate—improving profitability and supporting sustainability goals.

Guess what you want to know

-

Nicaragua PV Energy Storage 150kw Inverter

Nicaragua PV Energy Storage 150kw Inverter

-

Dominican PV Home Energy Storage

Dominican PV Home Energy Storage

-

Armenia PV Energy Storage 30kw Inverter

Armenia PV Energy Storage 30kw Inverter

-

Armenia Solar PV Energy Storage

Armenia Solar PV Energy Storage

-

Rooftop PV and Energy Storage

Rooftop PV and Energy Storage

-

PV energy storage system

PV energy storage system

-

Netherlands PV energy storage requirements

Netherlands PV energy storage requirements

-

Energy storage battery container price and return rate

Energy storage battery container price and return rate

-

Advantages of PV AC-side energy storage

Advantages of PV AC-side energy storage

-

Georgia PV Energy Storage Inverter Wholesale

Georgia PV Energy Storage Inverter Wholesale

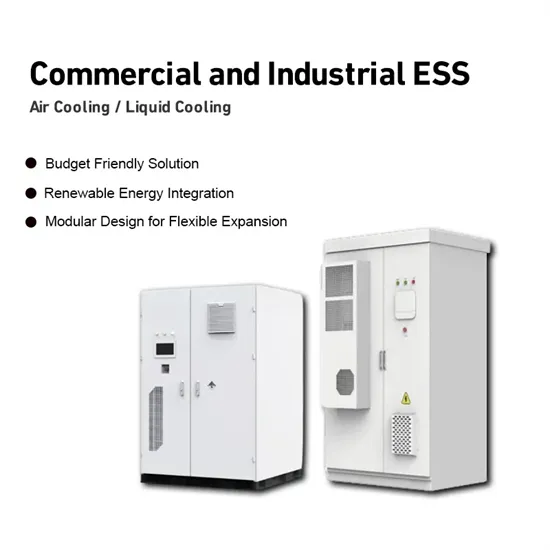

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.