Japan Battery Market Report | Industry Analysis, Size

Major Japanese manufacturers like Panasonic, GS Yuasa, and Toshiba have significantly invested in expanding their secondary battery

Get a quote

Global Lithium Battery Portable Power Stations Supply, Demand

The global Lithium Battery Portable Power Stations market size is expected to reach $ 5386 million by 2031, rising at a market growth of 16.7% CAGR during the forecast period (2025-2031).

Get a quote

Top 15 Lithium Companies in Japan (2025) | ensun

Understanding these factors provides valuable insights for anyone interested in the lithium sector in Japan, highlighting both the potential and the complexities of this evolving industry.

Get a quote

Outdoor Portable Lithium Power Stations Market

Supply chain disruptions in lithium-ion battery components are driving aggressive price adjustments and extended lead times across the outdoor portable power station industry.

Get a quote

Focus on outdoor industry power supply

Creative innovation of outdoor power supply, a machine with 10 years of portable outdoor power supply! With the advent of camping Tours, RV Tours and other

Get a quote

Japan Lithium-ion Battery Market Analysis

Major battery manufacturers are investing in scaling up production capacities to meet the growing demand for lithium-ion batteries. Government initiatives and subsidies aimed at promoting

Get a quote

Japanese offensive in battery production

Toyota, Nissan and other companies will invest one trillion yen (€6.3 billion) to increase Japanese battery production capacity by around 50

Get a quote

Toyota teams up with Japanese oil giant to build all

Japanese automaker Toyota has teamed up with the oil giant Idemitsu Kosan to construct a large-scale lithium sulfide plant to supply raw

Get a quote

Idemitsu to build lithium sulphide plant for solid-state

Idemitsu Kosan is set to build a large-scale lithium sulphide facility to accelerate solid-state battery production, aiming for commercialisation by

Get a quote

Top Japanese Lithium-Ion Battery Manufacturers in 2024

Osaka, known as Japan''s industrial powerhouse, is home to several lithium-ion battery production facilities, benefiting from the region''s skilled workforce and robust infrastructure.

Get a quote

Towards the lithium-ion battery production network: Thinking

To remedy this, we deploy a global production network (GPN) approach that highlights the increasing intersection of battery manufacturing with the automotive and power

Get a quote

Subaru and Panasonic Energy to Begin Preparation

Subaru Corporation Panasonic Energy Co., Ltd. Tokyo and Osaka, Japan, September 6, 2024 - Subaru Corporation ("Subaru") and Panasonic

Get a quote

Japan Battery Market Report | Industry Analysis, Size & Forecast

Major Japanese manufacturers like Panasonic, GS Yuasa, and Toshiba have significantly invested in expanding their secondary battery production capabilities to meet the

Get a quote

Toyota, Nissan, Other Automakers to Invest in

Toyota, Nissan, and Panasonic will be receiving $2.4 billion (350 billion yen) in subsidies by the Japanese government to boost the country''s

Get a quote

Pioneering Precision: How Japanese Manufacturing Fuels the

This article explores how Japanese manufacturing fuels the lithium-ion revolution, delving into the advantages and disadvantages of sourcing from Japanese suppliers,

Get a quote

TRENDS Research & Advisory

By reducing dependence on critical mineral imports, Japan is enhancing its energy security and diversifying its battery supply chain, which could reshape global energy storage

Get a quote

Japan Outdoor Lithium Battery Power Supplies Market by

In Japan, the Outdoor Lithium Battery Power Supplies market is growing at a rapid pace, driven by technological advancements and increasing consumer demand for sustainable

Get a quote

Japan Outdoor Lithium Ion Battery Power Supply Market By

The Japan Outdoor Lithium Ion Battery Power Supply Market size is reached a valuation of USD xx.x Billion in 2023, with projections to achieve USD xx.

Get a quote

Top Japanese Lithium-Ion Battery Manufacturers in 2024

Osaka, known as Japan''s industrial powerhouse, is home to several lithium-ion battery production facilities, benefiting from the region''s skilled workforce and

Get a quote

Pioneering Precision: How Japanese Manufacturing Fuels the Lithium

This article explores how Japanese manufacturing fuels the lithium-ion revolution, delving into the advantages and disadvantages of sourcing from Japanese suppliers,

Get a quote

Japan Lithium-ion Battery Market Analysis

Major battery manufacturers are investing in scaling up production capacities to meet the growing demand for lithium-ion batteries. Government initiatives and

Get a quote

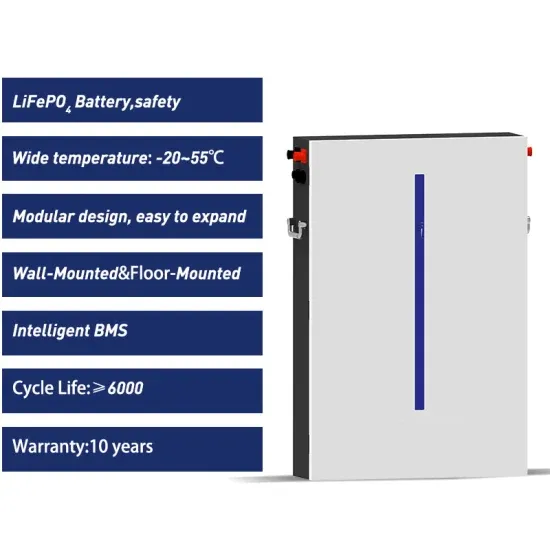

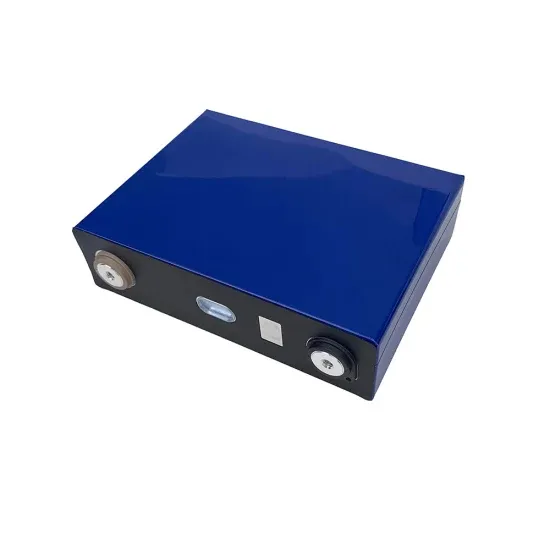

500-5000W American, Japanese, European standard lithium iron

500-5000W American, Japanese, European standard lithium iron phosphate outdoor energy storage power supply 220V high power

