Indonesia''s solar outlook for 2025 shows promising

The Indonesia Institute for Essential Services Reform (IESR) recently released its "2025 Indonesia Solar Outlook" report, revealing that as

Get a quote

Indonesia''s Solar Policies

The proof is in the numbers. Despite having substantial solar resources, Indonesia''s solar policy framework has failed to deliver cost-effective renewables to the grid. According to Institute for

Get a quote

Canadian Solar – Global

Under Dr. Qu''s leadership, we have grown into one of the world''s largest solar photovoltaic products and energy solutions providers, as well as one of the largest solar power plant

Get a quote

Indonesia Solar Panel Manufacturing Report | Market

Explore Indonesia solar panel manufacturing landscape through detailed market analysis, production statistics, and industry insights. Comprehensive data on capacity, costs, and growth.

Get a quote

Indonesia Solar Energy Market Analysis

Solar energy is gaining significant attention and adoption in Indonesia as the country looks to diversify its energy sources and reduce dependence on fossil

Get a quote

New US solar tariffs on Southeast Asia to raise prices,

A new round of U.S. solar panel import tariffs on Southeast Asian producers is expected to raise consumer prices and cut into producer profit

Get a quote

Indonesia Solar Energy Market Size | Mordor Intelligence

The Indonesia solar energy market is poised for significant growth, driven by the increasing demand for renewable energy and the decreasing

Get a quote

Indonesia Solar Energy Market Analysis

Solar energy is gaining significant attention and adoption in Indonesia as the country looks to diversify its energy sources and reduce dependence on fossil fuels. The Indonesia Solar

Get a quote

PT. Indonesia Solar Global (ISG)

Who Are We PT Indonesia Solar Global (ISG) is a Solar PV Module Manufacture in Indonesia, established in 2021. The company is headquarted in Jakarta & our plant is located in

Get a quote

PT Inutec Surya Indonesia | Distributor SMA, Huawei,

PT Inutec Surya Indonesia is a distributor of solar PV inverters and system components as well as a service and training provider. It is a partner of Inutec

Get a quote

Solar Energy Potentials and Opportunity of Floating Solar PV in Indonesia

In this paper, we conclude that Indonesia has vast potential for generating and balancing solar photovoltaic (PV) energy to meet future energy needs at a competitive cost.

Get a quote

Industry Visit: Notes from a Local Solar Module Manufacturer in

"The price of modules produced by local producers is around 15-17 cent/kwh, while imported solar modules cost 10-12 cent/kwh. Coupled with the TKDN relaxation rules for

Get a quote

Indonesia significantly reduces localization requirements for PV

In order to protect the development of the country''s new energy industry, Indonesia in recent years introduced a series of trade protection policies, especially for the

Get a quote

Solar Panel Costs in Indonesia Explained | HuiJue Group South

You know how people keep talking about renewable energy in Southeast Asia? Well, Indonesia''s solar panel market grew 23% last year according to MEMR data. But here''s the kicker –

Get a quote

Indonesia Solar Energy Market Size | Mordor Intelligence

The Indonesia solar energy market is poised for significant growth, driven by the increasing demand for renewable energy and the decreasing cost of solar PV technology.

Get a quote

Solar (photovoltaic) panel prices

IRENA presents solar photovoltaic module prices for a number of different technologies. Here we use the average yearly price for technologies ''Thin film a-Si/u-Si or

Get a quote

Global solar module prices mixed on differing demand

Global solar module prices mixed on differing demand outlook In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a

Get a quote

US panel price spread widens between India and Indonesia/Laos

Quotes for US-assembled modules with imported cells continue to be heard between $0.26/W and $0.33/W, while modules with domestic content – which are still limited

Get a quote

Top Solar Panel Manufacturers Suppliers in Indonesia

Even though Indonesia''s solar market outlook is pretty bleak, there is hope for the future. A recent IRENA report reveals that the Indonesian market can attain a capacity of 47 Gigawatts by

