American-made solar panels: Who are the top

Ohio-based First Solar is the largest manufacturer of solar panels in the U.S., producing about 50% more panels than the next-biggest American

Get a quote

How Amazon Procured the Most Renewable Energy

At the forefront of this green revolution, Amazon stands as the world''s largest corporate buyer of renewable energy, boasting more than 600

Get a quote

Amazon now has more than 600 wind and solar

Amazon is the largest corporate purchaser of renewable energy globally for the fifth year in a row With more than 600 projects worldwide,

Get a quote

Meta, Amazon, and Google lead the way in corporate

Meta was the largest corporate solar adopter in SEIA''s last Solar Means Business report in 2022, and the entity formerly known as Facebook

Get a quote

Amazon is the world''s largest corporate purchaser of renewable energy

Amazon invested in more than 100 new solar and wind energy projects in 2023, becoming the world''s largest corporate purchaser of renewable energy for the fourth year in a

Get a quote

Amazon buying big on solar – pv magazine USA

For the past five consecutive years, tech and retail giant Amazon has been the world''s largest procurer of renewable energy, investing in

Get a quote

14 Largest Solar Companies In The World [As of 2025]

In 2022, their renewables segment generated $4.38 billion in sales, the highest revenue since the launch of the solar business in 2011. They made an operating profit of about

Get a quote

Amazon celebrates five years as top global renewable

Amazon has achieved a remarkable milestone by claiming the title of the "Largest Corporate Purchaser of Renewable Energy Globally" for the

Get a quote

Chart: These 10 US companies buy and build the

Here are the 10 corporations responsible for adding the most solar to the U.S. grid, through both direct purchases of electricity from solar farms

Get a quote

Learn About Solar Energy (2025)

Interested in solar energy but not sure where to start? EcoWatch is your go-to resource for all things solar. Get Free Quotes From Approved Solar Installers By installing solar panels on

Get a quote

How Amazon bought more renewable energy than any other

Amazon was the largest corporate buyer of renewable energy in 2022 by a factor of more than four. Here''s a look at how and what kind of planning that takes.

Get a quote

Top 10 Solar Panel Manufacturers in Turkey | Price

CW Energy, since its inception in 2008, has grown to be one of the largest solar panel manufacturers in Turkey, boasting a remarkable 1.8

Get a quote

Amazon is the world''s largest corporate purchaser of renewable

Amazon invested in more than 100 new solar and wind energy projects in 2023, becoming the world''s largest corporate purchaser of renewable energy for the fourth year in a

Get a quote

Amazon buying big on solar – pv magazine USA

For the past five consecutive years, tech and retail giant Amazon has been the world''s largest procurer of renewable energy, investing in projects and signing power purchase

Get a quote

Who are the biggest buyers of solar panels?

In 2021, China was the leading country in the world based on solar energy consumption share, at 31.7 percent. Meanwhile, the United States accounted

Get a quote

Top Buyers of Solar Panels in the Renewable Energy Market

Discover who the biggest buyers of solar panels are in the growing renewable energy market. Learn how utility companies are driving the solar demand.

Get a quote

Solar Panel Price In Pakistan

Latest solar panel price in Pakistan. Find top brands like Longi, Jinko, Canadian, and JA with A-grade and B-grade options for sustainable energy solutions.

Get a quote

Amazon celebrates five years as top global renewable energy buyer

Amazon has achieved a remarkable milestone by claiming the title of the "Largest Corporate Purchaser of Renewable Energy Globally" for the fifth consecutive year, according

Get a quote

Who was the largest corporate purchaser of renewable energy

According to TechCrunch, Amazon''s renewable energy portfolio consists mostly of wind and solar farms and on-site solar power projects. Amazon says the whole thing would be

Get a quote

Chart: These 10 US companies buy and build the most solar

Here are the 10 corporations responsible for adding the most solar to the U.S. grid, through both direct purchases of electricity from solar farms and their own on-site solar arrays.

Get a quote

14 Largest Solar Companies In The World [As of 2025]

In 2022, their renewables segment generated $4.38 billion in sales, the highest revenue since the launch of the solar business in 2011.

Get a quote

Amazon was 2024''s largest corporate buyer of renewables

Amazon has claimed the title of the largest corporate buyer of renewable energy for the fifth year in a row, citing data compiled by BloombergNEF.

Get a quote

How Amazon Became World''s Largest Buyer of Renewable Energy

They also set up the biggest corporate power purchase of all: Amazon has leveraged that ecosystem to go on the largest ever solar and wind shopping spree, buying

Get a quote

Amazon Is Top Green Energy Buyer in a Market Dominated by US

Tech giant Amazon took the top slot, buying more solar and wind power than the next three companies combined. This market is well-positioned for more growth with improving

Get a quote

Chart: These 10 US companies buy and build the

Canary Media''s chart of the week translates crucial data about the clean energy transition into a visual format. Retailers Walmart and Target

Get a quote

Which countries use the most solar energy? [Top 13,

In 2022, India was the world''s fourth largest consumer of solar-generated electricity and the world''s fourth largest producer of solar panels.

