The State of African Energy

Onshore drilling is poised to lead the charge in exploration, while high-impact drilling, particularly in deepwater basins, is expected to elevate Africa''s prominence in global markets. The

Get a quote

AMEA Power picks Trinasolar to supply BESS for

The project for AMEA Power marks Trinasolar''s first energy storage project in the Middle East and Africa region. To date, Trina Storage

Get a quote

Top five energy storage projects in South Africa

Listed below are the five largest energy storage projects by capacity in South Africa, according to GlobalData''s power database. GlobalData uses proprietary data and

Get a quote

Mulilo wins five projects as South Africa''s battery

Eight projects under the second round of South Africa''s battery energy storage independent power producer (Besippp) programme have been

Get a quote

GSL ENERGY Africa Energy Storage Project Case Study

GSL ENERGY has been deeply involved in the African energy storage market, successfully deploying residential and commercial energy storage battery systems in Kenya,

Get a quote

Energy Boom in Africa: 2024 Marks a Breakthrough Year for

The outlook remains promising: in 2024, new projects totaling 40 GW were proposed, a 21% increase compared to 2023. Africa''s renewable energy sector is entering a

Get a quote

''Energy storage boom'' in Africa from 31MWh in 2017 to

As noted by AFSIA Solar, one of the most notable solar-plus-storage developments in Africa is Norway-based independent power producer (IPP) Scatec''s

Get a quote

Scatec reaches financial close and prepares for

Replicating successes from our hybrid solar and battery storage projects at Kenhardt, we will proceed to construct one of Africa''s first and

Get a quote

Spotlight on Africa: A continent of contrasts in energy storage

In early 2025, AFSIA said around 18 GWh of storage projects were under development across Africa, spanning a range of systems, regions, and needs – from 100-plus

Get a quote

Mr. Wale Shonibare, Director, Ener y Financial

Africa''s energy landscape is undergoing a significant transformation, with a growing emphasis on renewable energy sources such as solar and wind power. These intermittent energy sources

Get a quote

Spotlight on Africa: A continent of contrasts in energy storage

Similarly, Morocco is advancing large solar-plus-storage projects, including two facilities that will add a combined 1,200 MWh of battery capacity. In Uganda, a major new

Get a quote

Eskom officially opens largest battery storage project

Eskom has announced the inauguration of the largest Battery Energy Storage System (BESS) project on the African continent, marking a

Get a quote

Top 10 Energy Storage Companies in Africa Driving the

Discover the top 10 energy storage companies revolutionizing Africa''s power sector. Learn how batteries are powering the continent''s renewable energy future.

Get a quote

''Energy storage boom'' in Africa from 31MWh in 2017

As noted by AFSIA Solar, one of the most notable solar-plus-storage developments in Africa is Norway-based independent power producer

Get a quote

Top 10 Energy Storage Companies in Africa | PF Nexus

Discover the current state of energy storage companies in Africa, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Top 5 largest energy storage projects in Africa

With the energy transition currently underway in Africa, the rapid increase in energy production to meet both demand and emissions reduction

Get a quote

Energy Boom in Africa: 2024 Marks a Breakthrough Year for Energy Storage

The outlook remains promising: in 2024, new projects totaling 40 GW were proposed, a 21% increase compared to 2023. Africa''s renewable energy sector is entering a

Get a quote

Battery Energy Storage Project

The Project will be implemented at approximately 17 sites, located within or adjacent to existing distribution substations of Eskom, across four provinces of

Get a quote

Battery storage: the tech that could revolutionise

Any conversation on the need to electrify the African continent – and bring power to 600 million people who lack access today – almost always

Get a quote

Visualizing Africa''s Battery Storage Pipeline

This visualization highlights the continent''s battery storage pipeline, including projects that are operational, under construction, or in planning. It reveals both leading players

Get a quote

Eskom inaugurates 100MWh battery project in

The Hex BESS project site in Worcester, Western Cape. Credit: Eskom Holdings SOC. South African utility Eskom has inaugurated a first-of

Get a quote

Where are the energy storage sites in africa

Pumped hydro dams are prominently used as energy storage in East Africa, but that is changing with the increase in renewable energy and battery energy storage systems.

Get a quote

Africa energy storage projects

What is the future of energy storage in South Africa? rowthin energy storage demand. The rise in demand will come from the transformation of the energy system to include more renewables

Get a quote

Top 5 largest energy storage projects in Africa

Therefore, with its unparalleled potential for renewable energy, the development and implementation of energy storage technologies is vital to ensure and improve grid stability and

Get a quote

Guess what you want to know

-

West African large-scale energy storage project construction unit

West African large-scale energy storage project construction unit

-

Central African Republic Photovoltaic Energy Storage Project

Central African Republic Photovoltaic Energy Storage Project

-

Central African Republic Energy Storage Battery Project

Central African Republic Energy Storage Battery Project

-

South African Republic Battery Energy Storage System Project

South African Republic Battery Energy Storage System Project

-

Benin Telecommunications Off-Grid Energy Storage Project

Benin Telecommunications Off-Grid Energy Storage Project

-

Energy Storage Project Robotic Arm Automation

Energy Storage Project Robotic Arm Automation

-

Ecuador s first energy storage project

Ecuador s first energy storage project

-

UAE Energy Storage Photovoltaic Project

UAE Energy Storage Photovoltaic Project

-

Pretoria Behind-the-User Energy Storage Project

Pretoria Behind-the-User Energy Storage Project

-

Brunei Energy Storage Industrial Park Project Planning

Brunei Energy Storage Industrial Park Project Planning

Industrial & Commercial Energy Storage Market Growth

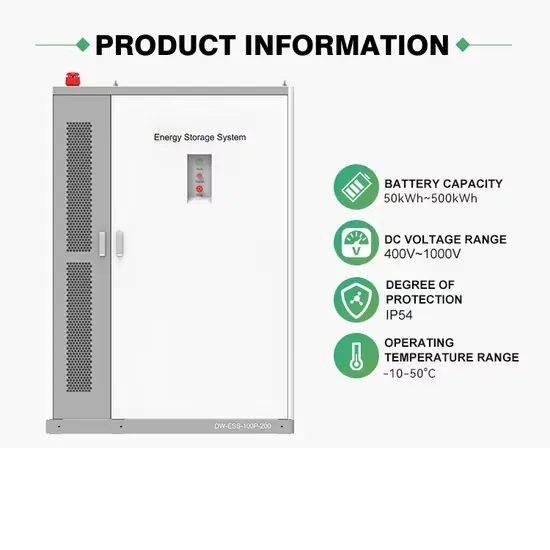

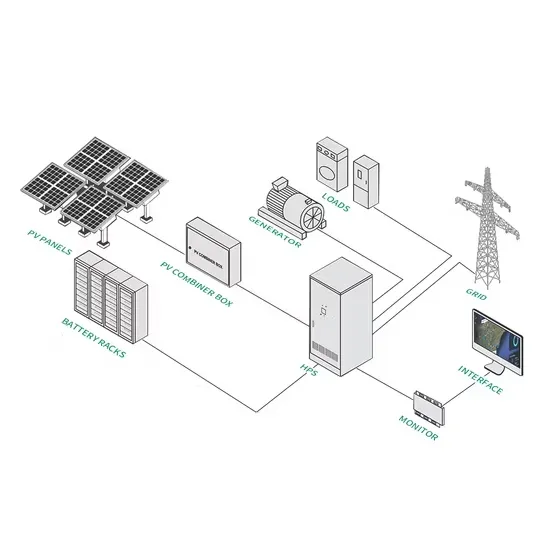

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.