Get a quote

Solar Levelized Cost of Energy Projection in Indonesia

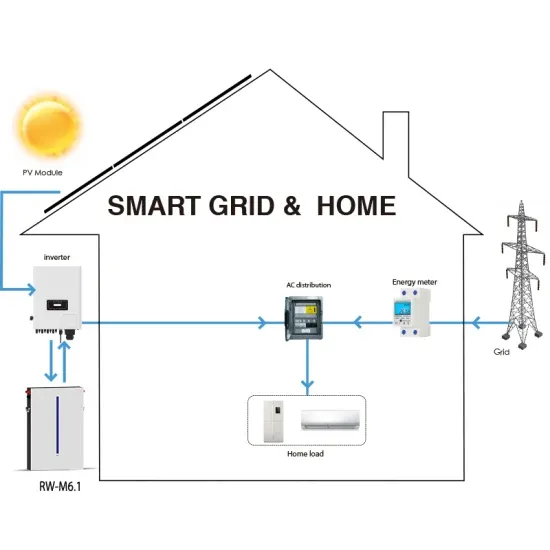

Models of On-Grid Silicon-based Solar Panel System without batteries (Model A) and with battery capacities (1x, 1.5x) of PV module as well

Get a quote

Indonesia''s Vast Solar Energy Potential

In this paper, we conclude that Indonesia has vast potential for generating and balancing solar photovoltaic (PV) energy to meet future energy

Get a quote

Solar panel prices have fallen by around 20% every

One of the most transformative changes in technology over the last few decades has been the massive drop in the cost of clean energy. Solar

Get a quote

6 FAQs about [Indonesia solar panel photovoltaic module prices]

How much does solar PV cost in Indonesia?

The tool calculates an IRR of 16.44%, and a pay-back period of 6 years. IEA estimated that in 2019, Solar PV installations in Indonesia had an LCOE of 80 US$/MWh. This compares with an IRENA estimate of the worldwide average of 60 US$/MWh in 2019, falling to 48 US$/MWh in 2021.

How much do solar modules cost?

“The price of modules produced by local producers is around 15-17 cent/kwh, while imported solar modules cost 10-12 cent/kwh. Coupled with the TKDN relaxation rules for imported solar modules, local products will lose out,” Zaeny said. This perspective from domestic solar industry players can serve as an evaluation of existing policies.

Which solar panels should I buy in Indonesia?

Most solar installers in Indonesia usually recommend panels made by “Tier 1” solar panel manufacturers. The Bloomberg New Energy Finance uses this tiering system as a measure of a manufacturer’s reliability and consistency. The prices of “Tier 1” solar panels vary based on where they are manufactured, their efficiency and warranty durations.

How much does solar maintenance cost in Indonesia?

We encourage solar homeowners to schedule an annual maintenance visit for your solar system, similar to air-conditioners. Your installers can both clean your solar panels and conduct tests on your inverters and breakers. Maintenance costs for your solar panel system usually range from 700k to 1 mil. IDR per visit in Indonesia.

What are the best solar panels for landed homes in Indonesia?

The most popular solar panel brands in Indonesia are typically the more affordable top Chinese manufactured panels in the list such as LONGi, Jinko, Trina, JA Solar, etc. Here’s a rough estimate of the standard system cost for landed homes in Indonesia. Remember that installation costs will also vary depending on the above factors.

Does Indonesia have a solar market?

Indonesia is a signatory to the UN Framework Convention on Climate Change (UNFCCC) and the Paris Climate Agreement. One would easily assume that the nation’s solar market is performing well, considering its government’s dedication to renewable energy. Unfortunately, Indonesia’s solar market has not lived up to its exponential potential.

