How is Energy Storage Profitable? Unlocking the Billion-Dollar Battery

But here''s the kicker – energy storage profitability isn''t fictional. In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030.

Get a quote

Policy options for enhancing economic profitability of residential

We find that the choice of optimal storage size and dynamic electricity tariffs are key to maximize the profitability of PV-battery energy storage systems.

Get a quote

How is the profit of energy storage power station construction?

The profitability of energy storage power stations is heavily influenced by market conditions, particularly supply and demand fluctuations. During periods of high energy

Get a quote

How is the profit of portable energy storage power supply

How is the profit of portable energy storage power supply A comprehensive examination reveals that 1. Profitability is influenced by market demand, 2. Technological

Get a quote

How is the profit of base station energy storage battery

1. Profitability of base station energy storage batteries is driven by several key factors: 1) decreasing operational costs, 2) increased efficiency in energy management, 3)

Get a quote

Battery Storage Optimization: Value Stacking Explained

3 days ago· The agility and responsiveness of modern battery systems make them ideal for these rapid trading opportunities, contributing to a more efficient and flexible energy system.

Get a quote

The Economics of Battery Storage: Costs, Savings,

Understanding the economics of battery storage is vital for investors, policymakers, and consumers alike. This analysis delves into the

Get a quote

How many billions of profits do energy storage batteries make?

The energy storage battery market generates substantial profits, estimated at around $20 billion annually, with ongoing growth projected due to increasing adoption in

Get a quote

How is the profit of industrial energy storage power station?

The profit of industrial energy storage power stations is influenced by various factors, including 1. the scale of deployment, 2. the types and prices of stored energy, 3.

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

The Economics of Battery Storage: Costs, Savings, and ROI

Understanding the economics of battery storage is vital for investors, policymakers, and consumers alike. This analysis delves into the costs, potential savings, and return on

Get a quote

How is the profit of energy storage battery cells? | NenPower

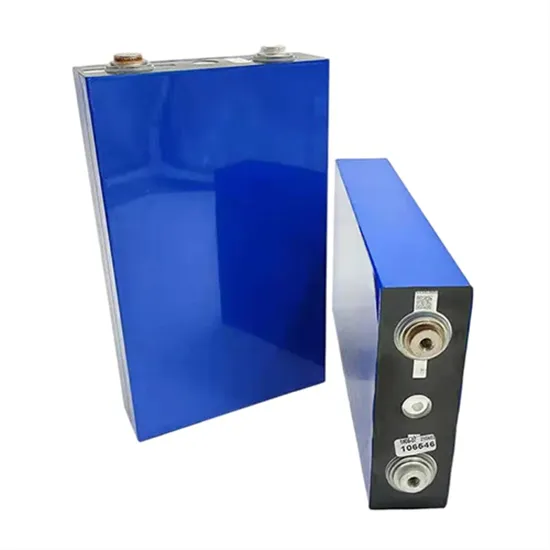

Energy storage battery cells generate profits through 1. increasing demand for renewable energy solutions, 2. advancements in technology enhancing efficiency, and 3. the

Get a quote

Powering Resilience and Profitability: How Battery Energy

5 days ago· How your business can turn energy volatility into opportunity, using BTM batteries as a foundation for a more resilient, profitable, and sustainable future.

Get a quote

How is the profit of factory energy storage power supply

The profitability of factory energy storage power supply can be effectively analyzed through various facets. 1. Profit margins play a crucial role, considering

Get a quote

How is the profit of lithium battery energy storage equipment?

1. The profitability of lithium battery energy storage equipment is determined by various factors, including initial investments, market demand, technological advancements,

Get a quote

What is the gross profit margin of energy storage

The gross profit margin of energy storage projects varies significantly based on several factors, such as market conditions, technology

Get a quote

Optimizing PV and grid charging in combined

The energy storage market is growing exponentially and residential batteries are being deployed including in grid-connected housing, in order to increase on-site use of PV

Get a quote

How many billions of profits do energy storage

The energy storage battery market generates substantial profits, estimated at around $20 billion annually, with ongoing growth projected due to

Get a quote

How is the profit of large energy storage power station?

The profit of large energy storage power stations can be elucidated through several core aspects: 1. Revenue Generation Methods, 2. Cost Dynamics, 3. Market Demand

Get a quote

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

5 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get a quote

The Profitability Challenges of Utility-Scale Battery

Increased energy storage is one of the most promising ways to handle the challenges from introducing lots of non-dispatchable generators to the grid.

Get a quote

Powering Resilience and Profitability: How Battery Energy Storage

5 days ago· How your business can turn energy volatility into opportunity, using BTM batteries as a foundation for a more resilient, profitable, and sustainable future.

