Five Core Advantages of Lithium Batteries for Telecommunication Base

The Five Core Advantages of EverExceed Telecom Base Station Lithium Batteries Compared with traditional lead-acid batteries, EverExceed lithium batteries offer remarkable advantages,

Get a quote

Regional Analysis of Lithium Battery for 5G Base Stations Growth

The global market for lithium-ion batteries in 5G base stations is experiencing robust growth, driven by the rapid expansion of 5G networks worldwide and the increasing demand

Get a quote

How about base station energy storage batteries

One significant aspect of these batteries is their ability to improve grid resilience, which is crucial in areas prone to power interruptions. This

Get a quote

Can telecom lithium batteries be used in 5G telecom base stations?

It is easy to install and provides reliable backup power. Conclusion In conclusion, telecom lithium batteries can indeed be used in 5G telecom base stations. Their high energy

Get a quote

Powering the future: 3M''s role in direct lithium extraction

Since the introduction of the lithium-ion battery in 1991, its use has expanded exponentially, doubling every two to three years. However, the success of lithium-ion

Get a quote

Configuring the Perfect System for Lithium-ion Battery

Production systems and equipment for manufacturing Lithium-ion battery cells. Safe, efficient cathode and anode powder handling for the

Get a quote

Five Core Advantages of Lithium Batteries for Telecommunication

The Five Core Advantages of EverExceed Telecom Base Station Lithium Batteries Compared with traditional lead-acid batteries, EverExceed lithium batteries offer remarkable advantages,

Get a quote

5G Micro Base Station Lithium Battery Backup

Power your 5G micro base station with this 51.2V lithium battery. Ideal for telecom backup and remote tower use. Long life, compact, and BMS-equipped.

Get a quote

Advanced electrode processing for lithium-ion battery

This Review discusses the benefits and drawbacks of advanced electrode processing methods, including aqueous, dry, radiation curing and 3D-printing processing

Get a quote

Lithium battery is the magic weapon for communication base station

Intelligent energy storage lithium battery can effectively protect the base station battery in the event of the accidental short circuit, lightning shock, and other conditions, timely

Get a quote

Advanced lithium-ion battery process manufacturing equipment

Using space-saving machinery and cost-effective, scalable technologies that can adapt to new battery advancements is a practical solution.

Get a quote

How about base station energy storage batteries | NenPower

One significant aspect of these batteries is their ability to improve grid resilience, which is crucial in areas prone to power interruptions. This detailed analysis provides an

Get a quote

United States 5G Base Station Lithium-Iron Battery Market

United States 5G Base Station Lithium-Iron Battery Market size was valued at USD 0.6 Billion in 2024 and is projected to reach USD 1.

Get a quote

Lithium battery is the magic weapon for

Intelligent energy storage lithium battery can effectively protect the base station battery in the event of the accidental short circuit, lightning shock,

Get a quote

United States Lithium Battery for 5G Base Stations Market

1. How will evolving regulatory standards and environmental policies in the United States influence the adoption and innovation of lithium batteries for 5G base stations? The

Get a quote

Lithium Battery for 5G Base Stations 2025 Market Trends and

Lithium batteries are becoming increasingly important for 5G base stations due to their high power density, long lifespan, and low maintenance requirements. The global lithium

Get a quote

MACHINE LEARNING AND IOT-BASED LI-ION BATTERY

In this paper, we solve the problem of 5G base station power management by designing a 5G base station lithium battery cloud monitoring system. In this paper, first, the lithium battery

Get a quote

Singapore Lithium Battery for 5G Base Stations Market Trends

The Singapore Lithium Battery for 5G Base Stations market is driven by a mix of established multinational corporations and agile local firms. Leading players typically offer a

Get a quote

How about base station energy storage batteries

Base stations primarily utilize lithium-ion and lead-acid batteries. Lithium-ion batteries are favored for their higher energy density, longer

Get a quote

Configuring the Perfect System for Lithium-ion Battery Production

Production systems and equipment for manufacturing Lithium-ion battery cells. Safe, efficient cathode and anode powder handling for the battery industry.