Get a quote

Battery Industry Strategy

Japan has developed a strategy of concentrated investment in the development of all-solid-state battery technology. However, there are still issues with all-solid-state batteries, and the market

Get a quote

AEPPL to invest Rs37.15 billion in second phase of lithium battery

Japanese joint venture Automotive Electronics Power Private Ltd (AEPPL) will invest Rs37.15 billion in the second phase of its lithium-ion battery production facility at Hansalpur, in Gujarat''s

Get a quote

Portable lithium electric outdoor power supply

Portable lithium electric outdoor power supply introduction In our daily lives, we rely heavily on electronic devices such as smartphones, PCs, and cameras.

Get a quote

Top 10 Battery Manufacturers in Japan

In this article, we will explore top 10 battery manufacturers in Japan such as GS Yuasa, Panasonic, Hitachi, Toshiba, NEC, Sanyo, Furukawa Battery, Shin-Kobe Electric

Get a quote

Japan Lithium Market Report

This summary highlights the critical market segments and trends shaping the lithium industry in Japan, focusing on the key drivers of lithium demand, supply chain

Get a quote

6 FAQs about [Japanese lithium battery production outdoor power supply]

How will Japan's lithium-ion battery market grow?

The Japan lithium-ion battery market is expected to witness significant growth in the coming years. The increasing adoption of electric vehicles, rising renewable energy projects, and technological advancements will be key drivers for market expansion.

Is Japan a leader in lithium-ion battery manufacturing?

Among the global leaders in battery technology, Japan stands out as a powerhouse in lithium-ion battery manufacturing, renowned for its innovation, reliability, and quality. As we step into 2024, let’s delve into the heart of Japan’s lithium-ion battery industry and explore the top manufacturers leading the charge.

Where are lithium-ion batteries made in Japan?

Osaka, known as Japan’s industrial powerhouse, is home to several lithium-ion battery production facilities, benefiting from the region’s skilled workforce and robust infrastructure. Nagoya, another industrial hub, plays a pivotal role in the battery supply chain, with a focus on advanced manufacturing processes and technology integration.

Can Japan develop a lithium industry?

When exploring the Lithium industry in Japan, several key considerations come into play. First, regulatory frameworks are crucial, as Japan's government actively promotes the development of a sustainable energy sector, which includes lithium for battery production.

What are the key players in the Japan lithium-ion battery market?

The Japan lithium-ion battery market is highly competitive, with the presence of both domestic and international players. Key market players include Panasonic Corporation, Sony Corporation, Toshiba Corporation, GS Yuasa Corporation, and Hitachi Chemical Co., Ltd.

Which Japanese manufacturers are focusing on secondary battery production?

Major Japanese manufacturers like Panasonic, GS Yuasa, and Toshiba have significantly invested in expanding their secondary battery production capabilities to meet the rising demand from automotive and energy storage sectors.

Guess what you want to know

-

Lithium battery outdoor power supply production

Lithium battery outdoor power supply production

-

New outdoor power supply solid-state lithium battery

New outdoor power supply solid-state lithium battery

-

Outdoor power supply with lithium battery

Outdoor power supply with lithium battery

-

Nanya lithium battery outdoor power supply wholesale

Nanya lithium battery outdoor power supply wholesale

-

How much does a custom-made lithium battery outdoor power supply cost in Portugal

How much does a custom-made lithium battery outdoor power supply cost in Portugal

-

Botswana lithium battery outdoor power supply

Botswana lithium battery outdoor power supply

-

Colloid battery production outdoor power supply

Colloid battery production outdoor power supply

-

Chad Huijue lithium battery outdoor power supply

Chad Huijue lithium battery outdoor power supply

-

Lithium battery outdoor power supply three degrees of electricity

Lithium battery outdoor power supply three degrees of electricity

-

Lithium battery life for outdoor power supply in Poland

Lithium battery life for outdoor power supply in Poland

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

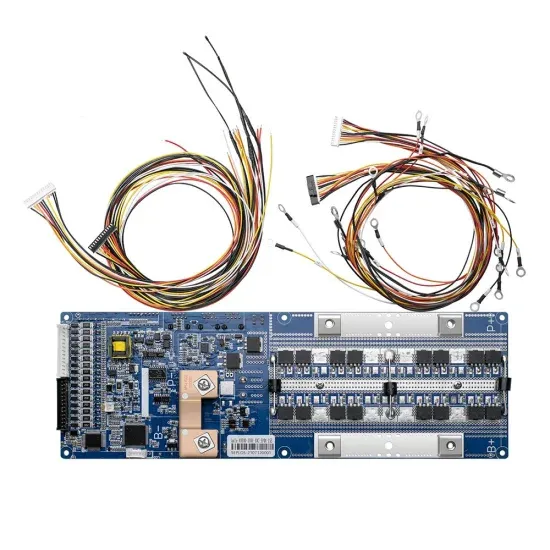

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.