Electricity prices above $5,000 per MWh

second driver was the reduced supply of low-priced capacity. In South Australia, this was primarily due to low wind and low solar output. As South Australia has little base-load capacity, during

Get a quote

OzTowers , Search for towers in your area.

Australian Mobile, State of the Nation lter Old Proposals Include Blackspot Data Active Only Include Historical Providers Telstra Optus Vodafone TPG NBN Postcode / Suburb * To use,

Get a quote

Mobile phone base stations and health | ARPANSA

Based on current research there is no established scientific evidence to support exposure to the low-level RF EME from mobile phone base station antennas

Get a quote

Rules for telco deployments

Small cells are installed by Telcos to provide improved coverage and capacity in local areas for both 4G and 5G services. They can be installed on light poles, bus stops, railway stations, and

Get a quote

C564:2025 Mobile Phone Base Station Deployment

The Mobile Phone Base Station Deployment Code is designed to: allow the community and councils to have greater participation in the decision-making process of Carriers when

Get a quote

New NBN base stations

See how the ACMA checks mobile phone tower emissions and use our EME Checker to find towers we''ve checked near you. NBN base stations and the rules telcos must follow on

Get a quote

List of earth stations in Australia

List of earth stations in Australia A number of historic and current Earth (or ground) stations in Australia are used to communicate and track human-made satellites. Many of the sites are

Get a quote

How mobile networks work

The base stations are linked to the rest of the mobile and fixed phone network and pass the signal/call on into those networks. In essence, a mobile phone needs to have ''sight'' of a

Get a quote

The Base Station in Wireless Communications: The

Base station, also known as BTS (Base Transceiver Station), is a key device in wireless communication systems such as GSM. Equipped with

Get a quote

Types of Telecommunication infrastructure in Australia

Telecommunications in Australia Telecommunications infrastructure is vital to powering our world and allowing us to stay connected. It carries data and voice services between users across the

Get a quote

CELLULAR TOWER LOCATOR

RFNSA offer a detailed list of all available carriers throughout Australia. To determine which carrier is suitable for you, you will need to identify the nearest cell tower. This information will

Get a quote

CATL unveils ''zero degradation'' battery storage system, Tener

CATL has launched its latest grid-scale BESS product, with 6.25MWh per 20-foot container and zero degradation over the first five years.

Get a quote

Technology and Infrastructure

Building next to a mobile phone base station Model Framework for Mobile Telecommunications Infrastructure Mobile Industry Resilience During Natural Disasters 5G – The natural choice for

Get a quote

Mobile phone base stations and health | ARPANSA

Based on current research there is no established scientific evidence to support exposure to the low-level RF EME from mobile phone base station antennas causes any health effects.

Get a quote

How to find out where your nearest mobile phone tower is

Experiencing patchy unreliable reception on your mobile phone? Wondering where your nearest cell tower is and if you can improve the signal?

Get a quote

Mobile Phone Base Station Deployment Code C564:2025 | ACMA

Mobile Phone Base Station Deployment Code C564:2025 18 March 2025 717.96 KB Mobile Phone Base Station Deployment Code C564:2025

Get a quote

CELLULAR TOWER LOCATOR

RFNSA offer a detailed list of all available carriers throughout Australia. To determine which carrier is suitable for you, you will need to identify the nearest

Get a quote

Phone towers and base stations

Telcos must share information about their plans for new phone towers. NBN Co. must follow the rules when they install NBN base stations. There are steps you must take if

Get a quote

Australian Telecommunications History | Nick vs Networking

By linking the two sides of Australia, Telecom opened up the ability to have a single time source distributed across the country, the station in Lyndhurst in Victoria, created

Get a quote

Australian Defence Satellite Communications Station,

The Australian Defence Satellite Communications Ground Station is located at Kojarena, 30 km east of Geraldton in Western Australia. In 2024 the

Get a quote

Mobile phone base stations and health

The radio signal generated by mobile phone base station antennas is often referred to as radiofrequency Electromagnetic Energy (EME). Like many other things, base stations (and

Get a quote

transceiver station

A transceiver station, also known as a base station or cell site in the context of mobile communications, is a critical component in wireless communication networks. Its

Get a quote

Rules on new mobile phone base stations

There are rules and standards telcos must follow to install mobile phone base stations. The decision on who approves a base station depends on several planning factors, including: the

Get a quote

6 FAQs about [Australian telecommunications signal base station 6 25MWh]

What is the mobile phone base station deployment code?

The Mobile Phone Base Station Deployment Code is designed to: allow the community and councils to have greater participation in the decision-making process of Carriers when deploying mobile phone base stations.

Where can I find information about mobile phone base stations?

Information about proposed and current mobile phone base stations is available on the Radio Frequency National Site Archive (RFNSA) at You can subscribe to receive information about future installations of Small cells are installed by Telcos to provide improved coverage and capacity in local areas for both 4G and 5G services.

Who approves a mobile phone base station?

There are rules telcos must follow to install mobile phone base stations. The decision on who approves a base station depends on several planning factors, including: the classification/zoning of the land. To find out if a base station requires approval under local government, state or territory planning law, please contact your local council.