Get a quote

Lithium Storage Base Station Manufacturing | HuiJue Group E-Site

As global renewable energy capacity surges past 3,372 GW, lithium storage base station manufacturing emerges as the critical bridge between intermittent solar/wind power and

Get a quote

Taking battery manufacturing to the next level

To meet this demand, battery manufacturing needs to be faster, cheaper, more dependable, less energy-intensive and less wasteful. A key part of lithium-ion battery

Get a quote

Overview of Telecom Base Station Batteries

Definition Telecom base station battery is a kind of energy storage equipment dedicatedly designed to provide backup power for telecom base stations,

Get a quote

5G Base Station Lithium-Iron Battery Market Size, Market

Evaluate comprehensive data on 5G Base Station Lithium-Iron Battery Market, projected to grow from USD 1.2 billion in 2024 to USD 4.5 billion by 2033, exhibiting a CAGR of 16.5%. This

Get a quote

Communication Base Station Li-ion Battery Market

The transition to lithium-ion (Li-ion) batteries in communication base stations is propelled by operational efficiency demands and environmental regulatory pressures.

Get a quote

6 FAQs about [Base station lithium battery processing]

How can lithium-ion batteries be manufactured?

Lithium-ion batteries (LIBs) need to be manufactured at speed and scale for their use in electric vehicles and devices. However, LIB electrode manufacturing via conventional wet slurry processing is energy-intensive and costly, challenging the goal to achieve sustainable, affordable and facile manufacturing of high-performance LIBs.

What is advanced lithium-ion battery electrode processing?

Conventional lithium-ion battery electrode processing heavily relies on wet processing, which is time-consuming and energy-consuming. Compared with conventional routes, advanced electrode processing strategies can be more affordable and less energy-intensive and generate less waste.

Where are lithium-ion batteries found?

According to the California Energy Commission, the Salton Sea region (pictured above) contains the fifth largest lithium deposit in the world. As the world pivots towards electrification, the demand for lithium-ion batteries is set to skyrocket.

Is high-throughput electrode processing necessary for lithium-ion battery market demand?

High-throughput electrode processing is needed to meet lithium-ion battery market demand. This Review discusses the benefits and drawbacks of advanced electrode processing methods, including aqueous, dry, radiation curing and 3D-printing processing methods.

How can a local battery manufacturing system help a battery plant?

Local manufacturers will scale up and cover the entire machinery for a battery plant through collaborations, from producing electrodes to the final cell formation. Localizing innovation and equipment manufacturing will build a sustainable and competitive battery manufacturing system.

What is dry processing in solid-state batteries?

In solid-state batteries, dry processing offers a solution to prepare solid-state electrolyte–electrode interfaces without using liquid electrolytes, which is a challenge in traditional slurry-based processing 89.