Guess what you want to know

-

Nicaragua solar panel photovoltaic module seller

Nicaragua solar panel photovoltaic module seller

-

Rooftop solar photovoltaic panel prices

Rooftop solar photovoltaic panel prices

-

Northern solar photovoltaic panel prices

Northern solar photovoltaic panel prices

-

Thin-film solar photovoltaic panel prices

Thin-film solar photovoltaic panel prices

-

Canada Solar Panel Photovoltaic Module Sales

Canada Solar Panel Photovoltaic Module Sales

-

Which solar panel and photovoltaic module manufacturer is best in Guinea

Which solar panel and photovoltaic module manufacturer is best in Guinea

-

South Korean photovoltaic panel solar energy prices

South Korean photovoltaic panel solar energy prices

-

Burundi solar photovoltaic panel installation prices

Burundi solar photovoltaic panel installation prices

-

Photovoltaic module solar panel corrosion

Photovoltaic module solar panel corrosion

-

Photovoltaic solar panel manufacturer in Niue

Photovoltaic solar panel manufacturer in Niue

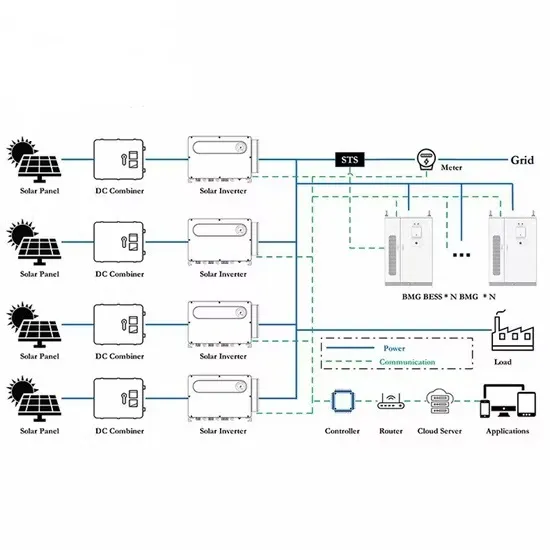

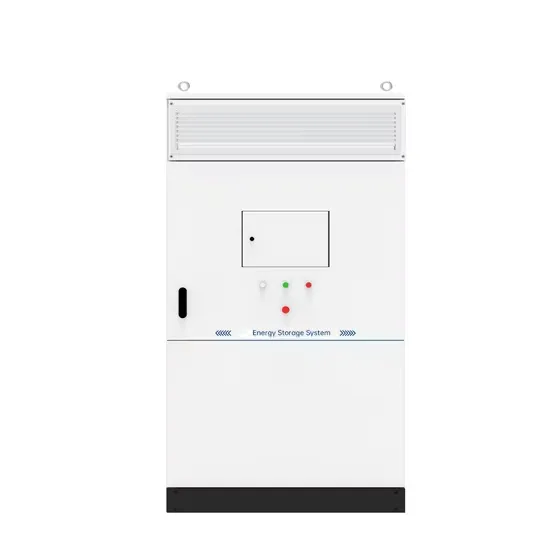

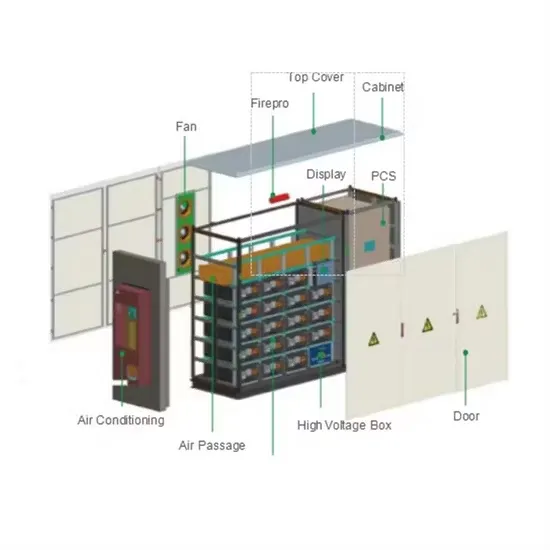

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.