Brazil''s Solar Boom: Why Energy Storage is Key for Businesses

Brazil''s new 2025 energy storage regulations create urgent opportunities for businesses to pair solar with lithium batteries. Here''s why: Overloaded grids cause

Get a quote

How big is brazil s new energy storage industry

Not much in terms of full or mass scale deployment of battery energy storage systems in Brazil has been done. The South American country is one of the many developing

Get a quote

Brazil''s Energy Storage Procurement Delayed: Behind The 1.7

Brazil''s energy storage procurement delayed: Behind the 1.7 billion reais power outage, confidence in renewable energy investment is tested The Brazilian energy storage market is at

Get a quote

Overview of New Energy Storage Developments

Currently, the United States, Europe, Japan, South Korea and other major economies focus on the development of new energy storage industry as

Get a quote

Economic analysis of industrial energy storage systems in Brazil:

A literature review demonstrated that this paper is a pioneer in demonstrating such a high level of economic feasibility for industrial battery energy storage systems in Brazil. One

Get a quote

Energy storage in batteries advances in Brazil and can reduce

With the release of battery technology, Brazil will be able to drastically reduce its dependence on thermal power plants to meet peak demand. This will result not only in lower

Get a quote

New Energy Storage Projects in Brazil: Powering the Future with

But hold onto your caipirinhas—this South American giant is fast becoming a hotspot for new energy storage projects. With abundant sunlight, ambitious climate goals, and

Get a quote

Brazil''s battery storage market could attract $7.8bn

Solar energy storage in Brazil is expected to attract BRL 45 billion ($7.8 billion) in investment by 2030, according to a study by Brazilian

Get a quote

How big is brazil s new energy storage industry

Why is the energy industry slowing down in Brazil? According to the Lexology, lack of capital and the absence of a strong regulatory framework governing the adoption, usage

Get a quote

The Energy Sector in Brazil: In-depth Analysis

Introduction Brazil stands out as one of the world''s largest producers of renewable energy, boasting an energy matrix that is primarily dominated by clean sources. Hydropower,

Get a quote

Brazil promotes new energy storage industry

Overall, Brazil''s energy storage market is poised for significant expansion as it adapts to increasing electricity consumption and the integration of renewable energy sources5.

Get a quote

Emerging Opportunities in Brazil''s Energy Storage

The Clean Energy Latin America (CELA) has recently conducted a comprehensive study that sheds light on the potential growth and lucrative

Get a quote

Energy storage in batteries advances in Brazil and

With the release of battery technology, Brazil will be able to drastically reduce its dependence on thermal power plants to meet peak

Get a quote

Renewable Energy Laws and Regulations Report 2025 Brazil

ICLG - Renewable Energy Laws and Regulations - Brazil Chapter covers common issues in renewable energy laws and regulations – including the renewable energy market,

Get a quote

Brazil''s Ten-Year Energy Expansion Plan 2034

This document outlines strategic guidelines for distributed generation and battery storage behind the meter, highlighting how Brazil intends to advance its energy sector to

Get a quote

''Brazilian solar arrays will include energy storage by 2027''

Solar-plus-storage hybrid systems will enter the Brazilian consumer market within two to three years, according to Júlio Bortolini, photovoltaic unit manager at Brazilian

Get a quote

Battery energy storage systems in Brazil: current regulatory and

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Get a quote

Brazil Residential Energy Storage Market (2025-2031) Outlook | Industry

Brazil Residential Energy Storage Market Overview The Residential Energy Storage market in Brazil is witnessing significant growth driven by the increasing adoption of renewable energy

Get a quote

''Brazil could have $3.8bn battery energy storage

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030,

Get a quote

Emerging Opportunities in Brazil''s Energy Storage Market: A

The Clean Energy Latin America (CELA) has recently conducted a comprehensive study that sheds light on the potential growth and lucrative opportunities within Brazil''s energy