Guess what you want to know

-

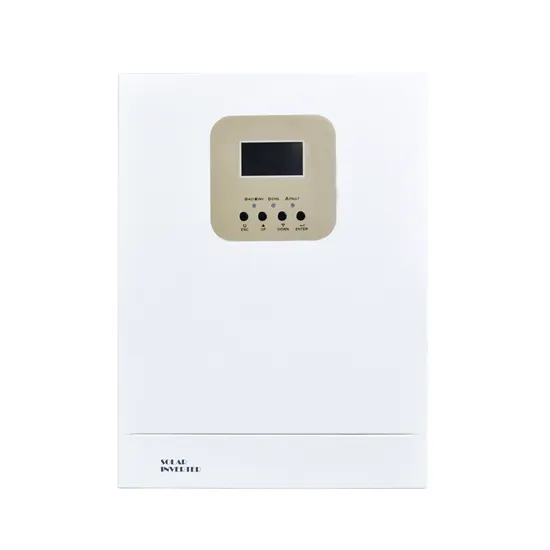

Base station lithium battery energy storage 100kw inverter manufacturer

Base station lithium battery energy storage 100kw inverter manufacturer

-

Lithium iron phosphate battery for communication base station energy storage

Lithium iron phosphate battery for communication base station energy storage

-

Photovoltaic communication lithium battery station cabinet base station

Photovoltaic communication lithium battery station cabinet base station

-

How to start charging the base station lithium battery

How to start charging the base station lithium battery

-

Base station lithium battery energy storage 20kw inverter quotation

Base station lithium battery energy storage 20kw inverter quotation

-

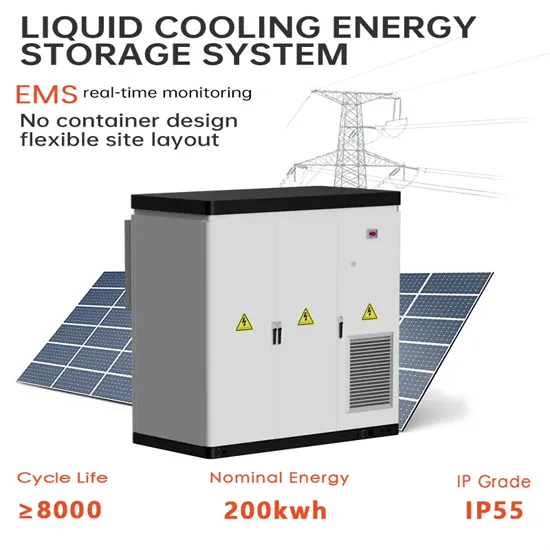

Liquid-cooled energy storage lithium battery station cabinet base station power system

Liquid-cooled energy storage lithium battery station cabinet base station power system

-

How long can the lithium battery in the base station battery cabinet last

How long can the lithium battery in the base station battery cabinet last

-

Simple lithium battery station cabinet base station

Simple lithium battery station cabinet base station

-

Energy storage cabinet lithium battery communication base station price

Energy storage cabinet lithium battery communication base station price

-

Price of lithium iron battery for communication base station

Price of lithium iron battery for communication base station

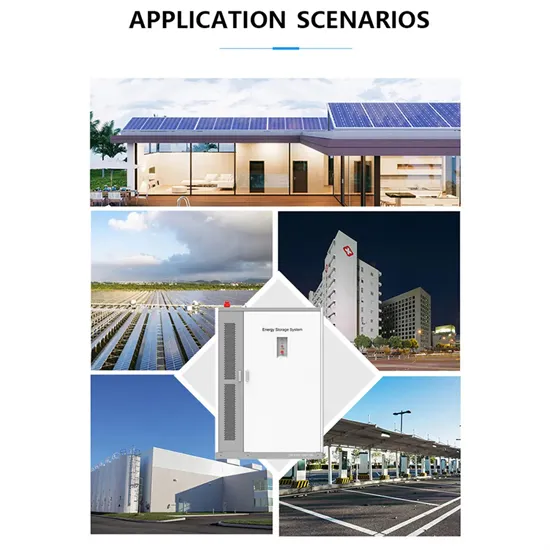

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

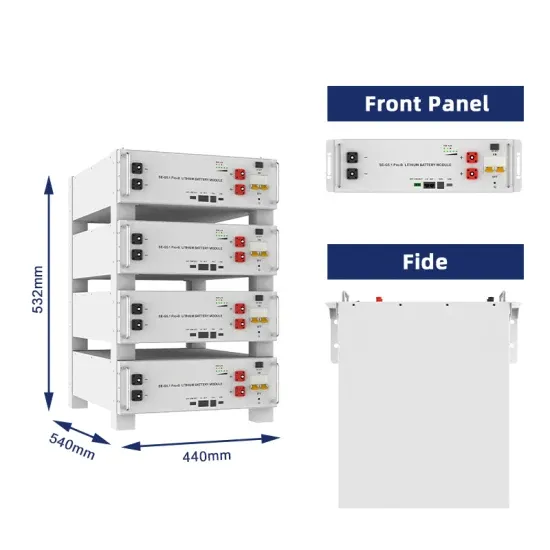

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.