What if a mobile phone base station is low-impact?

If a base station is low-impact or no approval is required under the local government, state or territory planning process, telcos consult with you by following the applicable consultation process in the Mobile Phone Base Station Deployment Code. All mobile phone base stations must stay within the safe limits of electromagnetic energy (EME).

Are mobile phone base station antennas harmful?

Based on current research there is no established scientific evidence to support exposure to the low-level RF EME from mobile phone base station antennas causes any health effects. An essential part of Australia's mobile phone network, base station antennas can be found on towers and buildings around the populated areas of our country.

Are NBN base stations the same as mobile phone towers?

The rules for these facilities are in Schedule 3 of the Telecommunications Act 1997 and the Telecommunications Code of Practice 2021. NBN base station s are not the same as mobile phone towers. The rules on mobile phone towers do not apply to the NBN. NBN base stations use radiofrequency electromagnetic energy (EME).

Guess what you want to know

-

Hungarian telecommunications green base station construction costs

Hungarian telecommunications green base station construction costs

-

Southern European telecommunications base station electricity prices

Southern European telecommunications base station electricity prices

-

Croatia Telecommunications Base Station Energy Storage System Cost Analysis

Croatia Telecommunications Base Station Energy Storage System Cost Analysis

-

Tanzania Telecommunications Base Station Photovoltaic

Tanzania Telecommunications Base Station Photovoltaic

-

Signal base station backup power supply

Signal base station backup power supply

-

EMS Building for Ireland Telecommunications Base Station

EMS Building for Ireland Telecommunications Base Station

-

North Korea s telecommunications base station inverter power generation regulations

North Korea s telecommunications base station inverter power generation regulations

-

China s telecommunications base station inverter grid-connected construction costs

China s telecommunications base station inverter grid-connected construction costs

-

Solar-powered telecommunications base station on the rooftop

Solar-powered telecommunications base station on the rooftop

-

Central African Republic Telecommunications Base Station EMS Building

Central African Republic Telecommunications Base Station EMS Building

Industrial & Commercial Energy Storage Market Growth

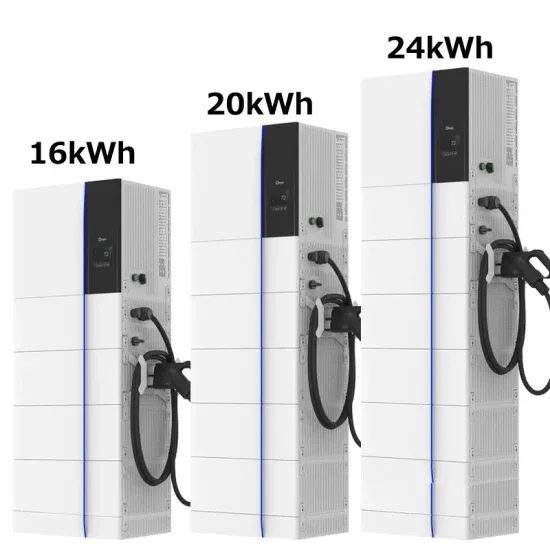

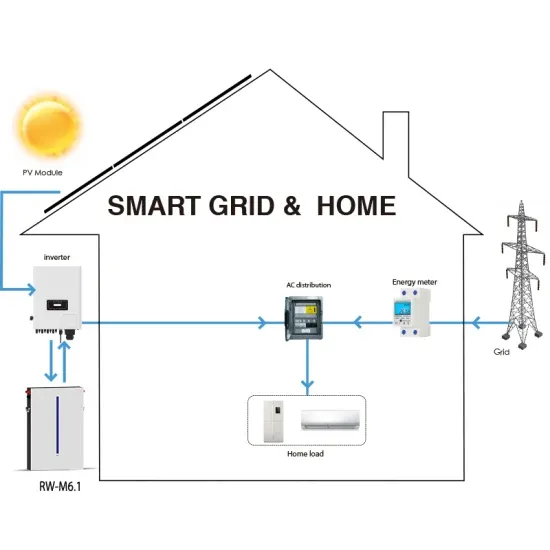

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

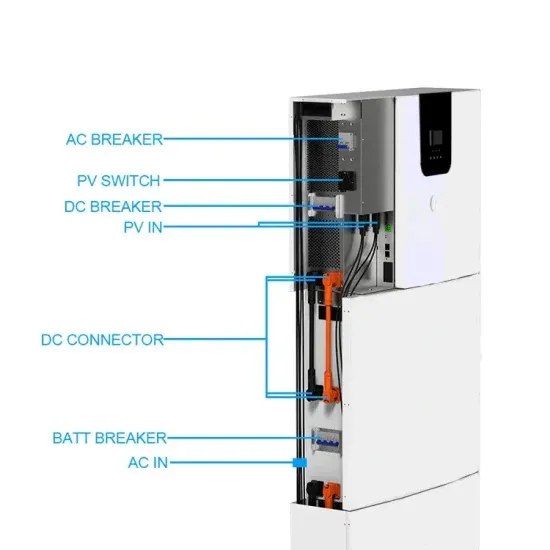

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.