Get a quote

6 FAQs about [The largest buyer of solar panels]

Which companies invest in solar energy?

BlackRock, Bank of America, CPP Investments, and HV Capital are its major investors. 14. Raycatch Raycatch uses AI and data analytics to optimize solar energy production and performance.

How much money does a solar company make in 2022?

They have a diversified product portfolio that includes hydrogen, wind, and solar power with advanced solutions like virtual power plants and AI-based energy management systems. In 2022, their renewables segment generated $4.38 billion in sales, the highest revenue since the launch of the solar business in 2011.

Did Amazon buy a 3 GW solar project?

That was more than double the 3 GW procured by second-largest buyer, Facebook parent Meta in the same year. Amazon states that it is now involved as an energy offtaker or investor in more than 600 solar and wind projects worldwide, from small rooftop PV installations through to triple-digit-megawatt solar and wind installations.

Is solar a better future?

As countries strive to meet ambitious carbon reduction targets and transition away from fossil fuels, the renewable energy sector, especially solar, has shown hope for a better future.

Is SunPower a good solar company?

SunPower has nearly four decades of dedicated solar experience — they are a top-rated US solar firm with 15,000+ five-star reviews. In 2023, it generated $1.68 billion in annual revenue and $239 million in operating profit. However, the company hasn’t been able to scale up — its earnings and stock price have stagnated over the past decade.

Is Canadian Solar a good company?

Canadian Solar has an impressive track record. It has shipped more than 118 GW of solar modules and 4.5 GWh of battery storage. The company prioritizes ethical sourcing and innovation, developing modules with advanced technology, such as N-type TOPCon, that can reach up to 715 W.

Guess what you want to know

-

Montenegro s largest solar panel factory

Montenegro s largest solar panel factory

-

How many volts are generally used for outdoor solar panels

How many volts are generally used for outdoor solar panels

-

180-watt solar panels

180-watt solar panels

-

Solar system plus solar panels

Solar system plus solar panels

-

Solar panels failed

Solar panels failed

-

Solar panels for Western European solar photovoltaic projects

Solar panels for Western European solar photovoltaic projects

-

Photovoltaic solar panels in Gabon

Photovoltaic solar panels in Gabon

-

Chad Taiwan Glass Solar Panels Industrial and Commercial

Chad Taiwan Glass Solar Panels Industrial and Commercial

-

Can solar panels power a 12V water pump inverter

Can solar panels power a 12V water pump inverter

-

Solar panels stacked together

Solar panels stacked together

Industrial & Commercial Energy Storage Market Growth

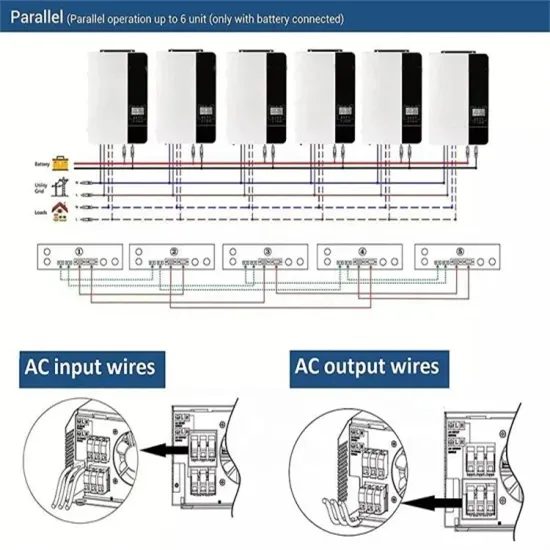

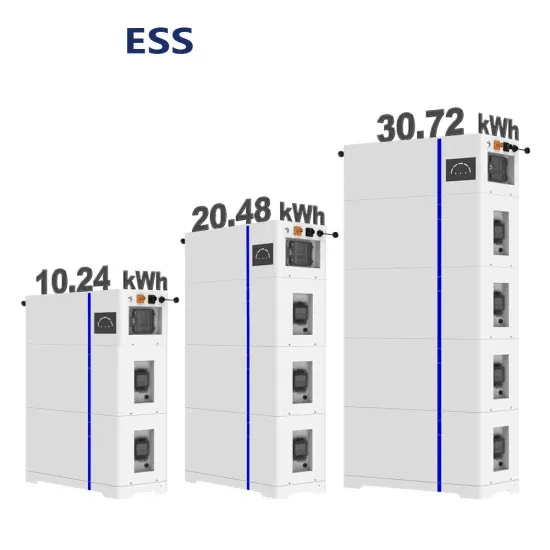

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.