Get a quote

Brazil''s energy storage auction to attract $450m in investments

Interest in the auction has been expressed by power companies such as Portugal''s EDP and Brazil''s ISA Energia. The auction will enhance Brazil''s power grid reliability by

Get a quote

Energy Crisis Promotes The Development Of Brazil''s Solar Industry

Research conducted by the Institute of Clean Energy and the Brazilian Association of Distributed Power Generation (ABGD) shows that the 10 GW of new distributed power

Get a quote

South America Energy Storage Industry 2025-2033

Government policies and initiatives in various South American countries are progressively fostering the adoption of energy storage

Get a quote

''Brazil could have $3.8bn battery energy storage market by 2030''

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United

Get a quote

6 FAQs about [Brazil promotes new energy storage industry]

Will energy storage systems grow in Brazil?

According to CELA's findings, the market for energy storage systems in Brazil is poised for a remarkable expansion, with an estimated annual growth rate of 12.8% until 2040. The study anticipates a substantial increase in installed capacity, reaching up to 7.2 GW during this period.

Why should you invest in energy storage in Brazil?

Opportunities for Stakeholders: Investment Opportunities: The projected growth in the energy storage market presents lucrative investment opportunities for both domestic and international investors looking to capitalize on the evolving energy landscape in Brazil.

What is driving Brazilian energy storage demand?

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United States markets dominated by utility-scale systems.

Will Brazil install a battery energy storage system in 2024?

A study by Brazilian consultancy Greener has indicated that the country installed 269 MWh of energy storage capacity in 2024, growth of 29% from 2023. Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

Will Brazil conduct the first energy storage auction?

Brazil is set to conduct the country's first-ever energy storage auction for adding batteries and storage systems to the national power grid.

Are battery storage systems viable in Brazil?

In Brazil, the cost of turn-key battery systems is notably high due to significant tax burdens. However, future projections indicate a potential reduction in battery costs, which could enhance economic feasibility for various applications. The booklet explores the viability of battery storage systems across different scenarios. For instance:

Guess what you want to know

-

East Asia s new energy storage industry

East Asia s new energy storage industry

-

Australia s new energy storage industry

Australia s new energy storage industry

-

South Africa promotes new energy storage

South Africa promotes new energy storage

-

Energy Storage and New Energy Power Generation

Energy Storage and New Energy Power Generation

-

Advantages and Disadvantages of New Energy Storage Cabinets

Advantages and Disadvantages of New Energy Storage Cabinets

-

Maldives New Energy Storage Planning Project Bid Opening

Maldives New Energy Storage Planning Project Bid Opening

-

New Zealand photovoltaic power generation with energy storage

New Zealand photovoltaic power generation with energy storage

-

Uruguayan energy storage and new energy supplier

Uruguayan energy storage and new energy supplier

-

Swiss new energy storage cabinet manufacturer

Swiss new energy storage cabinet manufacturer

-

Nicaragua 2025 New Energy Storage Project

Nicaragua 2025 New Energy Storage Project

Industrial & Commercial Energy Storage Market Growth

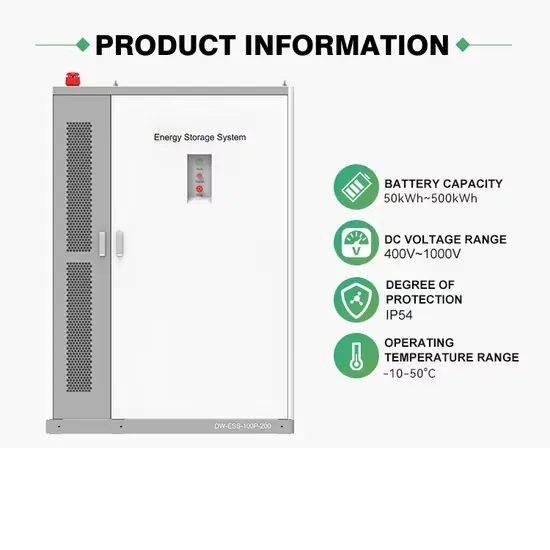

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.