Get a quote

How is Energy Storage Profitable? Unlocking the Billion-Dollar

But here''s the kicker – energy storage profitability isn''t fictional. In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030.

Get a quote

A comprehensive review of large-scale energy storage

4 days ago· ABSTRACT Addressing high-proportion renewable energy leads to insufficient grid regulation ability and frequency instability, a perfect electricity market clearing mechanism with

Get a quote

The Battery Storage Market Is Set to Grow Ninefold by 2040

Battery storage is rapidly expanding worldwide, lowering costs and stabilizing renewable energy supply as countries move away from fossil fuels.

Get a quote

How much is the profit of energy storage power station

The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Get a quote

Utilities report batteries are most commonly used for arbitrage and

We recently published an early release of data from our EIA-860, Annual Electric Generator Report, which includes new detailed information on battery storage applications,

Get a quote

6 FAQs about [Profitability of energy storage batteries]

Is battery storage a good investment?

The economics of battery storage is a complex and evolving field. The declining costs, combined with the potential for significant savings and favorable ROI, make battery storage an increasingly attractive option.

Are battery storage projects financially viable?

Different countries have various schemes, like feed-in tariffs or grants, which can significantly impact the financial viability of battery storage projects. Market trends indicate a continuing decrease in the cost of battery storage, making it an increasingly viable option for both grid and off-grid applications.

Why is battery storage important?

The global shift towards renewable energy sources has spotlighted the critical role of battery storage systems. These systems are essential for managing the intermittency of renewable sources like solar and wind. Understanding the economics of battery storage is vital for investors, policymakers, and consumers alike.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How has the cost of battery storage changed over the past decade?

The cost of battery storage systems has been declining significantly over the past decade. By the beginning of 2023 the price of lithium-ion batteries, which are widely used in energy storage, had fallen by about 89% since 2010.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Guess what you want to know

-

Grid-side energy storage profitability

Grid-side energy storage profitability

-

Manufacturing price of large energy storage batteries

Manufacturing price of large energy storage batteries

-

The effectiveness of local energy storage batteries in Kyrgyzstan

The effectiveness of local energy storage batteries in Kyrgyzstan

-

Are communication base station batteries energy storage batteries

Are communication base station batteries energy storage batteries

-

Medical Energy Storage Batteries

Medical Energy Storage Batteries

-

What batteries are used in energy storage products

What batteries are used in energy storage products

-

The economic benefits of lithium energy storage batteries

The economic benefits of lithium energy storage batteries

-

Application of energy storage batteries in factories

Application of energy storage batteries in factories

-

Price of large-capacity energy storage batteries in the United Arab Emirates

Price of large-capacity energy storage batteries in the United Arab Emirates

-

A Southeast Asian company that makes energy storage batteries

A Southeast Asian company that makes energy storage batteries

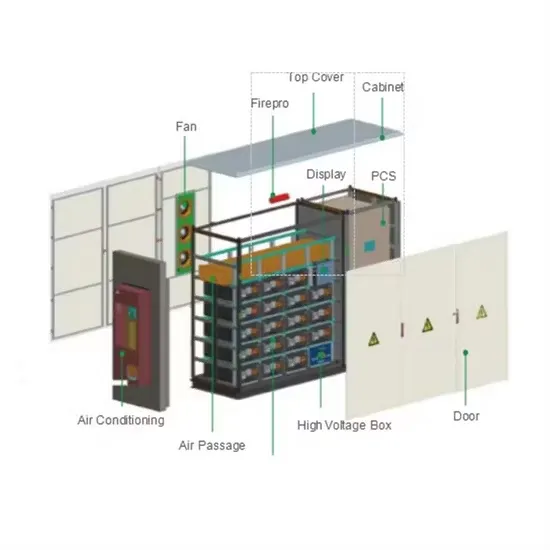

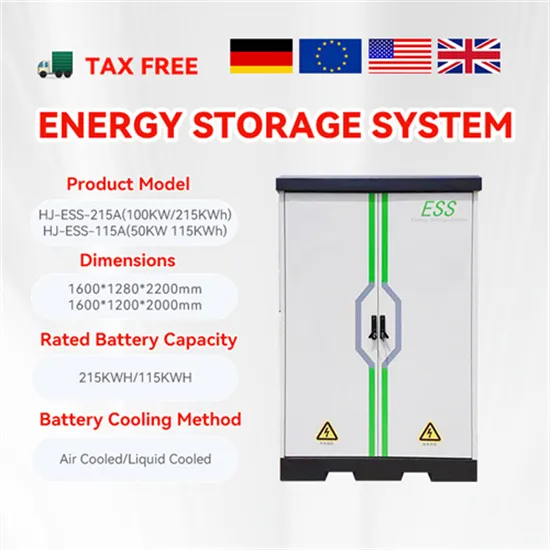

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.