PV Price Watch: China''s module prices reach RMB0.75/W

On 11 March 2025, the results of the China Datang Group''s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from

Get a quote

Photovoltaic Price Index

Every month we publish a current price index on the development of wholesale prices of solar modules. In doing so, we differentiate between the main technologies available on the market.

Get a quote

Assessment of Photovoltaic Systems in the APEC Region

1.2 Solar PV Projects in South East Asia region d in 4 participating AMS were analysed in this study. Almost two-thirds of these projects are from Malaysia while the rema

Get a quote

US Government Finalizes Tariffs on Southeast Asian

U.S.-based manufacturers say that Chinese companies based in Cambodia, Vietnam, Thailand, and Malaysia are dumping cheap solar panels

Get a quote

Solar PV Market in APAC

Asia-Pacific Solar Photovoltaic (PV) analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report

Get a quote

retail price solar panels suppliers

Wholesale and retail factory sell reasonably pricedsolar cells solarpanel Country/Region: China Main Products: SolarPanel, Solar System, Solar Water Pump, Solar Street Light Total

Get a quote

US sets tariffs of up to 3,521% on South East Asia

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian

Get a quote

Asia Pacific Solar Panel Market Report 2025

The South East Asia Solar Panel market is projected to witness growth at a CAGR of 11.0% during the forecast period, with a market size of USD 2722.4 million in 2024. The

Get a quote

Asia Photovoltaic Panel Installation Costs 2024 Pricing Guide

Wondering how much solar panel installation costs across Asia? This comprehensive guide breaks down photovoltaic system prices, regional variations, and money-saving strategies for

Get a quote

Solar Panel Wholesale Price List in Dubai, UAE

FAQ about Solar Panels: What are solar panels? How to use solar panel at home? Solar Panel Price in Dubai-UAE Solar panels in uae, solar panel price

Get a quote

Asia-Pacific Solar Photovoltaic Materials Market | CAGR of 10.2

In 2021, according to the International Renewable Energy Agency (IRENA), the cost of electricity generation from solar power has reduced by around 85% between 2010 to 2020.

Get a quote

US imposes steep tariffs on South East Asian solar cell imports

The committee has accused major Chinese solar panel manufacturers with facilities in Malaysia, Cambodia, Thailand and Vietnam of selling panels below production

Get a quote

East Asia Photovoltaic Panel Manufacturer Price Analysis Trends

As global demand for sustainable energy solutions surges, East Asia has emerged as a hub for photovoltaic panel manufacturing. With countries like China, Japan, and South Korea leading

Get a quote

Top 10 Solar Companies in Thailand [Updated 2025]

9. Solaris Green Energy Solaris is a Thailand-based distributor of solar panels, inverters, batteries and more to complete solar systems for residential and

Get a quote

MENA Solar and Renewable Energy Report

Introduction Renewable energy usage has been growing significantly over the past 12 months. This trend will continue to increase as solar power prices reach grid parity. In 2019, the global

Get a quote

Asia Pacific Solar Photovoltaic Market

Several solar panel manufacturers and component suppliers in China and other parts of Asia were forced to shut down or reduce operations during the early stages of the pandemic, which led to

Get a quote

Asia Pacific Solar Panel Market Report 2025

The South East Asia Solar Panel market is projected to witness growth at a CAGR of 11.0% during the forecast period, with a market size of USD 2722.4 million in 2024. The Rest of Asia

Get a quote

PV Price Watch: China''s module prices reach

On 11 March 2025, the results of the China Datang Group''s 2025-2026 PV module framework purchase tender were announced, with the spot price of n

Get a quote

Southeast Asia solar markets set for growth this year

New PV capacity additions in Southeast Asia are expected to bounce back this year for the first time since 2020, according to the Asian

Get a quote

Solar (photovoltaic) panel prices

IRENA presents solar photovoltaic module prices for a number of different technologies. Here we use the average yearly price for technologies ''Thin film a-Si/u-Si or

Get a quote

3 FAQs about [East Asia photovoltaic panel retail price]

What is the Asia-Pacific solar photovoltaic (PV) market?

The Asia-Pacific Solar Photovoltaic (PV) Market is segmented by Product Type (Thin Film, Multicrystalline Silicon, and Monocrystalline Silicon), End-User (Residential, Commercial, and Utility), Deployment (Ground Mounted and Rooftop Solar), and Geography (China, India, Japan, South Korea, and Rest of Asia-Pacific).

Who are the key players in the Asia-Pacific solar photovoltaic market?

The Asia-Pacific Solar Photovoltaic (PV) Market is fragmented. Some of the key players in this market (not in a particular order) include JA Solar Holdings Co., Trina Solar Ltd, Adani Green Energy Ltd., Azure Power Global Limited, and First Solar Inc. Need More Details on Market Players and Competitors?

Where did photovoltaic cost data come from?

Photovoltaic cost data between 1975 and 2003 has been taken from Nemet (2009), between 2004 and 2009 from Farmer & Lafond (2016), and since 2010 from IRENA. Prices from Nemet (2009) and Farmer & Lafond (2016) have been converted to 2024 US$ using the US GDP deflator, to account for the effects of inflation.

Guess what you want to know

-

Regular photovoltaic panel manufacturer in East Asia

Regular photovoltaic panel manufacturer in East Asia

-

East Asia Photovoltaic Panel Manufacturer

East Asia Photovoltaic Panel Manufacturer

-

Niger industrial photovoltaic panel BESS price

Niger industrial photovoltaic panel BESS price

-

Southeast Asia hollow photovoltaic panel specifications and dimensions

Southeast Asia hollow photovoltaic panel specifications and dimensions

-

150w folding photovoltaic panel price

150w folding photovoltaic panel price

-

460w photovoltaic panel price

460w photovoltaic panel price

-

What is the retail price of photovoltaic panels in Cyprus

What is the retail price of photovoltaic panels in Cyprus

-

Double glass 530 photovoltaic panel price

Double glass 530 photovoltaic panel price

-

Photovoltaic panel price breakdown

Photovoltaic panel price breakdown

-

West Asia rooftop photovoltaic panel installation

West Asia rooftop photovoltaic panel installation

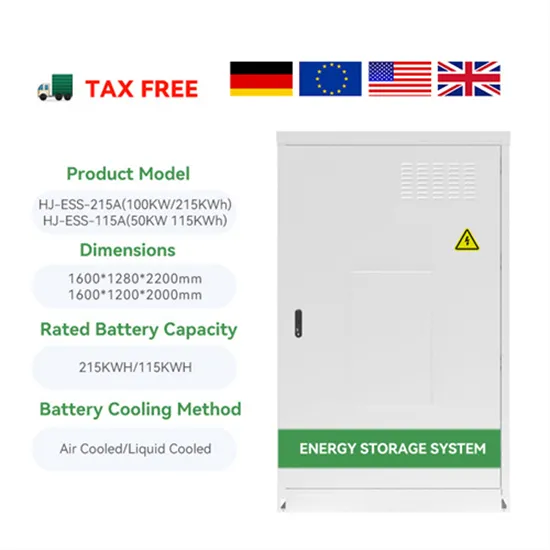

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.